*This report is written by virtual NISHI (crypto analyst of SBI VC Trade)@Nishi8maru) contributed to CoinPost.

Bitcoin Market Report (Feb. 9-Feb. 15)

Bitcoin rose nearly 150% in January 2011, mainly due to buybacks of short (selling) positions, but since February it has entered a range of around $23,000, and the rise has come to a halt as it enters an adjustment phase. It has become. The price at the time of writing is $22,900.

feet

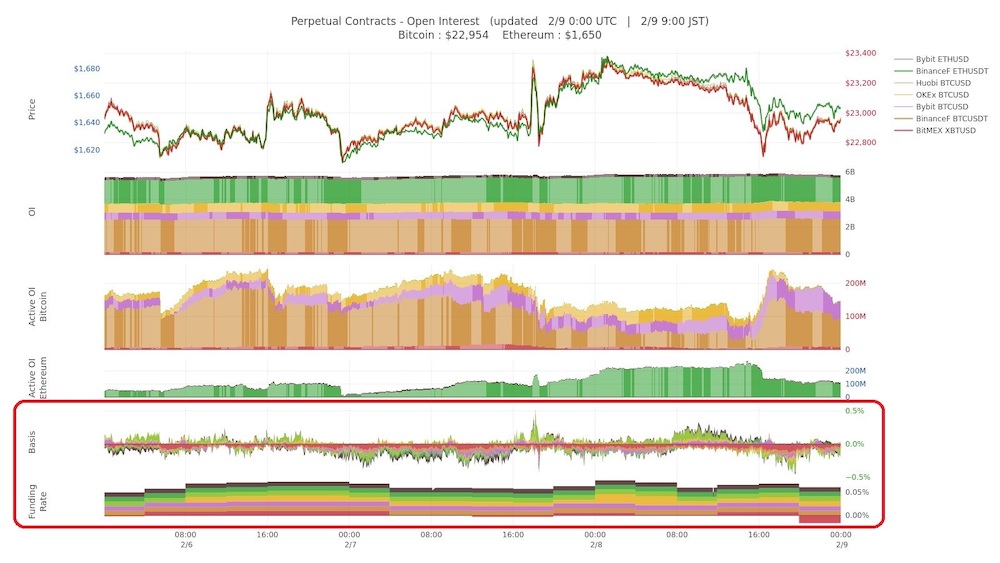

Looking at the funding rate (funding rate) and Basis, which is the difference between the spot price and the perpetual futures price, there is no sense of overheating and it is in a flat state.

source:BTC Status Alert

Futures and Derivatives Market

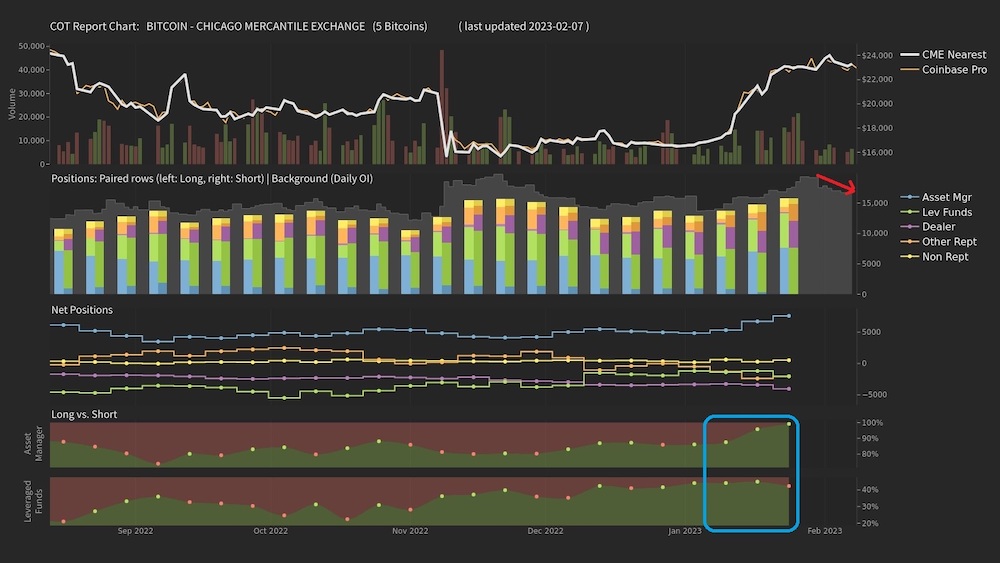

At the Chicago Mercantile Exchange (CME), the open interest (OI) has been on a downward trend since the end of January.

In January, when the price rose, OI temporarily decreased (repurchase of short positions occurred). Movement is changing.

