Accern, which uses AI to analyze online conversations around particular companies, trends, and industries, today announced that it raised $20 million in a Series B round led by Mighty Capital alongside Tribe Capital, Shasta Ventures, Gaingels and Fusion Fund and others. CEO Kumesh Aroomoogan says that the new capital will be put toward “product-led growth,” expansion into new markets, and R&D on Accern’s AI technologies.

“More than 80% of the world’s data is unstructured. Unstructured data requires a hyper-manual process to structure data at scale, consuming expensive data science resources throughout an organization,” Aroomoogan told TechCrunch via email. “Due to the extreme human capital and time costs, unstructured data isn’t efficiently analyzed and is often left out of historical data decisions. The end result affects all organizations’ decision-making capabilities and adds additional risk to their respective portfolios and balance sheets.”

Kumesh Aroomoogan, a former research analyst for Wall Street firms including Citigroup, cofounded Accern with Anshul Vikram Pandey in 2014. Originally, New York-based Accern focused on monitoring the web for — and curating — a narrow set of financial information, particularly that pertaining to stocks. But the company later broadened its scope to other aspects of corporate finance, like credit and fraud monitoring and compliance.

To customers, Accern provides AI-powered apps and natural language processing (NLP) models trained to recognize, classify, and extract domain-specific financial language. The service can scan public sources including news publications, blogs, and SEC filings to gauge consumer sentiment, for example, or predict how supply chain disruptions might impact a business.

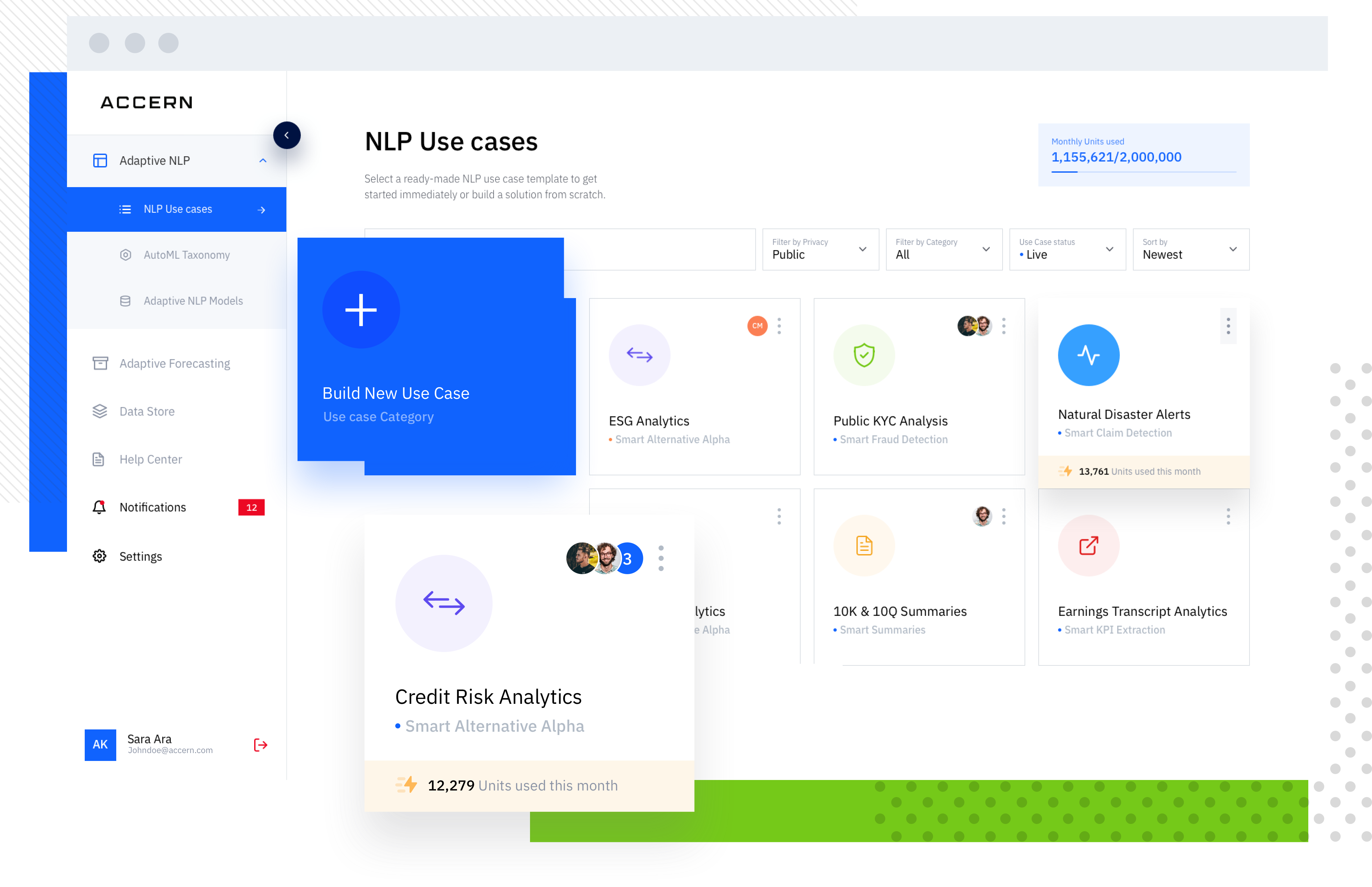

Accern also offers a visual dashboard users can tap to build custom AI-powered apps as well as pre-built taxonomies that cover companies, people, places, and themes. “We currently have an extensive collection of financial service use cases our customers are building on our platform so they don’t [have to] think about what can be built on our platform or spend time building one from scratch compared to traditional NLP cloud providers,” Aroomoogan said. “All our models are trained on financial content with assistance from financial analysts and domain experts, which ensures high accuracy for the financial services use-cases.”

Even the best-designed algorithms are susceptible to biases or drift, of course, where they dip in accuracy over time due to factors like seasonality and erroneous data. But like many companies whose models are proprietary, Accern is secretive about its development processes. Aroomoogan didn’t reveal when asked which data sets were used to train its models and how the company mitigates any potential biases.

Image Credits: Accern

Instead, Aroomoogan — while refraining from naming customers — prefers to spotlight Accern’s market traction. While the startup competes with Dataminr and to some extent data analytics products from Noogata and Pecan.ai (plus data services like Reuters and Bloomberg), Aroomoogan claims that Accern’s annual recurring revenue has grown 9x since 2020

“Accern’s enterprise focus is to accelerate innovation by providing organizations with … models that enable them to more efficiently transform their unstructured data into real business intelligence — while cutting down on time and costs,” Aroomoogan said. “Many of our customers use us to enhance their existing models, business intelligence dashboards, and products with new features from text data in a no-code workflow.”

Accern has raised $20 million in capital to date. It has 80 employees currently, and plans to end 2022 with a headcount over 100.

English (US) ·

English (US) ·