This week’s attention!

The other day, Satoshi Nakamoto was featured on an NHK program. Although it may be unrelated, “Since the beginning of 2023, some “Satoshi era” Bitcoins have started to move.”

Earlier this week, a large amount of Bitcoin (BTC) acquired through mining during the network’s early stages was moved, joining a rare case of “Satoshi-era” Bitcoin being moved.

More than 1,000 BTC from early miners was moved to trading desks and custodian services on December 4, according to on-chain data firm CryptoQuant, which shared with CoinDesk in a December 7 report. These tokens were moved between August and November 2010, 13 years ago, and are believed to have been mined from block rewards at an estimated total cost of $100.

Bitcoin price trend

Bitcoin surpassed $40,000 this week. In Japanese yen, at the time of writing this article, it is around 6.4 million yen.

Bitcoin (BTC) exceeded $40,000 for the first time in 18 months on December 3 (US Eastern Time), and Ethereum (ETH) exceeded $2,200 as the overall market rose modestly.

Bitcoin (BTC) and Ethereum (ETH) have rallied in the past 24 hours as optimism around possible spot exchange-traded fund (ETF) approval in the U.S. continues to grow and gold’s peak price also provides a tailwind. It rose by 4%.

BTC surpassed the $41,000 mark on December 4th, extending its year-to-date gain to over 152%.

Bitcoin (BTC) hit a new 19-month high on the 4th, exceeding $42,000 (approximately 6.09 million yen, equivalent to 145 yen per dollar), spurred by some “panic buying.” Expectations for lower interest rates, an impending decision on a Bitcoin spot ETF, and inflows into digital asset funds supported crypto markets.

Bitcoin (BTC) soared on the 5th, reaching $44,000 (approximately 6.38 million yen, equivalent to 145 yen to the dollar) for the first time since early April 2022 on some crypto asset exchanges such as Coinbase. exceeded. The upside was supported by lower interest rates and expectations for approval of a Bitcoin spot ETF (exchange traded fund) in the United States.

According to data from CoinGlass, short traders betting on a fall in Bitcoin prices liquidated about $70 million (approximately 10.2 billion yen, equivalent to 146 yen per dollar) on December 4th, and only on the 5th. But it lost about $90 million (about 13.2 billion yen). These may be contributing to Bitcoin’s strength this week, which saw it jump from $39,000 to $44,000.

The rise of Bitcoin (BTC) stopped on the 7th. Instead, Ethereum (ETH) and Solana (SOL), which soared to a 19-month high, led the crypto market rally.

Bitcoin related

When we look back on microstrategy and El Salvador years or decades from now, will we see it as a great achievement?

With the price of Bitcoin rising above $42,000 (approximately 6.09 million yen, equivalent to 145 yen per dollar), US MicroStrategy’s unrealized gains from holding a large amount of Bitcoin reached $2 billion (about 6.09 million yen, equivalent to 145 yen per dollar) on the 4th. 290 billion yen).

El Salvador’s President Nayib Bukele said on X (formerly Twitter) on the 4th that Bitcoin (BTC) rose to the level of $42,000 (approximately 6.09 million yen, equivalent to 145 yen to the dollar) over the weekend. In response, he announced that his home country’s Bitcoin investments are currently generating more than $3 million in valuation gains.

On the 4th, BlackRock, the world’s largest asset management company, and Bitwise, a crypto asset investment company, each filed revised versions of their S1 forms with the US Securities and Exchange Commission (SEC). provided additional information that may have been pointed out by the SEC during its discussions.

Key derivatives market indicators show that sophisticated traders are turning from Bitcoin (BTC) to Ethereum (ETH), suggesting ETH could outperform in the coming weeks. ing.

Market trends

Along with BTC during the Satoshi era, early investors in Ethereum also moved large amounts of ETH to exchanges. Elon Musk has been in the news related to crypto assets for the first time in a while.

Cathie Wood’s investment management firm, ARK Invest, sold Coinbase stock for the third time this week, selling for about $4.7 million at the Nov. 30 closing price. 37,377 shares worth 1 billion yen (exchanged at 1 dollar = 150 yen) were sold.

Tokens such as GFY, TRUCK, and GROK, derived from Elon Musk’s products and recent statements, have appeared on blockchains such as Ethereum.

This is a tiring trend that has plagued the crypto industry for years. Opportunistic developers are quickly building large amounts of tokens, inspired by hot concepts.

The stock price of Nasdaq-listed cryptocurrency exchange Coinbase has soared nearly 300% this year, far outpacing Bitcoin (BTC), the largest cryptocurrency. According to technical analysis research firm Fairlead Strategies, Coinbase has the potential for further upside as momentum confirms a breakout of its long-term base pattern.

