15 Cryptocurrency Market Predictions for 2024

On the 7th, VanEck, a major US asset management company, released a forecast report for the crypto asset (virtual currency) market in 2024. This suggests that the industry is entering a new stage of development.

The report predicts that there will be a significant flow of funds into smaller tokens immediately after the Bitcoin (BTC) halving. In addition, the integration of Web3 and existing businesses is expected to accelerate, with corporate ownership of crypto assets entering a new phase and a decentralized network of wireless hotspots increasing the number of paying members across the United States. Here are VanEck’s 15 predictions:

- Arrival of US recession and debut of spot Bitcoin ETF

- 4th Bitcoin halving goes smoothly

- Bitcoin’s all-time high in Q4 2024

- Ethereum market position against Bitcoin in 2024

- Advantages of ETH Layer 2 after EIP-4844

- NFT activity reaches new peak

- Binance relinquishes top spot in spot trading

- Stablecoin market capitalization hits record high as USDC market share recovers

- Decentralized exchanges capture record spot trading market share

- Bitcoin Yield Opportunities Driven by Remittances and Smart Contracts

- Emergence of titles that lead blockchain games

- Solana outperforms Ethereum with DeFi TVL revival

- Meaningful Adoption of DePin Networks

- New accounting standards increase corporate token holdings

- Consistency with DeFi KYC regulations

Corporate crypto asset holdings are accelerating

What is noteworthy is the view that corporate ownership of virtual currencies will enter a new phase. VanEck announced that Coinbase is the first publicly traded company to list the revenue of layer 2 blockchain “BASE” in its quarterly report, which led to the U.S. Financial Accounting Standards Board (FASB) recording a mark-to-market gain on a company’s crypto assets. It is expected that this will serve as an opportunity to formulate guidelines to enable this. This will be a tailwind for companies that hold Bitcoin and other crypto assets.

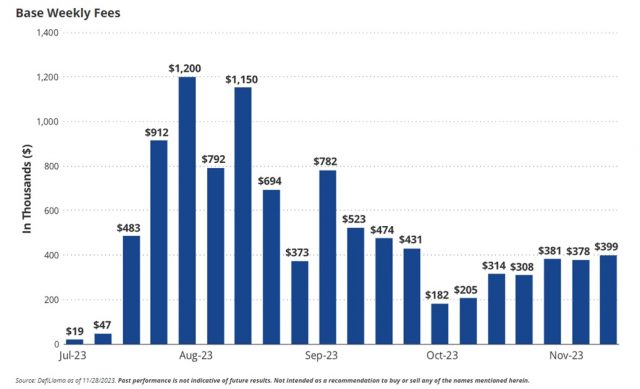

Weekly earnings of layer 2 blockchain “BASE” Source: VanEck

The accounting changes are scheduled to take effect in 2025, but many companies may adopt them before then.

Additionally, the Bitcoin ecosystem is expected to expand. It is predicted that the Lightning Network will play an important role in 2024 as demand for remittances increases in emerging countries.

Although BTC lockups on the Lightning Network are currently high risk, the proliferation of node management protocols and self-custody solutions like Amboss and Fedi will allow users to more safely participate in the remittance market and profit from it.

Furthermore, it is expected that projects such as the Cosmos-based Babylon project will offer Bitcoin staking functionality, allowing for interest income. Regarding the NFT market, it is said that the ETH to BTC NFT issuance ratio will approach 3:1 by 2024 due to the influence of Bitcoin’s Ordinal Protocol and other factors. Furthermore, VanEck added that Stacks (STX), the smart contract infrastructure on Bitcoin, will be in the top 30 coins by market capitalization.

connection:Coinbase CEO denies issuance of Base tokens, integration plans with Solana etc.

Solana’s breakthrough

Analyzing past market trends, it is expected that Bitcoin will maintain its position as the leader in the cryptocurrency market and continue to drive price growth. However, right after a halving, Bitcoin’s value tends to flow into smaller tokens.

VanEck said that after the halving scheduled for April 2024, Bitcoin’s market dominance may decline and the altcoin market may become more active. This trend will encourage the concentration of trading activity on decentralized exchanges (DEXs) that actively list new coins. Due to UI/UX improvements, many users are moving to crypto wallets instead of exchanges.

Furthermore, DEX market share in spot trading is expected to reach a new high as L1 chains with high processing performance such as Solana (SOL) improve the trading experience for users.

Solana is also expected to see a recovery in DeFi total value of deposits (TVL) and become a top-three blockchain in terms of market capitalization, TVL, and number of active users. With this growth, VanEck claims Solana will receive a flurry of applications for physical ETFs from asset managers, helping to expand its market share. He also stated that Solana’s price oracle, Pyth, could exceed the total value of the DeFi protocol that incorporates Chainlink (LINK), “Total Value Secured (TVS).”

connection:What is the most bullish scenario for Solana price evaluation until 2030? = Major US asset management company VanEck

Ethereum L2 competition

While Ethereum is not projected to surpass Bitcoin’s market position in 2024, VanEck believes it will outperform other major asset classes, including mega-cap tech stocks. He also pointed out that other smart contract platforms like Solana could eat into Ethereum’s market share.

Regarding Ethereum’s Layer 2 (L2) ecosystem, the implementation of EIP-4844 (Protodunk Sharding) is predicted to capture the majority of transaction volume with EVM (Ethereum Virtual Machine) compatible Total Value Locked (TVL). ing.

connection:Ethereum to implement “EIP-4844” that reduces L2 fees by up to 100 times

This innovation will reduce transaction fees and improve scalability for L2 chains such as Polygon, Arbitrum, and Optimism. As a result, by the fourth quarter of 2024, Ethereum’s DEX volume and number of transactions are expected to increase by 2x and 10x from the current level.

Chains like Arbitrum have extremely short block times of 0.25 seconds, which can increase transaction throughput and potentially increase arbitrage between DEXs and other markets. DEX and L2 are expected to increase trading opportunities and collect more trading volume.

Greater adoption of decentralized projects

VanEck predicts that USDCoin (USDC) could overturn Tether (USDT) as the stablecoin market size hits a new all-time high and adoption by institutional investors accelerates.

The DePin network is also a point of interest. It is a community-owned decentralized mapping protocol that rivals Google Street View and could potentially give Google an advantage in speed and cost of capital. Additionally, Helium, a decentralized network of wireless hotspots, is expected to continue growing as it increases the number of paid members for 5G plans across the United States.

Meanwhile, DeFi is becoming more harmonized with know-your-customer (KYC), and apps that use authentication services like Ethereum Attestation Service and Uniswap Hooks could see significant growth in terms of user base and fees. The Uniswap protocol is expected to further expand with additional trading volume through KYC gated hooks.

It is expected that there will be a major breakthrough in the field of Web 3 games, and it is expected that this will contribute to the development of the industry as a whole.

VanEck predicts that at least one blockchain-based game will have more than 1 million daily active users. Particularly notable are the high-performance games scheduled for release next year, such as Illuvium and Guild of Guardians, which have raised more than $100 million in funding. He argued that the Immutable (IMX) token, which has utility in these games, is likely to become a top 25 cryptocurrency by market value (currently 42nd).

connection:Web3/NFT game “Illuvium” partners with largest e-sports team Team Liquid

The post 2024 virtual currency market forecast, shift to altcoins and increase in corporate token holdings – VanEck appeared first on Our Bitcoin News.

1 year ago

98

1 year ago

98

English (US) ·

English (US) ·