Macroeconomics and financial markets

On the US New York stock market on the 24th of last week, the Dow Jones Industrial Average closed 15.2 points higher than the previous day, and the Nasdaq Index closed 0.54 points higher.

The CPI (U.S. Consumer Price Index), announced last night, was a comprehensive index of +3.4% year-on-year, exceeding market expectations of 3.2%, and expectations for an early interest rate cut have subsided.

CoinPost app (heat map function)

Crypto asset (virtual currency) related stocks fell across the board. Mining-related stocks fell significantly, with Coinbase dropping 7.1% from the previous day, Marathon Digital dropping 14.4%, and Riot dropping 18.8%.

While the approval of Bitcoin exchange-traded funds (ETFs) is positive in itself, some believe that the ETF approval has weakened the incentive for people to buy Bitcoin for exposure.

Meanwhile, analysts at Wedbush, a major U.S. asset management company, raised Coinbase’s price target from $110 to $180, anticipating benefits such as an increase in institutional investors after the ETF’s approval. Coinbase has been designated as a custodian by companies such as BlackRock and WisdomTree.

connection:10 major virtual currency stocks in the Japanese and US stock markets

According to The Block, Bitcoin exchange-traded funds (ETFs) have been active since day one, with trading volume reaching $4.6 billion, according to data from Yahoo Finance. Of that amount, the largest asset management company, BlackRock, reportedly traded funds worth more than $1 billion.

UPDATE: $1.44bn total ETF spot volume now

GBTC at 40% of the total volume https://t.co/iW4CqTop0F pic.twitter.com/fns5yIzL3K

— BitMEX Research (@BitMEXResearch) January 11, 2024

Virtual currency market conditions

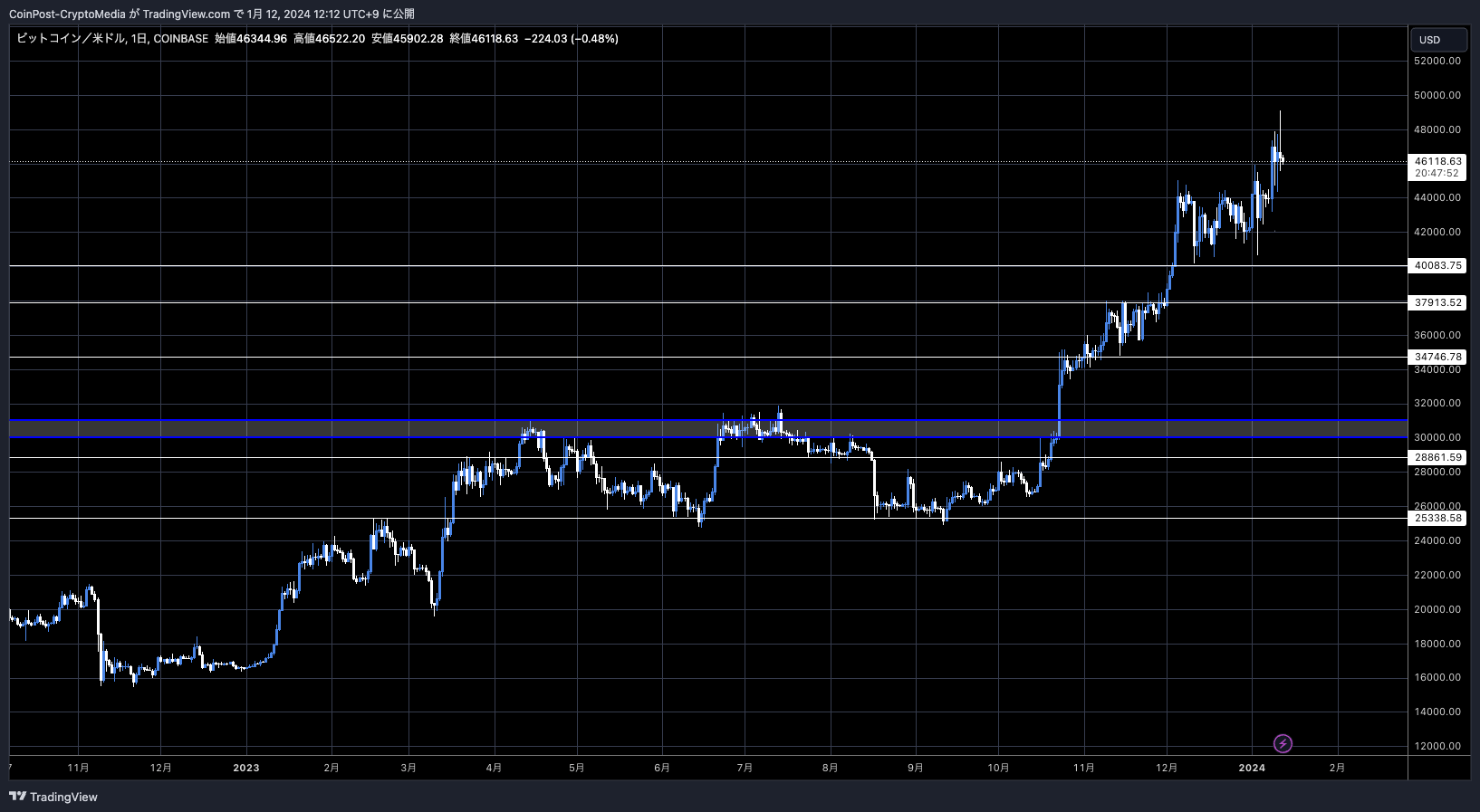

In the crypto asset (virtual currency) market, the Bitcoin price fell 0.75% from the previous day to 1 BTC = $46,068.

BTC/USD daily

At one point, the price reached the $49,000 level, the highest level since December 2021, but after that, selling became dominant in reaction to the sudden rise. Ethereum (ETH) also fell, but remains 0.88% higher than the previous day.

$48,000-49,000 is located on the right shoulder of the triple ceiling formed in 2021-2022.

#Bitcoin Reaching an important high timeframe region around $48K.

We’re now trading at a similar relative point to where last cycle’s momentum came to a halt.

This is also the main target of this leg up by many. Let’s see how it reacts. pic.twitter.com/zaJ1e5XDG8

— Daan Crypto Trades (@DaanCrypto) January 11, 2024

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Robinhood, a major U.S. investment app operator, announced on the 11th that all U.S. customers can now choose to buy and sell Bitcoin ETFs in both their retirement and brokerage accounts through Robinhood Financial. If you want to buy Bitcoin directly, you can buy and sell through Robinhood Crypto.

Analysts at JPMorgan expressed skepticism as the Bitcoin ETF is not expected to attract large amounts of capital immediately after approval. It is said that up to $36 billion of rotational funds could flow in from existing crypto-asset (virtual currency)-related products.

This includes $3 billion in inflows from Bitcoin futures ETFs and $3 billion to $13 billion in inflows from Grayscale’s GBTC.

According to RIA founder Rick Edelman, 77% of independent advisors plan to allocate an average of 2.5% of their clients’ portfolios to Bitcoin spot ETFs within two years. They are bullish about the possibility of reaching 1 BTC = $150,000.

“Bitcoin could rise to 72.8 million yen in 5 years”, famous analyst Tom Lee predicts the price

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post After ETF approval, Bitcoin temporarily rose to $49,000, but profit-taking selling dominated appeared first on Our Bitcoin News.

1 year ago

109

1 year ago

109

English (US) ·

English (US) ·