*This report was written by Virtual NISHI, a crypto analyst at the crypto asset exchange SBI VC Trade.@Nishi8maru) contributed to CoinPost.

Bitcoin Market Report (January 17th to January 23rd)

Around 6 a.m. on January 11th (Japan time), the US SEC approved spot spot ETFs, and the price of Bitcoin skyrocketed, reaching $49,000 around the start of trading on the next day, January 12th. It skyrocketed.

However, due to the sale of $579 million from GBTC, which had no means of redemption until the 13th, the price plummeted to around $41,000. After that, the price rebounded on its own and remains stable at around $42,000 to $3,000. At the time of writing, it’s around $43,000.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

At your feet

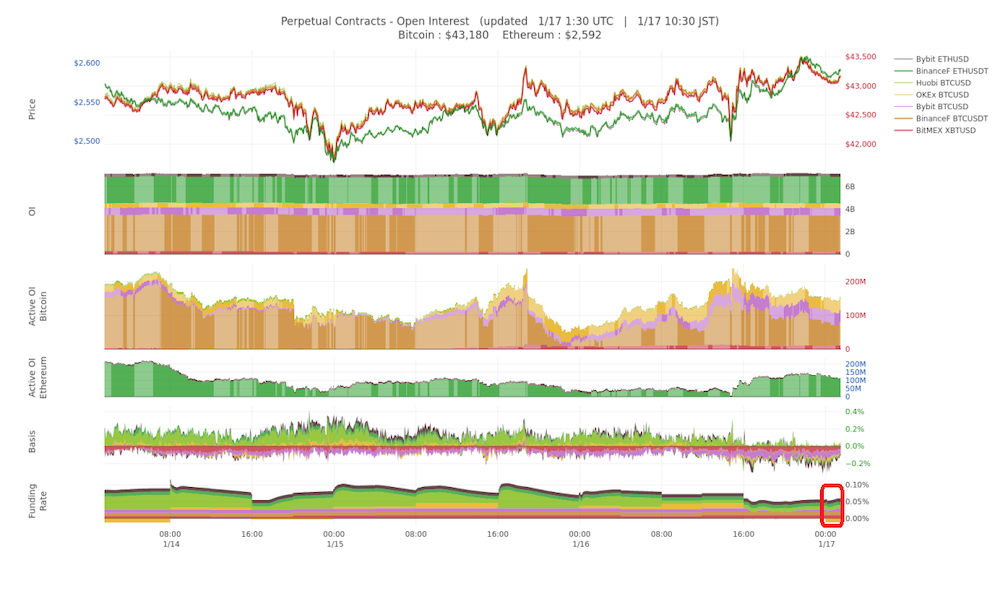

The active OI (unsettled open interest) of Bitcoin market orders was strongly biased toward long positions, but recently some exchanges have started to have negative funding rates, and a correction can be seen in the position bias.

source:BTC Status Alert

spot market

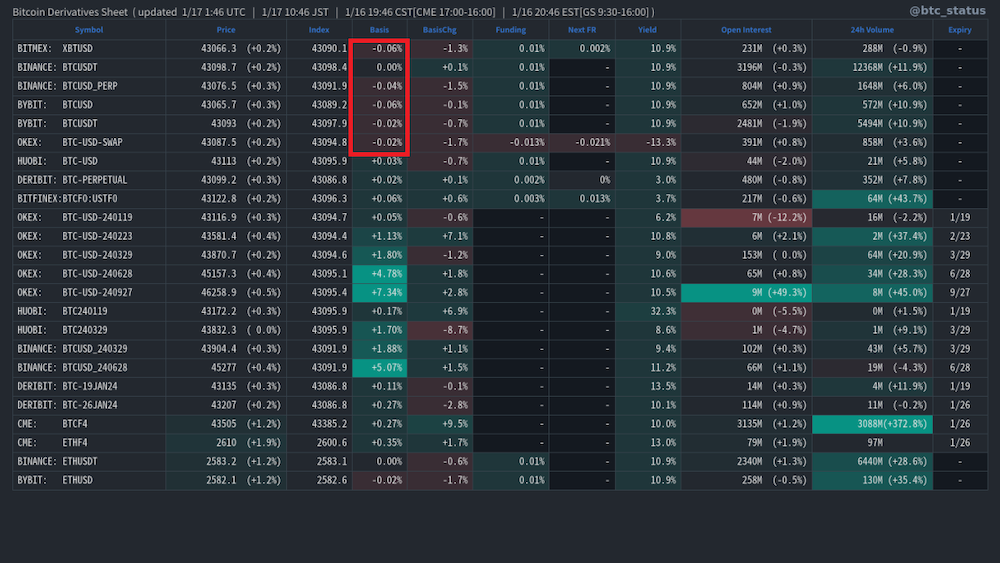

Looking at market trading, it can be seen that the spot market continues to be bought (red frame in the image below).

