At a certain point, the market will, indeed, stabilize. It has to. Demand for new smartphones has been consistently down for some time now, but the phones themselves are, obviously, here to stay. This is how we arrive at surveys that suggest people would give up shampooing or lose a finger rather than go without a handset (shakes fist “millennials!!).

But macro climates are gonna macro climate. And these new figures from Canalys feel awfully like numbers from the last several quarters. Q1 2022 saw a 12% year-over-year drop in global smartphone shipments. It’s the fifth straight quarter of decline for the category. So why does something like that warrant a Canalys headline like, “Global smartphone market shows signs of stability with a 12% decline in Q1 2023”?

“Stability” is, of course, a relative thing. Perhaps there’s a sense in which continued decline is stable — or at very least predictable. But that’s not what the firm is talking about here. Instead, it’s signals in the noise that point to some reason to be hopeful.

“However, we have noticed some signs of moderation in the continued decline,” says analyst Toby Zhu. “There have been improvements in demand for certain smartphone products and price bands. Furthermore, some smartphone vendors are becoming more active in production planning and ordering components. Canalys predicts that the inventory of the smartphone industry, irrespective of channel or vendor, can reach a relatively healthy level by the end of the second quarter of 2023.”

Image Credits: Canalys

Stability here means that, assuming a lot more things don’t suddenly go sideways for the world (not a bet I’d necessarily be willing to make at this point), things could start turning around for the market as soon as the end of this quarter. Embracing my tendency to embrace cheery optimism, I’ll point out that things have had a tendency to pile up lately. Declines pre-dated the pandemic and were ultimately accelerated by it. Then there were supply chain issues and then macroeconomic struggles. Knock-on effects upon knock-on effects.

From where I sit, here’s the primary reason to be positive: phones are commodities now. Sooner or later, people are going to need to upgrade. Phone manufacturers haven’t done a great job priming that pump — and the industry has yet to agree on a 6G standard — but at a certain point, devices slow down, batteries stop holding their charge and the time comes to buy a new one.

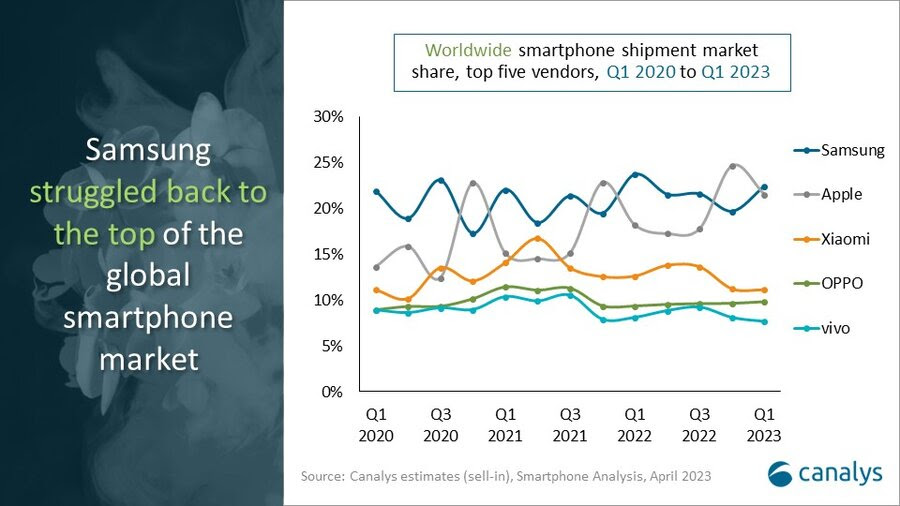

We’re three years into this global pandemic, and that time is probably right over the horizon for a lot of folks who have been holding off for various reasons. I suspect Apple having its hand forced on USB-C adoption will ultimately have a positive impact on iPhone 14 sales, as well. This time out, however, Apple hit second, at 21% of the market to Samsung’s 22. Xiaomi, Oppo and Vivo rounded out the top five.

A 12% decline in global smartphone shipments is what passes for stability these days by Brian Heater originally published on TechCrunch

English (US) ·

English (US) ·