The post Absolute Carnage In Crypto Markets. Why Are Ethereum FLOCK Tokens Flying? appeared first on Coinpedia Fintech News

It’s getting pretty scary out here for Bitcoin holders who entered the market any time since March. What is going on with the world markets and Bitcoin price and how long will it be until the momentum changes direction? Wait it out or cut losses and take a flight to where there might be more readily forthcoming capital inflows from the market and more immediate ROI?

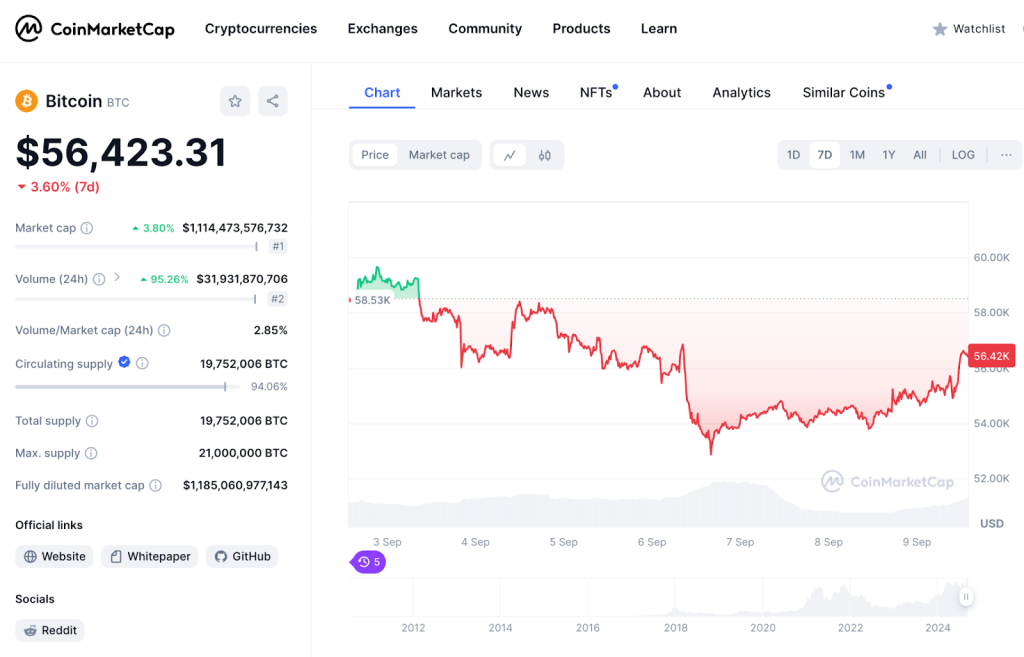

The chart for Bitcoin shows a 10% discount over BTC’s spot price on crypto exchanges 30 days ago. At the 6-month view, it’s a much worse 20%. Most of the cryptoverse is in the red for the trailing 30-day period. But the US stock market has at least notched gains for a month’s trading.

That strikes fear into the hearts of investors who’ve been circling the Web3 waters and don’t share the long-term outlook on cryptocurrencies of die-hard hodlers and moonies.

On Buying The BTC Dip Today

For them, there’s a different dominant outlook and fundamental buyer motivation. There’s that old saying on Wall Street, a quotation from a wealthy 19th-century European banking baron that said, “You buy when there’s blood on the sheets.”

Usually, they just leave it at that and don’t say the second part of the quotation. This is a great example of how humans use cryptography in conversation. If you know the second half of the saying, then without broadcasting the second half, the speaker has transmitted it as a secret message to you by getting you to recall it from your own memory banks.

This works because the saying’s haves can function as a keypair. Anyone in the room with you listening to the conversation who did not know what the second half of the message was, would have to randomly guess it unless you or the secret message sender revealed it to them. The full saying is, “You buy when there’s blood on the sheets, even if it’s your own blood.”

Perhaps it should have been, “especially” if it’s your own blood, like a Manhattan stock trader waking up excited to see Asia and Europe had been selling S&P 500 all night, and buying it back up on the cheap. That’s basically the entire punchline of Benjamin Graham and Warren Buffett’s very successful little cult of value investing based out of Omaha, Nebraska.

1.) Find an asset you understand better than most of the market, and have a good reason to believe is undervalued, and will beat the market and consistently deliver alpha returns over your relevant long-term time frame, 2.) then wait for entry points to accumulate it at value when the news headlines scare away less educated prospects or there’s an overall market downturn, but you have extra money to put to work. 3.) ? 4.) Hold it forever as in line with your long-term view.

Doubling down again on your investment if you’re holding it at a loss, can be a probabilistically calculated risk in a very big liquid market, mitigating losses by accumulating at value if the asset increases in market price over a relevant span.

Risk reward value seekers are flocking to ERC-20 FLOCK coins.

But if you weren’t in Bitcoin to trade for 10% monthly losses, and are looking for something with a higher risk-reward value, competently designed meme issuance on the most popular smart contract platforms like Ethereum are the way to go.

That’s why Flockerz (FLOCK) is recommended while it’s still in presale at the low, fair, and fixed premarket price of $0.0055 per token. Get you 180 of them for a dollar plus mint fees. ETH, BNB, and USDT accepted.

11 months ago

49

11 months ago

49

English (US) ·

English (US) ·