source:BTC Status Alert

derivatives market

Perpetual futures in the recent derivatives market have generally been trending at lower prices than spot prices, and are oversold (red frame in the image below).

source:BTC Status Alert

options market

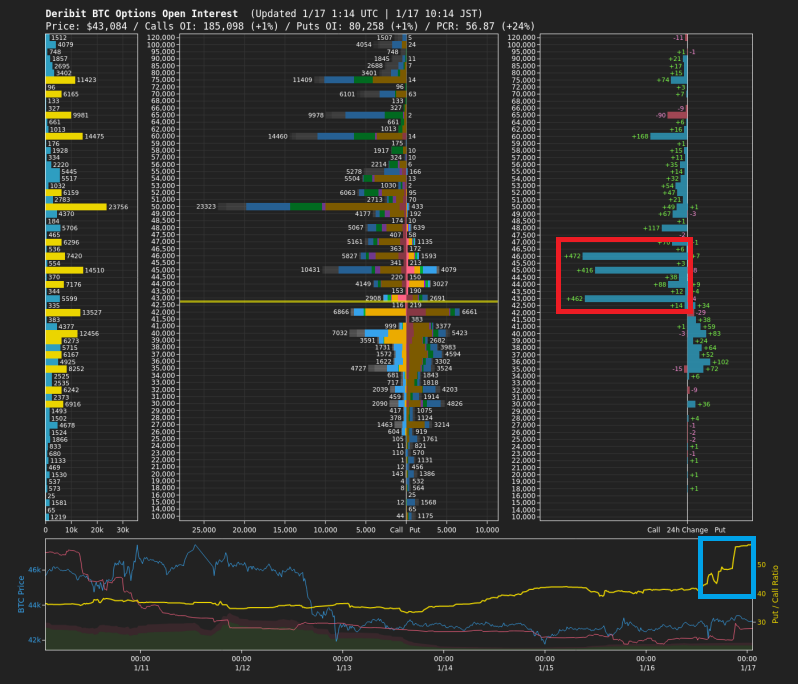

In the option market, which is traded in spot delivery, open interest is concentrated in the price range of $50,000, which is higher than the current price (red frame in the image below), but recently, open interest in the price range of mid-$40,000 has increased. (red frame in the image below).

Although the absolute level itself is not high, the PCR ratio has also increased (blue frame in the image below), and it can be interpreted that the attitude of market participants has changed to a slightly bearish one.

source:BTC Status Alert

futures market

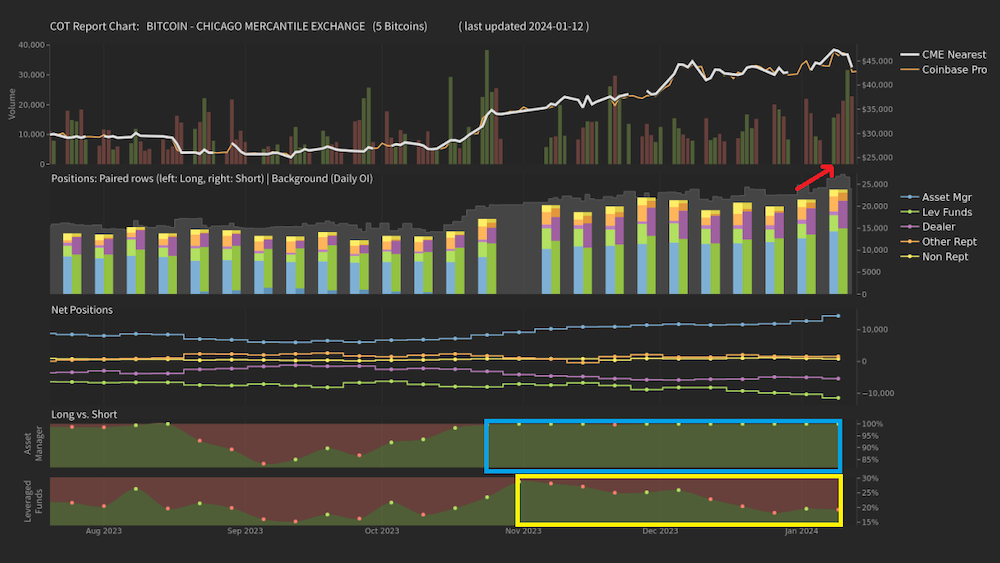

The OI of the futures market (CME) skyrocketed around the time of ETF approval (red arrow in the image below), indicating that capital inflows continue.

