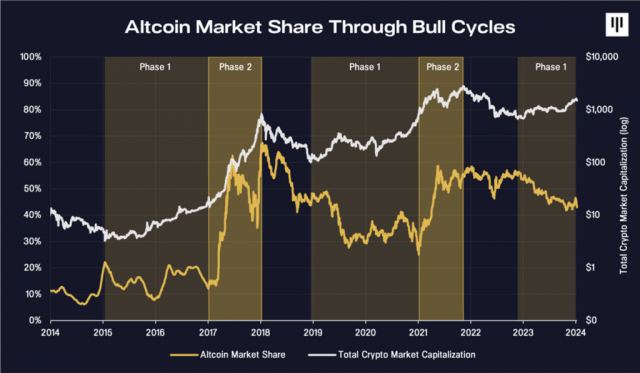

Two phases of a bull market

The crypto asset (virtual currency) market is constantly evolving, and its dynamic nature is especially evident during bull markets. In this market, there is a view that the market movement will be divided into two phases.

Initially, Bitcoin (BTC) will dominate the market, and then there will be a period when new investors start paying attention to altcoins (virtual currencies other than BTC). The market is now entering this second phase.

Source: PANTERA

This article analyzes market cycles based on insights from Pantera Capital, a leading VC firm. In the future, we will explore the possibilities of where altcoins will be born that will generate “alpha” that exceeds the returns of the overall market.

Phase 1: Bitcoin dominance

In the first stage, Bitcoin reigns as the king of the market, and many novice investors choose this solid foundation, further solidifying its dominance. However, not everyone is sitting back and watching BTC’s growth.

Investors eventually become fascinated by this “cryptocurrency rabbit hole” and begin digging deeper for new possibilities. There, new ideas and projects are sprouting and market growth is accelerating.

connection:2024 virtual currency market forecast, shift to altcoins and increase in corporate token holdings = VanEck

Phase 2: The Rise of Altcoins

In the second stage, the market landscape changes dramatically. Investors begin to shift their attention to altcoins with diverse use cases and high growth potential. New innovations are driving this phase, including the ICO boom in 2017-18 and the rise of DeFi (decentralized finance) and NFTs (non-fungible tokens) in 2020-21. The market share of altcoins is increasing, and their rate of increase shows the potential to far exceed that of Bitcoin.

Source: PANTERA

In Phase 2, altcoins often showed returns that overwhelmed Bitcoin, and according to historical data, the market capitalization of altcoins expanded by 239 times and 7 times.

What is the next area of focus?

It seems that many investors are looking for powerful altcoins in order to pursue alpha in the virtual currency market.

However, it is not easy to identify the bright altcoin from among the countless candidates.

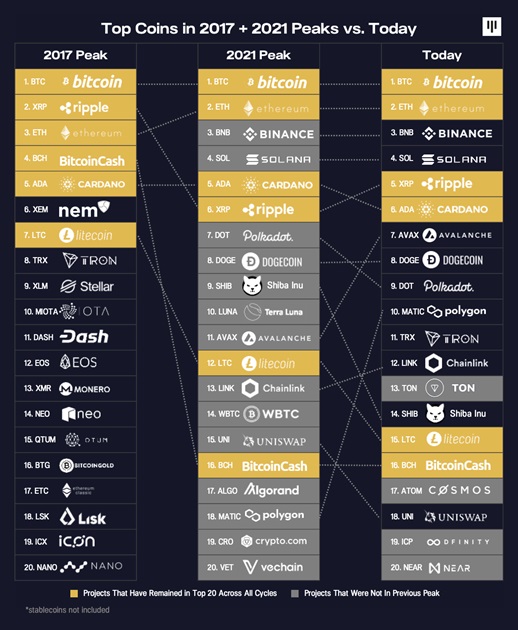

You should also pay attention to the high volatility of the market. For example, 14 stocks that were in the top 20 in 2017 lost their positions to newcomers in just a few years. Furthermore, 13 of these stocks have now fallen to an average of 123rd place in terms of market capitalization, illustrating the reality of a disruptive market.

Source: PANTERA

In this context, Cosmo Jiang, portfolio manager, and Erik Lowe, head of content at Liquid Strategies, emphasize product-market fit and solid unit economics, rather than just jumping on trends. This is the importance of carefully choosing altcoins that generate sustained real returns.

In what fields will altcoins that generate alpha exceeding Bitcoin emerge in the future? It is important to analyze popular keywords and representative products in detail, identify and predict the next market movements based on these trends.