This is because the rise in January was mainly due to short covering (repurchase of selling positions), but now the proportion of long positions in the total positions is gradually increasing, and a sharp rise due to short covering is occurring. It is thought that it is getting harder.

source:BTC Status Alert

On-chain environment

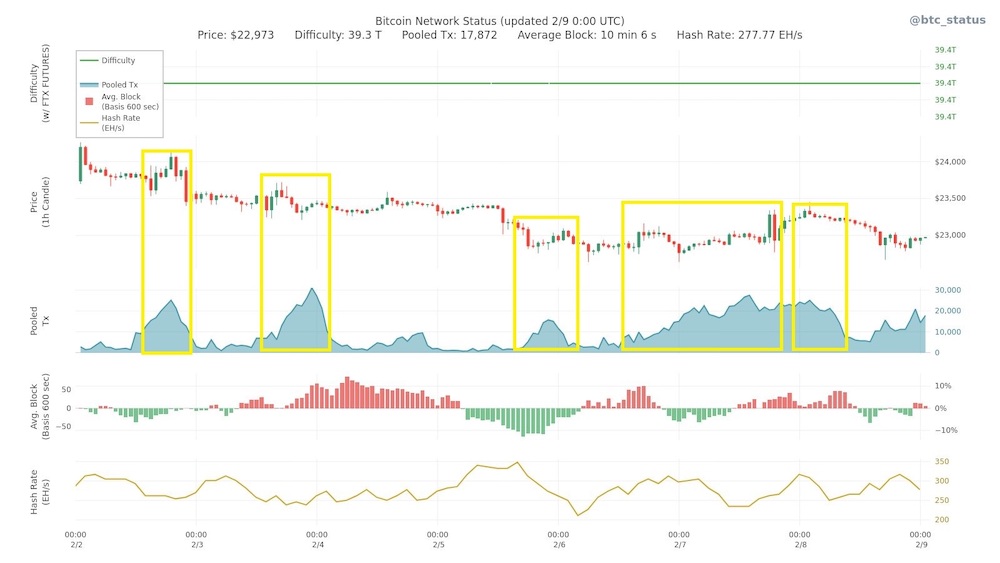

Since February, the price tends to fall as the transaction volume increases. Combined with the decline in CME OI, it is possible that some funds have flowed out of the cryptocurrency market.

source:BTC Status Alert

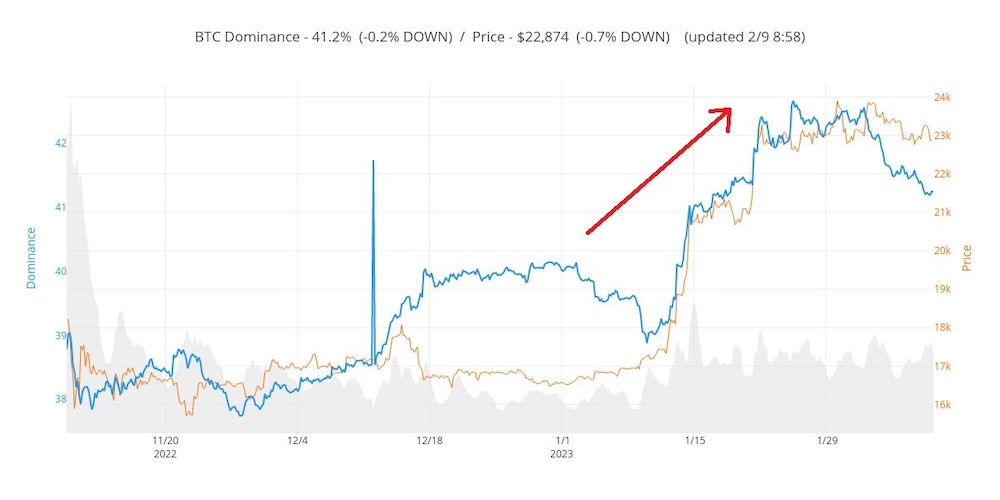

Bitcoin’s dominance in the overall cryptocurrency market has risen by 4 percentage points since January.

source:BTC Status Alert

External environment

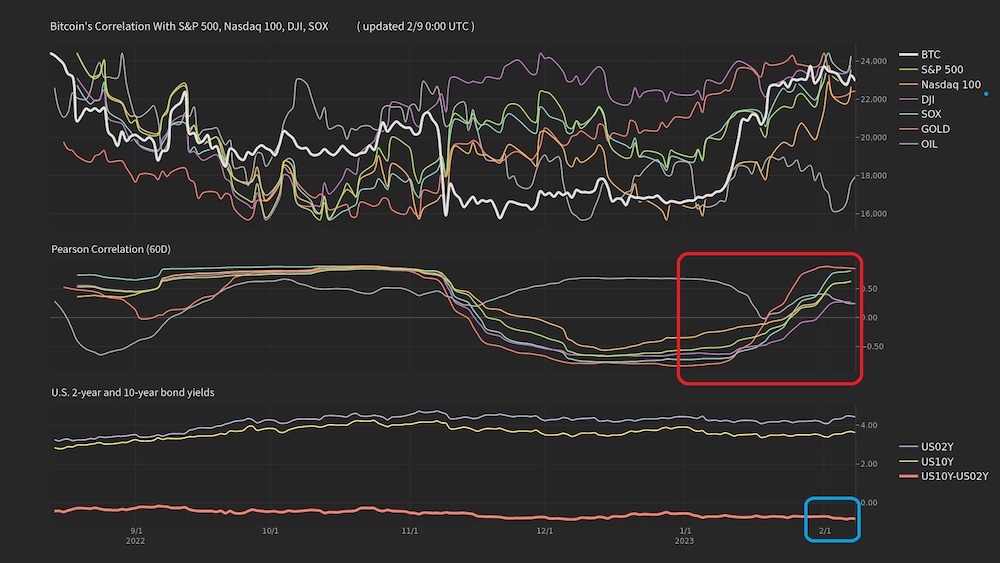

The correlation with the US stock price index had been declining since the beginning of November last year when the FTX shock occurred, but since the beginning of this year, the correlation has risen again, centering on the semiconductor index (SOX) (SOX + 0.81, S&P 500 + 0.81). 63, Nasdaq 100 + 0.63).

