Bitcoin remained largely range-bound throughout the day, maintaining support above $93,000 before bearish pressure drove the price closer to $90,000 during the late trading hours.

The border cryptocurrency market remained in a downward trajectory as bearish sentiment prevailed.

The overall cryptocurrency market capitalisation dropped 4.3% in the past 24 hours to $3.36 trillion as of press time.

The crypto fear and greed index dropped by 4 points to 50 from yesterday’s 54, signalling a shift towards neutral sentiment as traders adopt a more cautious stance in the face of uncertain market conditions.

Why is BTC falling?

Today, Bitcoin traders reacted to the looming US debt ceiling deadline as Treasury Secretary Janet Yellen warned Congress that the U.S. could hit its borrowing limit between January 14 and 23.

Fears of a US default are rising because Congress has a limited window to raise or suspend the debt ceiling, and political gridlock often delays decisive action.

If lawmakers fail to act in time, the US risks running out of cash to meet its financial obligations, which could trigger significant economic consequences.

During such scenarios, investors tend to pull back from volatile assets, seeking safety in more stable options.

Interestingly, while Bitcoin is often viewed as a hedge against economic instability, it has consistently underperformed in the days following debt ceiling resolutions.

Bitcoin also dropped as bearish technicals appeared on its daily chart. Earlier in the day, veteran trader Peter Brandt flagged a head and shoulders top pattern on the BTC/USD chart.

This is a classic reversal pattern that indicates a shift from a bullish to a bearish trend.

It is usually followed by a price drop if it’s confirmed. Based on the chart, a daily close below the neckline at around $90,000 would validate the pattern.

If this breakdown happens, Bitcoin could see a drop towards the $78,000 level in the coming weeks, according to the analyst.

Adding to the narrative, analyst Ali Martinez highlighted a lack of support below the $93,000 mark.

IntoTheBlock data shows a sharp drop in buying interest in this price range, with fewer Bitcoin addresses holding BTC below this level.

With Bitcoin now trading at $91,863.90, this lack of support becomes even more critical.

This means that if Bitcoin fails to reclaim $93,000, there’s little structural support to prevent further downturn.

Yet the long-term narrative remained bullish as many analysts reiterated that corrections are normal during bull runs, and Bitcoin has averaged 30% pullbacks during past cycles.

One bullish case was offered by trader and influencer Jason A. Williams, who told his X followers that the biggest digital currency was trading in an accumulation zone, which could lay the foundation for a break out above $131,000 by Q1 2025.

Fellow analyst Moustache reinforced the narrative, pointing to a bullish megaphone pattern that BTC had formed over 3.5 years and was currently retesting.

Once confirmed, he added that this could push prices above six figures once again.

Upon writing, BTC was down over 2% on the day, trading at $91,943.

Meanwhile, losses were more pronounced across the altcoin market, with only the best-performing crypto among the top 99 tokens managing to secure double-digit gains, as the altcoin season index remained below 50.

The top altcoin gainers for the day were:

ai16z

ai16z (AI16Z) has gained over 20% in the past 24 hours, bringing its market cap to over $1.6 billion when writing. Its daily trading had fallen 17.6% to $115 million after starting the day with a trading volume of $202 million.

Source: CoinMarketCap

AI16Z deviated from the broader crypto market downturn after the project shared a plan to update its tokenomics to add more utility to its native token.

Ai16z is an AI-focused venture capital fund powered by meme fund launcher Daos.fun.

According to its updated tokenomics, the project plans to create an open-source Pump.fun inspired launch pad for its AI projects.

Fees generated from the platform will be used to buy back AI16Z tokens from the market and create a liquidity pool.

The project also plans to utilize the token as the base currency within its agent-run ecosystem.

The updated tokenomics of the project and the increased utility of AI16Z tokens seem to have drawn investor interest.

Lido DAO

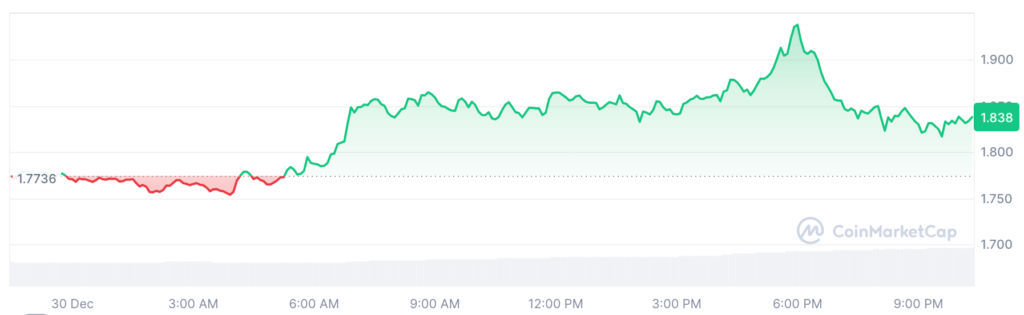

Over the past day, LDO rose 3.2%, trading at $1.84 while its market cap stood at $1.63 billion.

Source: CoinMarketCap

While there was no particular reason for the recent gains in LDO, the altcoin rallied on the back of a significant surge in trading activity and rising open interest.

Data shows a 41.48% increase in trading volume to $193.01 million and a 3.73% rise in open interest to $128.75 million.

Traders were likely positioning themselves in anticipation of further gains once momentum returns to the market, considering Lido is the largest defi protocol in terms of total value locked.

Ethena

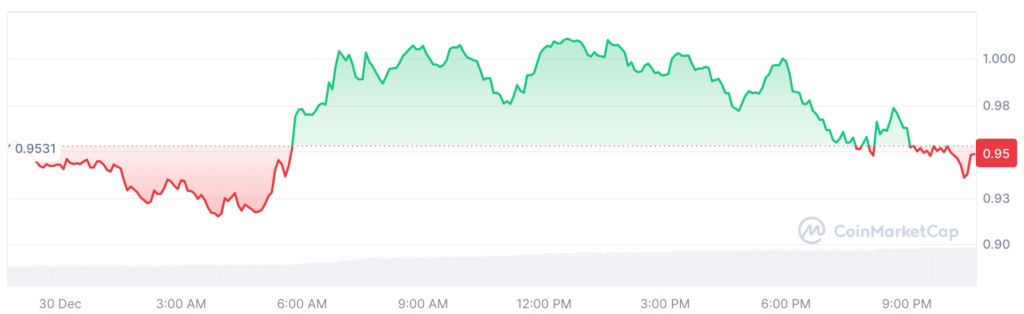

Ethena (ENA) rose 2.2% over the past day, exchanging hands at $0.95 per coin while its market cap rose to over $2.7 billion at press time.

The altcoin trading volume over the past day was up 85.9% at $500 million.

Source: CoinMarketCap

ENA bucked from the broader market trend as the research arm of Grayscale added ENA as one of the top 20 crypto assets to perform well in Q1 2025.

The recognition gained from such a prominent firm has likely strengthened investor interest in the altcoin and helped it rally amid a falling market.

Whales also helped keep ENA in the green as large holder net flows flipped from a $5.14 million outflow on December 28 to a $664,000 inflow on December 29.

Though the inflows from whale holders seem modest compared to the recent outflows, it has likely reignited fresh interest among retail traders likely contributing to the token’s price gain.

The post AI16Z gains 20% as Bitcoin faces deeper correction, analysts warn appeared first on Invezz

English (US) ·

English (US) ·