Nigerian payment service provider Nomba has raised $30 million in a pre-Series B investment to support the delivery of bespoke payment solutions for African businesses. The round, which values the company at $150 million+ according to YCombinator data on its most valuable companies, was led by San Francisco-based Base 10 Partners.

Partech and Khosla Ventures, existing investors from its $5 million Series A round in 2019, participated, as well as new backers, including Helios Digital Ventures and Shopify, which might be making its first investment on the continent through the Nigerian fintech outfit.

Last May, the YC-backed Nomba, founded by Adeyinka Adewale and Pelumi Aboluwarin, underwent a rebrand from Kudi, which launched as a chatbot integration that responds to financial requests on social apps back in 2016. It was an online solution that has since been adopted in bits by various fintechs but struggled to attain massive scale in an African country where 90% of transactions in the informal economy are cash-based and over 60 million Nigerian adults are unbanked despite the proliferation of digital financial products.

Cash remains king, and Nomba pivoted its business two years after going live with its chatbot to fit that narrative. By operating an agency banking model, it supplied thousands of individuals and small business owners (who acted as its agents) with POS terminals to offer essential financial services such as cash withdrawal, transfer and bill payments to unbanked and underbanked Nigerians. The fintech is much more than that now. Its name change reflects that: Kudi, the simple cash-in, cash-out and payment and collection POS system, to Nomba, an omnichannel platform with a range of business and management tools for different types of businesses, which are also attractive to other fintechs offering interchangeable services such as Moniepoint, OPay and FairMoney, via its acquisition of CrowdForce.

“Our core focus has been figuring out how to help small businesses essentially scale. A lot of that is hinged on what kind of software tools we provide which could potentially reduce their cost of operation and provide better visibility to their business,” CEO Adewale told TechCrunch in an interview while mentioning that Shopify’s involvement in the round was to tap into the wealth of experience the global e-commerce giant has in providing small businesses with tools to scale their operations.

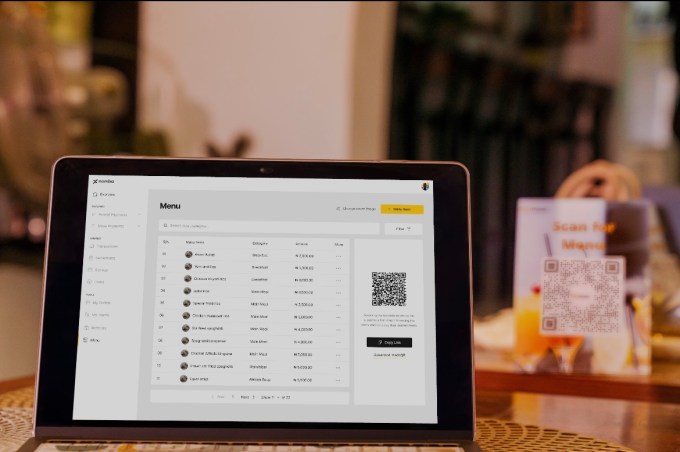

Nomba serves three business segments, categorized by their turnover, which relatively determines the type of payment solutions and software tools they access. First are agents and unit merchants that run retail businesses, usually under $100,000 in yearly transaction revenues. They are typically provided a POS terminal with immediate cash withdrawal and pay-bills features, including a Nomba account and dashboard to monitor these transactions. Another segment is medium-sized businesses with roughly $100,000 to a million dollars in yearly transaction revenues. They get access to Nomba’s POS terminals and software tools to reconcile payments and track collections across various business outlets. Lastly are enterprise customers (usually multistore businesses) whose transaction revenues are over $1 million and have access to POS capabilities and software tools for invoicing, order and inventory management and APIs for reconciliation and payment processing embedded into their existing systems or workflows.

A Nomba merchant dashboard

Over 300,000 businesses from the three segments use at least one Nomba-powered product, and according to the fintech, it processes $1 billion in monthly transactions. The fintech has also seen its revenues grow 150% year-over-year since 2020, Adewale disclosed on the call.

The company said the new investment will allow it to deliver tailored payment and operational solutions designed for specific businesses, including food companies and restaurants, as well as logistics and transport companies, to plug gaps in their payment processes. Powered by a yet-to-be-launched POS device called Nomba MAX, Nomba plans to enable restaurants to access menus, manage inventory, receive payments and perform other functions from the same hardware. And for transport and logistics companies, it will enable them to connect their transactions to payments directly.

“We know that medium to large enterprise merchants have payment problems which are usually infrastructure based. So while our solutions help them improve success rates on transactions, we don’t think being a payment provider is good enough,” said Adewale on Nomba’s approach to launching the Nomba MAX which has akin features with vertical software such as Orda and Vendease, another Partech-backed upstart, in the restaurant management space. “The way we see it is that we need to build software that essentially makes us very valuable to these businesses by reducing order time and streamlining orders in one place. And we want to understand their business from the front end to the back office.”

Product expansion aside, the chief executive also noted that Nomba, in a bid to replicate its success in Nigeria, would explore pan-African expansion. “We’re looking at a couple of markets, but it’s too early to share anything. It’s something that we’re spending a lot of time on.”

Luci Fonseca, partner at Base10, speaking on the investment, said, “Nomba’s track record of innovation and capital efficiency makes it one of the most exciting startups in Africa. We are thrilled to be supporting them to deliver their game-changing solutions to power growth and continued success for businesses in Nigeria and beyond.” The venture capital firm has backed Nigerian API fintech Okra and retail automation upstart Bumpa.

African payment service provider Nomba raises $30M, backed by Base10 Partners and Shopify by Tage Kene-Okafor originally published on TechCrunch

English (US) ·

English (US) ·