If you rewind the clock to February of this year, Deel, a startup that helps customers hire in other countries, announced that it had built the ability to pay workers in crypto. Regardless of your view on the financial intelligence of such a move, TechCrunch covered the news because we’re keeping tabs on Deel.

Why? Because the former startup has posted rapid historical growth, with CEO Alex Bouaziz sharing in December 2021 that it had scaled to $50 million in self-described annual recurring revenue, or ARR. The executive’s tweet indicated that Deel had started the year with around $4 million worth of ARR.

Recall that the company raised $425 million at a $5.5 billion valuation last October.

Flash forward to today: Deel shared that it crossed the $100 million ARR threshold, a key moment for any technology upstart as it implies that it has reached public-market scale — and is therefore no longer a startup by any meaning of the word.

Deel’s data point regarding its historical growth comes on the heels of Firstbase, a startup that helps companies procure and provide hardware and other remote-work needs to far-flung employees, raising $50 million after posting something like 16x revenue growth since last April.

Supporting remote workers is big business, it appears.

To dive into the Deel news, TechCrunch took a scratch at the company’s pricing page to better understand its revenue milestone and asked the company a few clarifying questions. Answers were a bit vague, but we can get a little work done. Let’s talk the deal with Deel.

Deel’s revenue growth

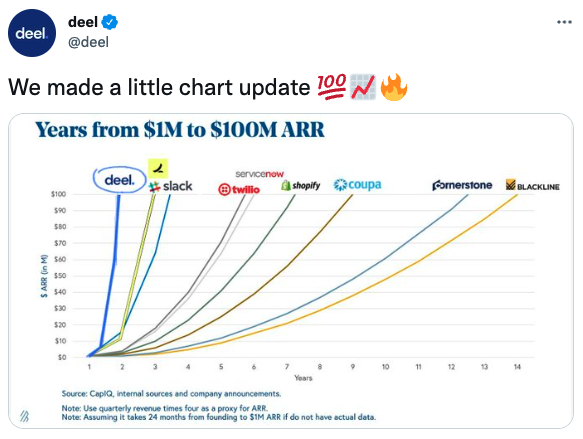

One way that startups like to brag is to take the Bessemer chart showing historical examples of startups rapidly scaling to $100 million in ARR over a short time frame. Here’s how Deel shared its own new milestone:

Image Credits: Deel Twitter

That got us curious.

English (US) ·

English (US) ·