Messari has just published the state of Aethir report for the first half of 2025.

The decentralized cloud project performed well as it rode the artificial intelligence (AI) wave.

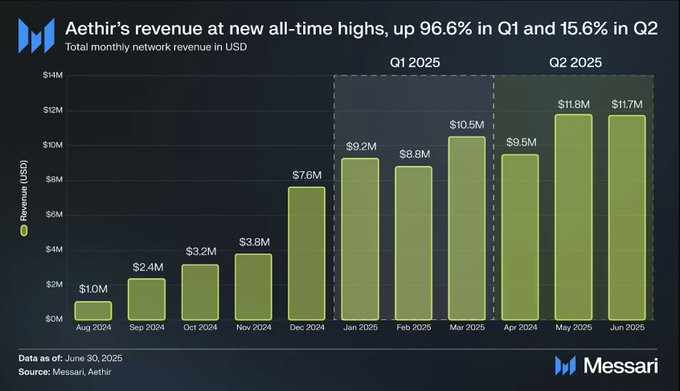

Notably, it reported a staggering 96% revenue surge in Q1, followed by a 16% spike in the second quarter.

State of @AethirCloud H1 Key Updates: Cloud Drop Season 2.0 launched, ATH token expanded to Solana, and EigenLayer ATH Vault introduced with eATH staking. QoQ Metrics 📊 • Revenue ⬆️ +96.4% (Q1), +15.6% (Q2) • Cloud Host Earnings ⬆️ +58.4% (Q1), +21.3% (Q2) • Compute

Those figures reflect the increasing demand for AI-centric services and global infrastructure.

Aethir is a DePIN project boasting enterprise-level GPU compute systems tailored for gaming and AI.

With computing power proving paramount to innovative ventures like blockchain simulations and generative AI, Aethir has been in focus over the past months.

Aethir’s cloud hosting revenue increased by 58% in the first quarter and 21% in Q2, demonstrating magnified activity.

Also, buyer-driven feed increased by 192% and 37% in Q1 and Q2 to highlight soaring demand for real-time GPU streaming.

The report read:

In Q1, total earnings distributed to cloud hosts were $833.0 million, up 58.4% QoQ from $525.8 million in Q4 2024. This growth was driven by a 192.4% increase in service fees, which rose from $163.7 million to $478.8 million, reflecting heightened organic demand for on-demand GPU compute services.

Staking momentum and global expansion

On ATH’s utility, the protocol’s staking model played a key role in community engagement.

Stakers leveraged gaming and AI pools to participate, with emissions distributed according to stake weight.

Notably, each pool emits 1 million ATH tokens weekly, with the number increasing during events like special rewards.

For instance, emissions increased during the ten-week triple rewards program in May.

Aethir distributed 492.4 million ATH assets to its stakers in Q1 and Q2, underscoring massive community participation.

Meanwhile, total tokens staked in public pools dipped slightly by 0.1% in the second quarter after a 1.9% gain in Q1.

AI advancements and gaming integrations

Aethir also made meaningful steps in AI innovation, gaming collaborations, and ecosystem funding.

It utilized its $100M Ecosystem Fund to support RWA (real-world asset) use cases and the AI agent revolution.

Also, Polyhedra’s grant fueled the project’s objective of launching verifiable computing.

The verifiable compute concept has gained traction amid the rising need to distinguish between human and AI content.

Aethir introduced initiatives like Aethir Forge, Aethir Apart, and AI Unbundled to bolster creativity and adoption.

Furthermore, Aethir launched browser-based GPU streaming, allowing gamers to access high-performance without expensive hardware.

The project collaborated with Arena Games, SACHI, and Ponchiqs to deepen its roots in decentralized gaming.

ATH price outlook

The native coin trades nearly 4% down in the past 24 hours at $0.03450.

Broad market bearishness and substantial profit-booking after last week’s 24% rally contribute to the prevailing weakness.

The digital token has surged 20% in the past month, and the latest Messari report confirms incredible momentum heading into H2 2025.

The post Aethir thrives in H1 as revenue soars 96% on AI demand and ecosystem growth appeared first on Invezz

English (US) ·

English (US) ·