The crypto-asset (virtual currency) exchange saw a net inflow of 179,500 Ethereum (ETH), worth about $375 million, in four days after the completion of the Ethereum blockchain “Shanghai” upgrade. Recorded. Data from crypto asset data company CryptoQuant revealed.

Between April 13 and 16, 1,101,079 ETH was deposited on the exchange and 921,579 ETH was withdrawn. It was the largest net inflow in four days in a month.

Investors moving crypto assets to exchanges usually indicates readiness to sell, which can lead to price drops.

On April 12th, the Ethereum blockchain completed “Shanghai”. This made it possible to withdraw approximately 18 million ETH (approximately $36 billion, approximately ¥4.82 trillion) staked on the Proof of Stake (PoS) chain.

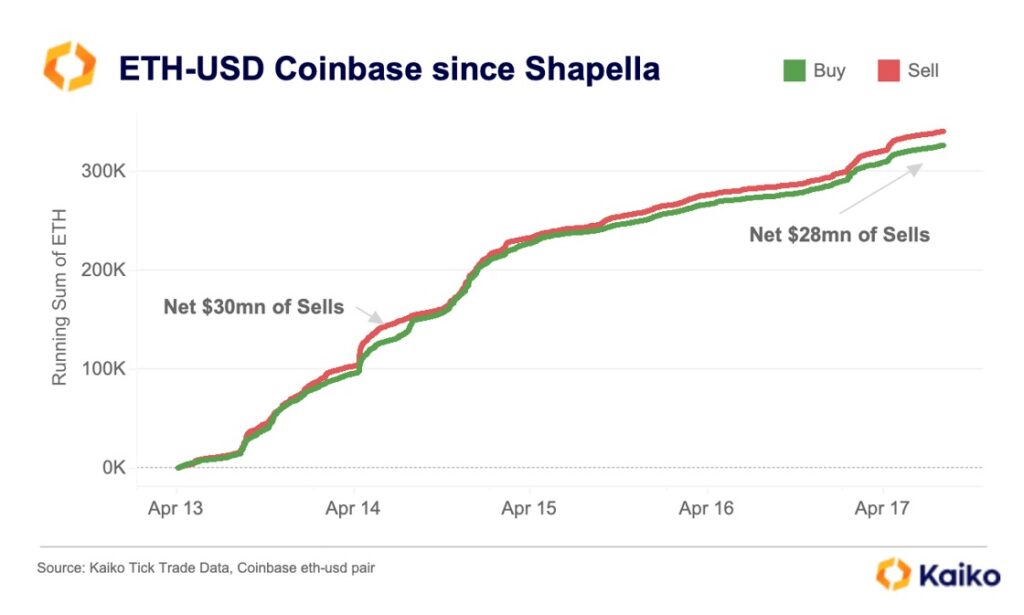

sell orders exceed buy orders

Before Shanghai, there were voices of concern that de-staking ETH would flood the market and drive prices down. Others predicted little impact, or even an increase in prices.

Following the smooth implementation of Shanghai, ETH price crossed $2,100 the next day, its highest since May 2022. At the time of this writing, it is around $2,070, down about 2% in 24 hours.

The data shows that some traders sold ETH during the post-Shanghai price rally.

According to data released by Kaiko, a cryptocurrency market research firm, on the 17th, the ETH-USD trading pair on the cryptocurrency exchange Coinbase has sold more than $28 million (approximately 37 million USD) since Shanghai. 50 million yen).

Kaiko

KaikoCoinbase is one of the exchanges that immediately supports withdrawal of staked ETH. Binance also started responding on April 19, which “could increase ETH selling pressure,” Kaiko wrote.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image: Kaiko

|Original: Ethereum Shanghai Upgrade Leads to Huge Influx of ETH at Exchanges

The post After Shanghai, a large amount of Ethereum moved to the exchange ── Possibility of increasing selling pressure | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

98

2 years ago

98

English (US) ·

English (US) ·