Bitcoin L2 and “DeFi Summer 2.0”

The Bitcoin network is entering a new era with the addition of programmability features. Ordinals appears in the first layer (L1), and Stacks (STX) and Rootstock appear in the second layer (L2), showing signs of “DeFi Summer 2.0” in Bitcoin.

connection:“Altcoin season” has arrived, with meme coins BONK, ORDI, PoW-based KAS, etc. achieving record increases

Compared to BTC’s huge market capitalization of $820 billion, the circulating value of “Wrapped BTC (WBTC)” is only about $6 billion, and the distribution value (TVL) in DeFi is thought to be less than 0.05%. It has come out. Looking at the example of Ethereum, there is a good chance that the ratio will rise to 1-2% (approximately $10-15 billion).

It is also important that Bitcoin has much higher cultural recognition and memetic value, so it can be said that the soil is ripe for the birth of NFTs and meme coins.

SNS tokenization

In August 2023, friend.tech pioneered a new form of tokenized social experience on Base L2. It allowed users to buy and sell fractional “shares” of other people’s X (formerly Twitter) accounts, and at its peak reached 30,000 ETH TVL (approximately $50 million at the time).

connection:Analyzing the appeal and risks of social Fi “friend.tech” linked to X (formerly Twitter)

This trend is expected to evolve further in 2024. NFTs will function as profiles and social resources, allowing them to be traded on-chain. By aligning with the DeFi ecosystem, Lens and Farcaster stand out as two of the leading Web3 native applications integrating DeFi and social networks.

Projects like Blackbird are popularizing tokenized points systems for loyalty programs in specific industries (e.g. restaurants), combining stablecoin payments with tokenized rebates to reinvent the consumer experience. , provides a functional on-chain alternative to credit cards.

connection:Polygon-based decentralized SNS major Lens updates V2, monetization function for creators and usability improvements

Stablecoins and tokenized real assets (RWA)

In 2024, the adoption of tokenized real assets (RWA) is expected to increase dramatically. Tokenized U.S. Treasuries are already gaining momentum, with $800 million tokenized through platforms such as Ondo. These moves are expected to increase asset liquidity and bring new possibilities to the market.

connection:Why investors are interested in real asset tokenization and what is Real World Assets (RWA)?

AI, PIN (physical infrastructure), etc. will become decentralized

The data economy is undergoing a fundamental restructuring, with vastly improved user and developer experiences. These range from on-chain AI systems, decentralized physical infrastructure networks (DePIN), on-chain knowledge graphs, complete on-chain gaming and social networks, and more.

For example, Hivemapper, which creates distributed Google Maps on Solana, Bittensor’s distributed machine learning platform, and Modulus Labs’ efforts in ZKML (a combination of zero-knowledge proofs and machine learning) and AI generation are attracting attention.

Furthermore, The Graph (GRT)’s NFT art and on-chain knowledge graph, and Realmsverse, which creates on-chain games and wisdom on Starknet, are expected to provide new value to the market.

connection:bitbank lists virtual currency The Graph (GRT) for the first time in Japan

The rise of app chains

Of the top 10 L2s by TVL (Total Value Locked), three (dydx, Loopring, Ronin) are effectively niche app chains. Smaller, newer L2 chains such as Base and Blast rely on certain “killer apps” (e.g. friends.tech, Blur).

App chain toolkits (OP Stack, Arbitrum Nitro, StarkEx, etc.) are also available, and a hub model is emerging that hosts many of these app chains. Major rollup providers (Rollup-as-a-Service) such as Caldera, Conduit, and Eclipse are expected to gain prominence in 2024.

Evolution of modular blockchain

Throughout 2023, modular blockchain and ZKP (Zero Knowledge Proofs) are evolving, including the launch of Celestia mainnet, Espresso’s Arbitrum integration, RiscZero’s open source Zeth Prover, and Succinct’s launch of ZK Marketplace.

Modular blockchains are modularized to focus on specific areas, and companies in the ZK space are also adding features such as coprocessors, privacy layers, proof marketplaces, and zkDevOps (development and operations privacy protection). It offers.

It is expected that ZKP will become the interface between the various components of the modular blockchain stack. For example, Axiom uses ZKP to provide proof of Ethereum’s past state, which developers can use to perform computations in their dApps.

On the consumer side, we expect to see increased use of ZK-based decentralized IDs and other forms of identity and privacy protection.

connection:What is the next trend for modular blockchains?

The post 7 major themes that indicate the next investment destination as altcoins enter a bullish cycle appeared first on Our Bitcoin News.

1 year ago

112

1 year ago

112

English (US) ·

English (US) ·