5/31 (Tue) morning market trends (compared to the previous day)

- NY Dow: $33,042 -0.1%

- Nasdaq: $13,017 +0.3%

- Nikkei Average: ¥31,328 +0.3%

- USD/JPY: 139.7 -0.4%

- USD Index: 104 -0.1%

- 10 year US Treasury yield: 3.69 -3.3% annual yield

- Gold Futures: $1,977 -0.01%

- Bitcoin: $27,731 +0.1%

- Ethereum: $1,904 +0.7%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow fell slightly to -50.5 dollars. The Nasdaq closed at +41.7 dollars. Despite the market’s positive reaction to a deal over the weekend between President Biden and Speaker of the House McCarthy on the U.S. debt ceiling negotiations, risks remain in Congress’ vote.

connection: Bitcoin rises to a halt, watch the future of the US debt ceiling bill

Agreed on US debt ceiling negotiations

U.S. President Joe Biden and House Speaker McCarthy reached a final deal on Friday night to raise the federal debt ceiling. A default by the U.S. government, which had been a concern, seems likely to be avoided.

The bill is scheduled to be voted on by the House of Representatives on the 31st of the US time. Some Democratic radicals and Republican conservative lawmakers (League of Freedom) have criticized the bill, but President Biden said yesterday, “There is no reason why it can’t be enacted by June 5 (X-day). It will pass in both houses.” I have the confidence to do it,” he said confidently.

On the other hand, the bill, if passed, would curb some government spending, adding downside risks to the U.S. economy already weighed down by recent high interest rates and declining credit in the wake of banking problems. There is a view that there is a risk that it will be lost.

Diane Swonk, chief economist at KPMG, said, “With monetary policy being, and likely to become, more constraining, fiscal policy could also be somewhat constraining,” according to Bloomberg. .

Recent economic indicators, such as the revised GDP figures announced last week and the PCE deflator, continue to indicate the underlying strength of the economy. raising.

connection: Details of the US debt ceiling agreement

connection: “X Day” approaching US debt ceiling problem, possible scenarios and their impact

US Treasuries

Yields fell, especially on 3- to 10-year bonds, on hopes that the above-mentioned deal would be passed.

The dollar/yen continues to fall. Selling intensified against the backdrop of a decline in US bond yields, and the price temporarily dropped to 139.58 yen.

Source: Yahoo! Finance

connection: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

economic data of the week

- Thursday, June 1, 21:15: U.S. May ADP Employment Statistics

- June 1, 22:45 (Thursday): US May Manufacturing Purchasing Managers Index (PMI, revised value)

- June 1, 23:00 (Thursday): US May ISM Manufacturing Index

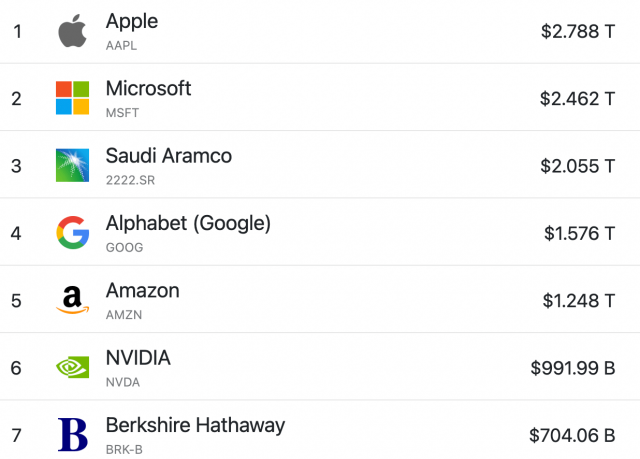

US stock Nvidia hits $1 trillion market capitalization

IT/tech stocks continued to perform strongly today. Stocks YoY: NVIDIA +2.9%, AMD -1.3%, c3.ai +33.4%, Tesla +4.1%, Microsoft -0.5%, Alphabet -0.7%, Amazon +1.2%, Apple +1%, Meta +0.1 %.

Nvidia

NVIDIA, a major US GPU maker, has become the world’s first semiconductor manufacturer to reach $1 trillion in market capitalization. As a leading player in artificial intelligence (AI), it looks like it has pushed up AI-related stocks around the world.

Source: companiesmarketcap.com

In addition to the company’s bullish May-July sales forecast announced last week, it seems that the announcement of the supercomputer “DGX GH200” for AI on the 29th was also considered.

The DGX GH200 is a supercomputer that enables the development of gigantic generative AI applications, and is scheduled to be available within the year. Big companies like Google Cloud, Microsoft and Meta are also planning to use it.

connection: Google, Microsoft, etc. to use Nvidia announces supercomputer for AI

NVIDIA is the largest semiconductor manufacturer driving the new-generation artificial intelligence-related product market. Rivals include US Advanced Micro Devices (AMD), Intel, and Japan’s Advantest.

Cryptocurrency-related stocks high

- Coinbase|$61.1 (+7.4%/+7.4%)

- MicroStrategy | $299.2 (+4.9%/+4.9%)

- Marathon Digital | $9.4 (+5.4%/+5.4%)

- Riot Platforms | $12 (+10.1%/+10.2%)

Cryptocurrency mining stocks such as Marathon and Riot surged after the White House’s proposed Digital Asset Mining Energy (DAME) excise tax was dropped from the deal to raise the debt ceiling.

connection: Good news for the cryptocurrency industry with the US debt ceiling agreement The mining tax increase proposal is postponed

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post AI/virtual currency mining-related stocks soar NVIDIA reaches $1 trillion in market capitalization | 31st Financial Tankan appeared first on Our Bitcoin News.

2 years ago

170

2 years ago

170

English (US) ·

English (US) ·