However, the inverted yield curve (a state in which the US 2-year yield exceeds the 10-year yield) is expanding (blue frame in the image below), and it can be said that the headwinds for the entire crypto asset market are still strong.

source:BTC Status Alert

options market

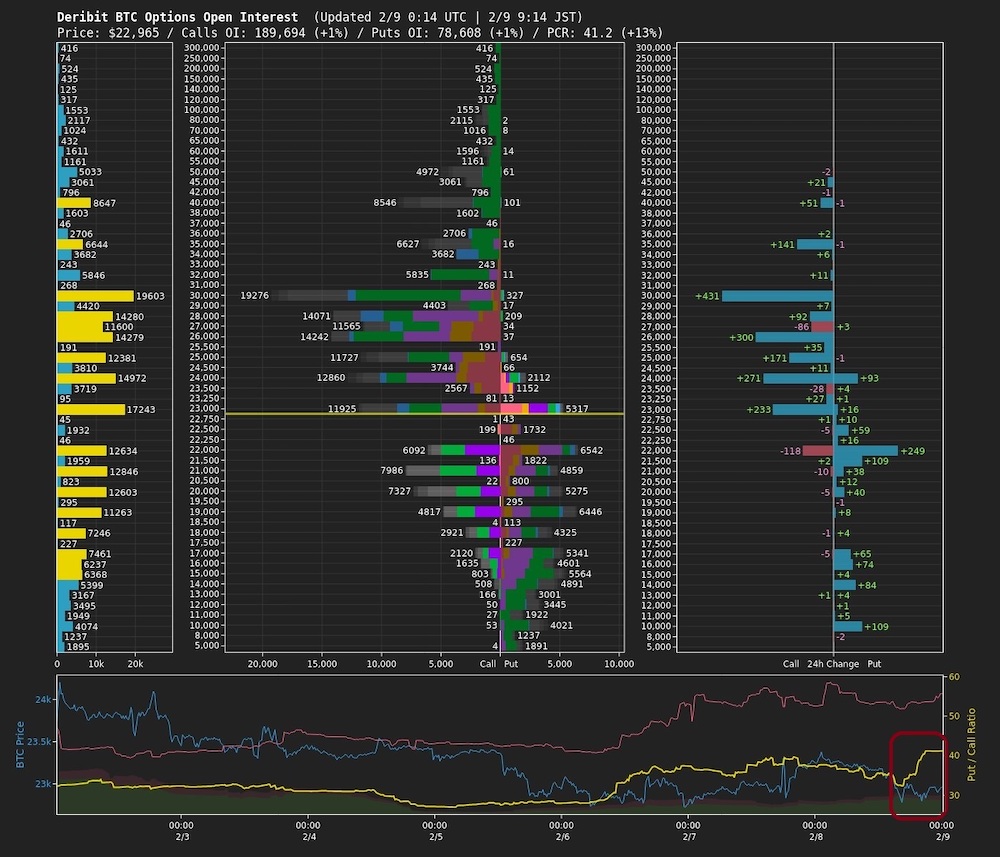

Despite a slight decline in prices in February, the PCR ratio, which is the ratio of puts and calls, has risen (yellow line in the red frame in the image below), indicating that trading in the physical delivery market is increasing. Weakness can be seen.

Miners (bitcoin miners) who have a lot of physical products may be a little bearish.

source:BTC Status Alert

hash rate

The next difficulty is expected to be -2.21% easier, but the hash rate (mining speed) is still at a high level.

Recent Crypto Indicators

February 14 U.S. Consumer Price Index (CPI): January 2011 Results

February 15 Cardano (ADA) SECP hard fork

A crypto economic index calendar that has never existed in the world.

I made it carefully so that a Japanese trader could stand an absolute advantage. https://t.co/cYcebDABgO

— Virtual NISHI (@Nishi8maru) March 26, 2020

Summary

The chain of bankruptcies triggered by the bankruptcy of the FTX Trading Group has come to a halt, and although prices were rising mainly due to short covering (buying back of short positions) in January, the position balance was adjusted after February, and overall The share of short positions in

In addition, there was a slight outflow of funds from the crypto-asset market, which has made the market somewhat bearish, and we believe it is entering an adjustment phase as a whole.

The post A professional commentary on the Bitcoin derivatives market at the beginning of 2023 | Contributed by virtual NISHI appeared first on Our Bitcoin News.

2 years ago

234

2 years ago

234

English (US) ·

English (US) ·