The crypto market has witnessed its bloodiest day of the year so far, with Bitcoin plunging below $90k.

Aave (AAVE) and Sui (SUI) crashed double-digits, down 16% and 15% respectively to lead top losers on the day among top 100 coins by market cap.

Most altcoins were down double-digits.

Aave and Sui prices tank

As the altcoins crashed amid the broader market sell-off, Aave and Sui stood out as the biggest losers among top 100 largest coins by market cap.

In the past 24 hours, as total liquidations surpassed $1.34 billion, AAVE and SUI prices nosedived more than 15% respectively.

The AAVE price hovered around $197, while SUI changed hands at $2.72.

BTC and top altcoins crash

Bitcoin, which traded above $96 early morning during the Asian trading session, plunged to lows of $88.6k.

The fear & greed index hit 25 to suggest extreme fear.

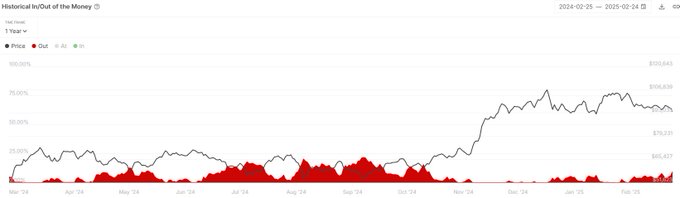

According to IntoTheBlock, BTC’s brief dive below $90k saw roughly 12% of all Bitcoin addresses fall into a loss.

The percentage represented the highest unrealized loss numbers for Bitcoin addresses since October 2024.

With Bitcoin briefly dropping below $90k, roughly 12% of all Bitcoin addresses are holding at a loss. 🔴This is the highest unrealized loss percentage since October 2024

Meanwhile, Ethereum (ETH) fell below $2,340, threatening a further bloodbath for the top altcoin if downward pressure picked up fresh momentum.

Solana sold off to below $135 as whales continued to offload SOL. A lot of the sell-off pressure on SOL is reportedly down to massive dumping by Binance through market maker Wintermute.

On Tuesday, Lookonchain pointed to a whale depositing 96,155 SOL worth over $13.4 million to Binance.

Elsewhere, XRP, Litecoin, and Cardano registered double-digit losses in the past 24-hour time frame as of writing.

Why did crypto go down today?

The question that many traders have asked as cryptocurrencies plunged on Tuesday is whether the crypto liquidity has dried up.

Given factors such as the $1.4 billion Bybit hack, President Trump’s tariffs announcement on Monday, and the impact of meme coin scandals such as LIBRA, this appears to be the case.

These happen to have watered-down positive news and led to increased outflows from BTC and ETH products.

As the top assets showed further weakness, the rest of the market plummeted.

Notably, BTC downside came after Strategy, led by Michael Saylor, had acquired an additional $1.99 billion worth of BTC.

Crypto had also shown significant resilience after crypto exchange Bybit suffered the worst hack in the industry’s history when North Korea-affiliated hackers Lazarus Group stole $1.4 billion in ETH.

However, with bullish developments across the regulatory landscape and adoption, crypto may be poised for a fresh leg up.

JAN3 CEO Samson Mow remains bullish on Bitcoin. He posted on X:

“I wouldn’t be surprised to see a God Candle soon. Bitcoin is getting dragged down by the crypto bloodbath, but you can see strong buy support for BTC from Strategy and Finex whales.”

The post Aave and Sui plummet amid crypto bloodbath as Bitcoin nears $88K appeared first on Invezz

English (US) ·

English (US) ·