March 10 (Thursday) morning market trends (compared to the previous day)

- NY Dow: $32,254 -1.6%

- Nasdaq: $11,338 -2%

- Nikkei Stock Average: ¥28,444 +0.47%

- USD/JPY: 136.1 -0.9%

- USD Index: 105.2 -0.3%

- 10-year US Treasury yield: 3.9 -1.6% annual yield

- Gold Futures: $1,834 +0.9%

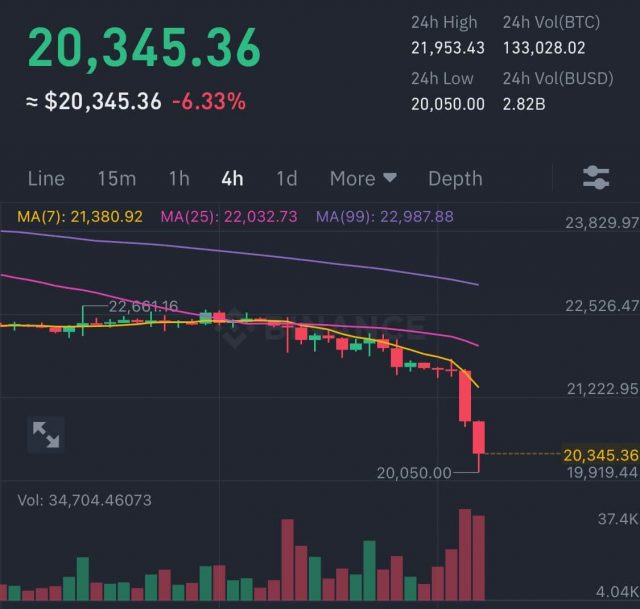

- Bitcoin: $20,338 -8%

- Ethereum: $1,440 -7.4%

traditional finance

crypto assets

Today’s New York Dow has fallen for three days in a row, and there was a scene where it fell more than $ 600 at one point. The Nasdaq and S&P 500 also fell sharply. It seems that there is growing concern about the rate hike being prolonged.

The number of new U.S. unemployment insurance claims announced last night (the week ending March 4) increased by 21,000 to 211,000, surpassing market expectations of 195,000. Concerns about the February employment report appear to have weighed on the market. Meanwhile, the number of continuing unemployment insurance recipients (week ending February 25) increased to 1,718,000, the biggest increase since November 2021.

In addition, US President Biden’s fiscal 2024 budget message announced on the 9th revealed the details of the tightening of taxes on the ultra-rich and corporations. In particular, the proposal to raise the tax rate of “capital gains tax”, which is related to investors, from the current 20% to 39.6% could become a negative factor in the market. On the other hand, the bill is likely to face strong opposition from the Republican Party, which controls the House of Representatives, and is unlikely to pass without changes.

Economic indicators for March (Japan time)

- March 10, 22:30 (Friday): U.S. February average hourly wage (vs. previous month), change in February non-agricultural sector employment (vs. previous month)

- March 14, 21:30 (Tuesday): US February Consumer Price Index Core Index (CPI)

- Wednesday, March 15, 21:30: U.S. February Retail Sales

- Wednesday, March 15, 21:30: U.S. February Wholesale Price Index (PPI)

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

US stocks

Today IT and tech stocks are all down. The decline in AI-related stocks was conspicuous. By individual stock, NVIDIA -3%, c3.ai -8.5%, Big Bear.ai -12.7%, Tesla -5%, Microsoft -0.5%, Alphabet -2%, Amazon -1.8%, Apple -1.5% , Meta-1.7%, Coinbase-7.8%, Silvergate Capital-42%, Starbucks-2.1%.

Starbucks has sold a limited number of 2,000 NFTs for beta users in the Web3 NFT business “Starbucks Odyssey”. They are priced at $100 each and have already sold out. Users who purchase will receive 1,500 points that can be used to level up on the Starbucks Odyssey platform.

source:

connection: Risk aversion strengthens Bitcoin continues to fall, Mt.

connection: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase | $58 (-7.8%/-10%)

- Canaan | $2.3 (-6.7%/-15%)

- Signature Bank | $90 (-12%/-20%)

Bitcoin miner Canaan reported an 82% drop in revenue in the fourth quarter of last year compared to the same period last year. The company cited the lack of market demand for mining machines as the Bitcoin price was falling.

Shares of Signature Bank, which also serves cryptocurrency companies, have fallen sharply. Yesterday, Silvergate Capital announced that it would voluntarily liquidate, which could make it difficult for traditional money to flow into the cryptocurrency market. Coinbase, which has dissolved its partnership with Silvergate, has moved its accounts to Signature Bank.

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

The virtual currency market also fell sharply

Bitcoin (BTC) temporarily fell below the $21,000 level and plummeted to just before $20,000.

Source: Binance

On the same day, the New York Attorney General sued cryptocurrency exchange KuCoin for violating securities laws. The attorney general argued that some stocks, including Ethereum (ETH) and LUNA, are securities, noting that the price of ETH is dependent on the efforts of founder Vitalik and others involved. It is asking the court to withdraw KuCoin from New York, which is not registered with the authorities.

connection: Why did the Japanese government start promoting the “Web3 policy”?Summary of important points and related news

connection: Commentary on the relationship between government bonds and interest rates, and the impact on the cryptocurrency market

GM radio last night

Last night was the 12th GM Radio. We invited Mousser Rahmouni, Head of Marketing & Sales at Striga, to talk about “Cryptocurrency Banking Infrastructure and Regulation”. Recently, problems such as the bankruptcy of Silver Gate have attracted attention.

connection: “GM Radio” European virtual currency infrastructure company “Striga” will participate next time

Click here for Wednesday’s radio archive.

https://t.co/SOPA9HkAzd

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 8, 2023

The post |10th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

139

2 years ago

139

English (US) ·

English (US) ·