Coinbase and MicroStrategy stock prices soared 9% ahead of market open as Bitcoin (BTC) surged 4% in the past 24 hours, extending year-to-date gains to more than 150%. It skyrocketed recently.

Institutional traders are bullish on Bitcoin (BTC), mixed on Ethereum (ETH) and skeptical of altcoins, a new report from Bybit Research reveals.

A large Ethereum (ETH) holder held about 90 million dollars (approximately 13.5 billion yen, equivalent to 1 dollar = 150 yen) worth of tokens for five years on the cryptocurrency exchange Kraken. Lookonchain, an on-chain analysis tool, announced on December 5th that it has moved toPosted.

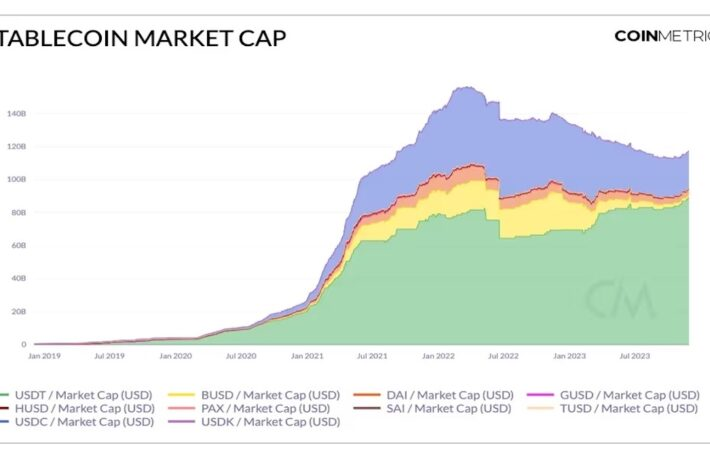

The stablecoin market is expanding for the first time in more than 18 months, and new capital is flowing into crypto assets, as symbolized by Tether (USDT)’s market capitalization reaching a record high of $89 billion.

The total market capitalization of major stablecoins has increased by about $5 billion over the past month to $124 billion, according to data from Glassnode.

BONK’s open interest has increased 10 times. (Coinglass)

BONK’s open interest has increased 10 times. (Coinglass)The season for dog-themed tokens is here again, with prominent tokens delivering multi-fold returns to their holders.

First launched last December, the Shiba Inu-themed BONK has grown to 1,000 in the past month amid an increase in capital inflows to the Solana blockchain and high-risk bets on the token based on the network’s popularity. recorded a return of more than %.

Two tokens associated with space logistics company Geometric Energy are rising ahead of the Dogecoin (DOGE)-themed satellite DOGE-1’s mission to enter lunar orbit.

Industry trends

In Japan, revisions to the end-of-year mark-to-market valuation taxation of crypto assets are progressing, and it looks like there will be more tailwinds.

According to a report released by cybersecurity firm Recorded Future on November 29, the Lazarus Group, a hacker group linked to North Korea, has racked up $3 billion (approximately 435 billion yen) over the past six years. The suspect stole crypto assets equivalent to 145 yen per dollar.

On December 5, the Liberal Democratic Party and New Komeito held a tax investigation committee to assess requests for tax reform submitted by various ministries and agencies. According to the Nikkei Shimbun, the taxation of crypto assets (virtual currency) on companies will be reviewed, and adjustments will be made to remove crypto assets that are continuously held for purposes other than short-term trading from being subject to mark-to-market taxation at the end of the fiscal year.

Cathie Wood’s ARK Invest shares of crypto exchange Coinbase hit a 19-month high on the back of Bitcoin’s (BTC) recent surge. , and sold the same stock worth $33 million (approximately 4.8 billion yen, equivalent to 146 yen = 1 dollar) based on the closing price on December 5th.

Dogecoin (DOGE) soared in the U.S. on the 6th after tech entrepreneur Elon Musk said his artificial intelligence (AI) startup xAI was “not raising funds.” It started to fall back in the morning.

One More Things

RWA tokenization, security tokens, digital securities…there are various names for it, but there is no doubt that efforts in this area are accelerating.

As demand for real-world asset (RWA) tokenization increases among traditional financial institutions, French banking giant Societe Generale is issuing its first tokenized green bond on the Ethereum network. completed.

On December 7, Hitachi announced that it will issue a total of 10 billion yen in unsecured corporate bonds, including green digital track bonds (digital environmental bonds) that use digital technologies such as IoT (Internet-of-Things) and blockchain platforms. He announced that he had decided on yen.

|Written and edited by Takayuki Masuda

|Photo: Shutterstock

The post 1000 BTC moved in the “Satoshi era” / Institutional investors ignore altcoins[Weekly Review: 12/2-12/8] appeared first on Our Bitcoin News.

1 year ago

159

1 year ago

159

English (US) ·

English (US) ·