The post $260M in Ethereum Sent to Exchanges, Market Crash Ahead? appeared first on Coinpedia Fintech News

It appears that the recent price crash is just the beginning, as whales and institutions have sent a significant amount of Ethereum (ETH) to exchanges. On October 4, 2024, a prominent crypto expert made a post on X (Previously Twitter) that nearly $260 million worth of ETH had been deposited to the cryptocurrency exchanges over the past 24 hours.

Ether (ETH) Exchange Reserve Soars

Whenever whales or institutions send their asset from wallet to exchanges, it is considered a potential sell-off signal. The potential reason for this significant ETH transfer is the ongoing tension between Iran and Israel.

This significant ETH transfer from wallets to exchanges hints at bearish market sentiment and a potential price crash in the coming days.

However, ETH is currently trading near the $2,375 level and has experienced a price surge of over 1.3% in the past 24 hours hours. During the same period, it seems that investors and traders were hesitant to participate, as its trading volume dropped by 25%.

Ethereum Technical Analysis and Upcoming Levels

According to expert technical analysis, ETH appears bearish as it has broken the crucial support level of $2,400 and is trading below the 200 Exponential Moving Average (EMA) on a daily time frame. Based on ETH’s price momentum, it seems the asset is currently retesting the breakdown level.

Source: Trading View

Source: Trading ViewIf ETH closes its daily candle below the $2,330 level, there is a strong possibility it could decline significantly, potentially reaching the $2,200 level or even lower in the coming days.

Bearish On-Chain Metrics

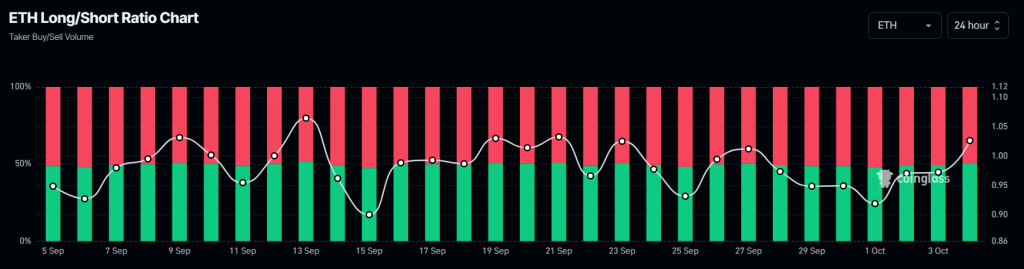

However, ETH’s on-chain metrics suggest mixed sentiment. According to the on-chain analytics firm Coinglass, ETH’s long/short ratio currently stands at 1.0263, indicating bullish market sentiment among traders. A ratio value above 1 is generally considered a bullish sign.

Source: Coinglass

Source: CoinglassIn addition, ETH’s future open interest has declined by 2.5% over the last 24 hours, indicating the liquidation of positions and suggesting that traders are hesitant to build new ones

Combining all these on-chain metrics, technical analysis, and exchange reserves, it appears that Ethereum is weak, with bears currently dominating the asset.

1 month ago

17

1 month ago

17

English (US) ·

English (US) ·