The post A Brewing War? How Jupiter, BullX, and Axiom are Grappling with AI‑Powered “Vibe” Traders appeared first on Coinpedia Fintech News

What happens when retail traders get smart? The house fights back. In this context, one can see that a quiet conflict has been brewing between DEX incentives and new AI tools eating into those profits. On Solana, for instance, the memecoin frenzy has resulted in platforms like Jupiter, BullX, and Axiom facing a generation of savvy “vibe traders,” armed with real-time analytics.

Less panic trading means fewer impulsive swaps, and potentially lower fee revenue for DEX venues that “profit from rugs.”

In this broader context, it also bears mentioning that the use of DEX’s has exploded over the past year, processing $1.76 trillion in spot volume during 2024 alone. By January 2025, DEXs captured 20% of global crypto trading, more than double their market share from a year prior.

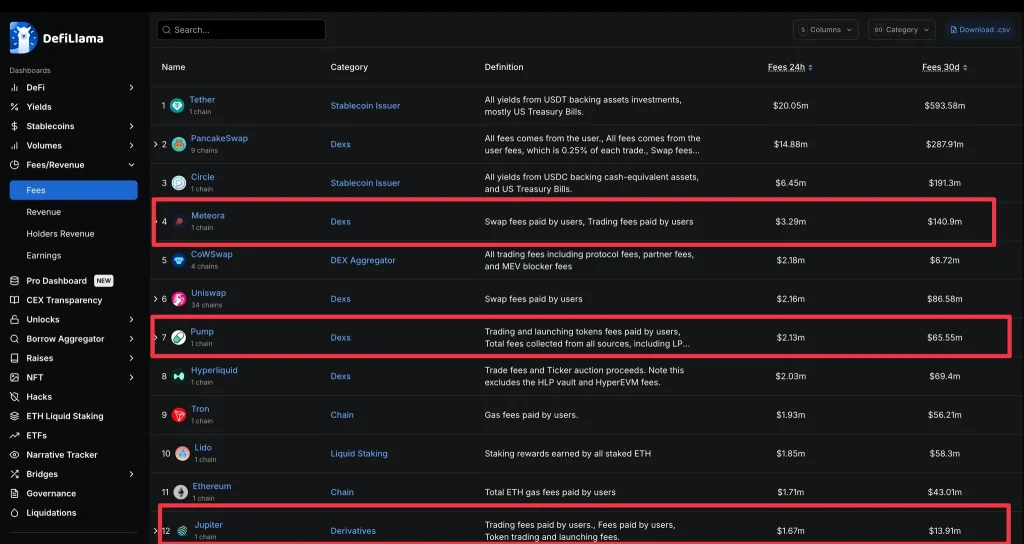

This growth has been fueled in part by retail speculators piling into volatile meme coins. In fact, such manic volume has been the lifeblood of DEX profitability with Jupiter, Solana’s leading DEX aggregator, handling roughly $40 billion in trading volume each month. Similarly, BullX and Photon too raked in hundreds of millions in fees during the 2024 memecoin boom.

However, amidst these surging numbers a conflict has arisen, with a wave of AI-driven tools now helping retail players navigate this chaos with data-driven clarity.

In other words, exchanges accustomed to retail FOMO and confusion are now confronting users equipped with AI co-pilots intent on leveling the field. It’s the casino vs. the card counters, and the casinos are quietly adjusting.

AI + DeFi Equals Real‑Time Alpha with AssetSwap.ai

This is where AssetSwap.ai has entered the fray, building an AI infrastructure to turn meme coin speculation into structured, data-driven execution. To elaborate, the platform connects GPT-powered agents directly into live DeFi markets, so its tools don’t just observe the market but rather act on it.

At the core of AssetSwap.ai is an AI agent called MemeSniper which scans, analyzes, and even executes trades in real time. Unlike a frenzied human chasing a green candle, the AI parses thousands of signals per second across on-chain data, prices, macro trends, and social sentiment. It then routes trades algorithmically through Jupiter, the most liquid DEX hub on Solana, for optimal execution.

The result is an AI-driven trading co-pilot that can actually deploy capital at machine speed, with human-like intuition backed by data. One simple prompt to AssetSwap’s GPT-style interface yields a full token analysis rather than guesswork. For example, a user might ask, “Is $KOALA about to pump?” and within seconds get a breakdown of key metrics like:

- Entry score: An algorithmic gauge of the token’s momentum and risk/reward

- Community traction: Growth of holders and social buzz surrounding the coin.

- Wallet trends – Are smart money wallets buying or selling the token.

- Volatility index – How wild its price swings are

All of these actions happen in plain English chat, replacing the myriad of charts and dashboards with an intuitive Q&A, with traders no longer needing to be experts in technical analysis or scour Twitter for alpha; they can simply ask the AI what’s next and get an answer backed by real data.

In fact, as per reports, AssetSwap’s early users are already firing off over 10,000 AI prompts per week, using the platform daily to make faster, smarter calls in markets that move too fast for any human alone.

From “RugFi” to “VibeFi”

What’s unfolding is more than a tech upgrade, it’s a cultural shift that AssetSwap’s team calls “VibeFi.” Instead of the regular fear-driven, rumor-fueled trading, the new ethos is about using data and AI insight to trade with confidence and context. On the subject, Yoann Defay, co-founder and CTO for AssetSwap, recently opined:

“DEXes are execution pipes – fast, blind, and indifferent. AssetSwap is the brain layer that reads the room before you click buy,”

Now that retail traders have an AI co-pilot, the traditional power dynamics are indeed flipping. High-volume platforms and trading bots can no longer count on retail FOMO to drive volume unabated as users are starting to ask smarter questions and avoid obvious traps.

This tension is likely to grow, as evidenced by the fact that some incumbent platforms have begun integrating their own AI analytics or offering fee rebates to keep traders engaged. Axiom, for one, recently launched a points reward system tied to an upcoming airdrop.

The bottom line, however, is that when retail gets smart, the house indeed takes notice. AssetSwap.ai and its MemeSniper agent are proof that the game is changing with degenerate meme traders slowly but surely evolving into data-empowered “vibe” traders.

4 hours ago

12

4 hours ago

12

English (US) ·

English (US) ·