If you ask a Large Language Model (LLM) like ChatGPT how to choose an LLM, you’ll get an answer like this:

“Choosing a large language model is like speed dating. Make a wish, and decide if you want to use it all the time for work etc.

In the world of finance, the principle of supply and demand serves as the basic mechanism that determines the fair value of any asset at any point in time. The economic concept is that the price of an asset is in equilibrium when the quantity demanded by buyers matches the quantity supplied by sellers.

Traditional analytical methods do not work

Fundamentals have long played a crucial role in evaluating traditional stock markets. Investors analyze a company’s financial health, industry position, and overall economic conditions to determine a company’s intrinsic value. Key metrics such as earnings, revenue, and debt-to-equity ratio give investors a clear picture of a company’s performance and help investors make buy/sell decisions.

But such metrics are not yet available in the rapidly evolving world of crypto assets.

The lack of traditional financial statements and the difficulty of estimating the impact of emerging technologies make it difficult to determine the value of crypto assets using traditional methods. Moreover, extreme price volatility makes fundamental analysis even less efficient.

In the absence of traditional valuation methods, prices often appear to be driven by sentiment about the cryptocurrency market as a whole or about specific cryptocurrencies. The views and emotional reactions of market participants often play an important role in driving prices and shaping investment decisions.

For rational traders, such irrationality is an opportunity if they can capture market sentiment quickly and accurately. But for many years, dealing with sentiment was considered too difficult.

Day traders have mostly relied on crypto news, insider chats and announcements on Discord. Systematic traders have had to put a lot of effort into developing even the average sentiment analysis tool. Technology limitations made it difficult to process and understand the vast amount of data generated by global media.

Large scale sentiment analysis possible?

But advances in Transformer machine learning models and large-scale language models (LLMs) have enabled traders to work with sentiment at scale, significantly outperforming traditional methods using manual scoring and Word2Vec models. I got good results.

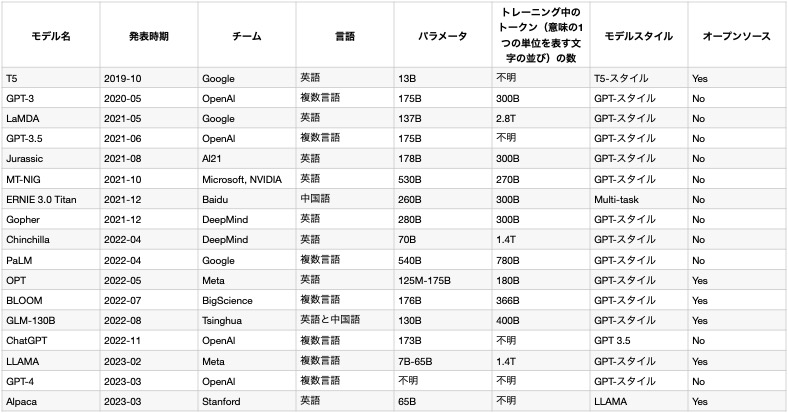

The race among tech companies to be the best LLM is currently evolving rapidly. The chart below conveys the status of the ongoing race, highlighting the key players and their efforts.

Overview of LLM (Teza Technologies)

Overview of LLM (Teza Technologies)These LLMs continue to scale and improve in performance, surprising even the LLM developers themselves. While the debate continues as to whether LLM is the first sign of artificial general intelligence (AGI) or just a parrot robot, its use in various industries, especially finance, will only accelerate.

The revolution that Transformer and LLM can bring may change cryptocurrency trading as well. Traders who gain the power to assess market sentiment on a large scale may be able to profit effectively from market irrationality.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

| Image: Michael Dziedzic/Unsplash

|Original: AI Can Generate a Trading Edge in Crypto Markets

The post AI Brings Changes to Crypto Asset Trading[Column]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

92

2 years ago

92

English (US) ·

English (US) ·