Looking at the breakdown, the long ratio of Asset Manager has been 100% since late October last year (blue frame in the image below), while the ratio of short positions for Leveraged Funds, which aim for profit from price differences, is 100% since late October last year. has been increasing since November (yellow frame in the image below).

source:BTC Status Alert

External environment

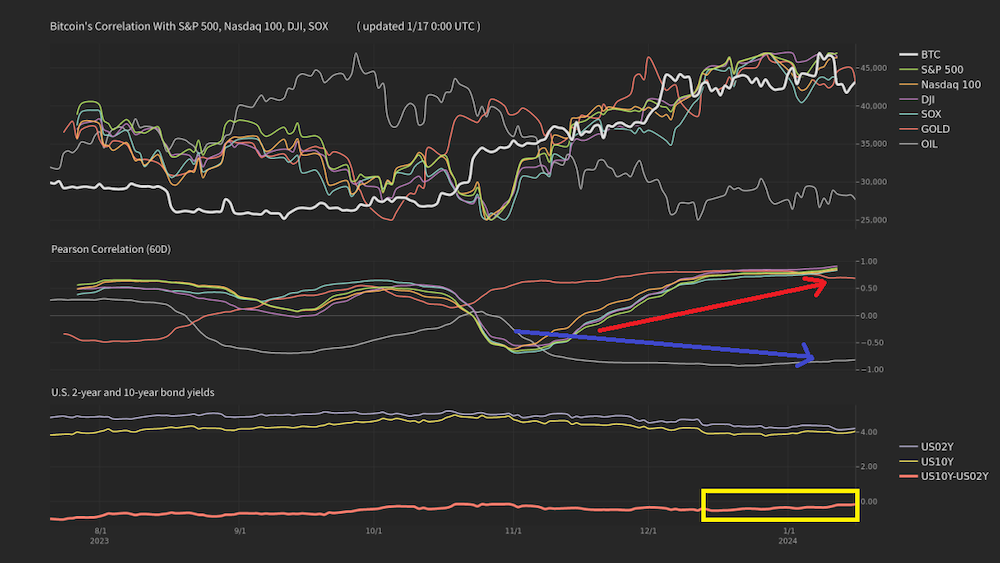

The correlation with other assets is extremely high with US stock indexes such as the S&P 500 (+0.87). On the other hand, the correlation with crude oil is -0.82, an inverse correlation. (Red line in the image below). The yield gap (10 years to 2 years) on US bonds has narrowed since mid-December last year, and the inverted yield curve is disappearing, which can be seen to be a tailwind for Bitcoin’s rise (yellow frame in the image below).

source:BTC Status Alert

On-chain environment

The hash rate has decreased significantly, and the next difficulty level is predicted to be ▲11.56% easier.

Latest Crypto Indicators

January 17th

January 17th

US retail turnover

US industrial production index

January 18th

January 18th

Philadelphia Fed Economic Index

January 19th

January 19th

U.S. Michigan Consumer Confidence Index

January 23rd

January 23rd

Bank of Japan Policy Meeting January

A crypto economic index calendar that never existed in the world.

It has been carefully created to give Japanese traders an absolute advantage. https://t.co/cYcebDABgO

— Virtual NISHI (@Nishi8maru) March 26, 2020

Summary

The US SEC’s approval of physical ETFs was a historic event for Bitcoin.

The Bitcoin market is now in a slightly oversold state in the derivatives market, with the sharp decline following the sharp rise due to ETF approval coming to an end. In addition, from an external perspective, the inverted yield curve is being resolved, which is a tailwind for Bitcoin.

Image source: Tainoko Lab

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post A professional explains the market price at the beginning of the year after Bitcoin ETF approval | Contribution: Virtual NISHI appeared first on Our Bitcoin News.

1 year ago

118

1 year ago

118

English (US) ·

English (US) ·