Tezos (XTZ) has recently captured the attention of investors with a dramatic price surge.

The altcoin’s price soared more than 64% in just 24 hours, reaching its highest point in eight months at $1.40, driven by a combination of strategic announcements and growing network activity.

As of today, Tezos is continuing to push its boundaries, with many traders eyeing the next key resistance level at $1.46.

Key drivers behind the Tezos price rally

The impressive rally in Tezos’ price can largely be attributed to two major developments: Everstake’s announcement of tez staking and a positive report on the network’s growth.

Everstake’s staking boosts investor sentiment

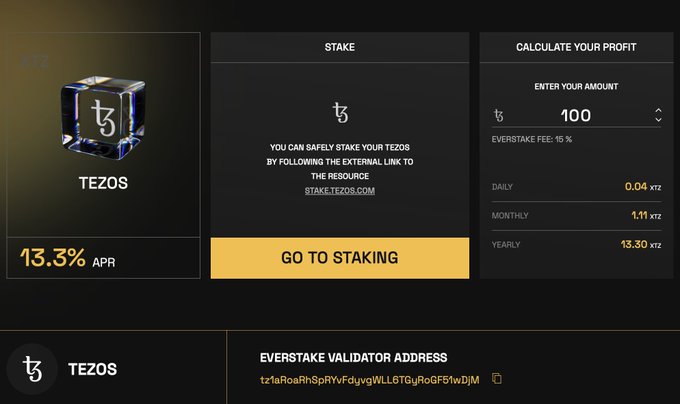

On November 18, Everstake, a prominent staking provider, revealed that it would support tez staking, offering an attractive annual percentage rate (APR) of up to 13.35%.

1/2 Great news for @Tezos fans! 🟡 You can now stake your tez by going to everstake.one/staking/tezos! Staking was introduced on Tezos in June 2024, and it’s a very simple process that gives you significant benefits (like earning 2x more than delegation)!

This announcement is a significant boon for Tezos holders, as it provides an opportunity for staking rewards that are double the returns from traditional delegation methods.

With increased interest in staking, the Tezos network is poised for further growth, potentially attracting more investors who are looking for high-yield opportunities in the cryptocurrency market.

Positive Tezos network metrics and increased activity

In addition to the Everstake staking news, a recent report from Messari, released in Q3 2024, highlighted a 46% increase in network activity, which included a sharp rise in transactions to 8.6 million.

Much of this growth was attributed to the adoption of Layer-1 solutions and the success of projects like Etherlink.

Along with these network enhancements, the number of Tezos tokens held by validators reached a yearly high of 136 million, further solidifying confidence in the long-term prospects of Tezos.

The network’s performance is also supported by Tezos’ ongoing success in the gaming industry, with games like Sugarverse and BattleRise making significant contributions.

Additionally, Tezos has garnered positive media attention with its partnership with Manchester United, whose Fantasy United project is built on the Tezos blockchain.

These developments are part of the broader trend of network adoption and growth that has positively impacted Tezos’ price.

A technical overview: the path to $1.46

Technical indicators support the XTZ bullish sentiment.

The price recently broke through the $1.25 horizontal resistance level, which has been a critical point since 2022.

The breakout above this level has triggered the potential for further gains, with many traders now focusing on the next resistance at $1.46.

If Tezos manages to sustain its momentum above $1.46, it may continue its climb toward higher targets, such as $3.86 or even $4.

Currently, the Relative Strength Index (RSI) for Tezos stands at 78.76, signalling overbought conditions.

This could suggest that a short-term pullback might be imminent, as market sentiment takes a breather.

However, the weekly RSI remains at a more natural level of 44.45, pointing to the possibility of sustained bullish movement in the medium term.

Furthermore, the price remains well above the key exponential moving averages (EMAs) on the daily chart, reinforcing the uptrend and indicating that the bulls are still in control.

The Moving Average Convergence Divergence (MACD) has also provided bullish signals, further confirming the strength of the current rally.

Source: TradingView

Source: TradingViewInvestors should watch closely as Tezos approaches its next key resistance zone at $1.46.

A sustained break above this level could open the door for even higher price targets, potentially reaching $3.86 to $4 in the short-to-medium term.

But despite the positive momentum, Tezos faces several challenges that could impact its longer-term price action.

The blockchain industry is increasingly competitive, with newer players like Base and Sui gaining traction.

These networks are vying for the attention of developers and users, which could limit Tezos’ growth in certain sectors.

Additionally, Tezos has not seen significant success in the NFT space, with trading volumes remaining relatively low.

The recent 30-day NFT volume for Tezos stood at just $242,000, a figure far behind other blockchain networks that dominate the NFT market.

This could be an area of concern, as growth in the NFT sector could have been a key contributor to Tezos’ price movement.

Moreover, the number of active wallets on the Tezos network has been declining, with a 6% drop in the past year, which highlights the challenge of attracting and retaining users.

These factors may limit the upside potential for Tezos if they are not addressed in the coming months.

The post All eyes on $1.46 after Tezos (XTZ) hits 8-month high following Everstake staking appeared first on Invezz

English (US) ·

English (US) ·