Digital currencies flashed recoveries on Tuesday on bullish sentiments, with Bitcoin gaining 2% to $83.81K.

Altcoins confirmed the shifting trends, catalyzing debates about potential near-term rallies.

With the financial space poised for volatility due to the new tariff wave, what’s next for large-cap cryptos?

Cardano’s pattern signals recovery

ADA has maintained the $0.60 foothold despite broad market uncertainty.

The altcoin recovered to $0.6739 at press time after dipping to $0.622.

Cardano gained more than 3% in the past 24 hours amid bullish sentiments.

Chart by CoinMarketCap

Chart by CoinMarketCapThe potential morning star formation during bounce-back suggests more gains for the altcoin.

ADA bulls will target a retest of the resistance at $0.73.

Decisive breakouts past this obstacle could drive prices towards $0.92, translating to an approximately 35% gain from the current value.

The 40% daily trading volume surge reflects investor optimism in ADA sustaining its rally attempt.

Nevertheless, enthusiasts should watch the key region at $0.640 – $0.645.

ADA stabilized at this range before its latest uptick.

Continued uptrends above the region would support ADA’s recoveries towards the $0.92 target.

However, technical indicators display neutral momentum, suggesting potential trend shifts in either direction.

The Moving Average Convergence Divergence indicates indecision, while the RSI at 43 hints at pullbacks below 40, which could trigger considerable selling pressure.

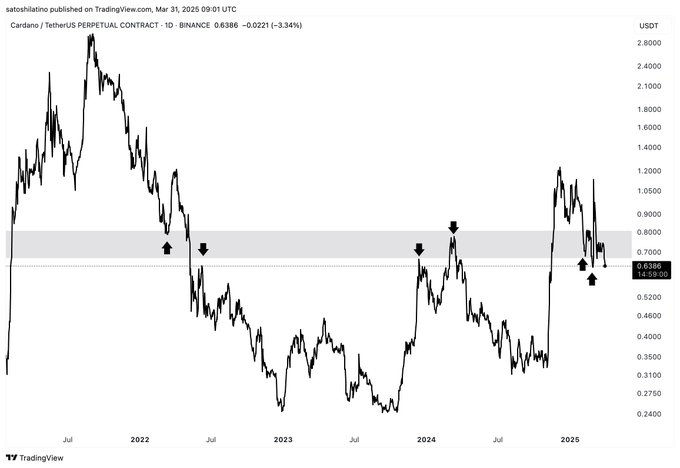

Furthermore, analyst Ali Martinez highlighted the price level at $0.70 – $0.80 as crucial for ADA’s trajectory.

Source – Ali on X

Source – Ali on XFailure to reclaim this support range could catalyze potential declines to $0.31, a more than 50% decline from current prices.

BNB stable amid meme coin activity

Binance Coin trades at $616 after an over 3% increase in the past day.

The alt has displayed resilience lately, maintaining the $600 psychological mark despite broad-based drawdowns.

Various factors contribute to BNB’s stability.

Increased DeFi and meme token activities on BNB Chain have kept the digital asset afloat, especially after Solana’s meme market slowed down.

The thriving PancakeSwap (BNB Chain’s primary DEX) reflects the meme coin craze.

Veteran Master of Crypto trusts CZ’s support and new initiatives, such as liquidity incentives and the BNB AI Hack, are propelling real innovation.

Most L1s took a hit after the crash. But $BNB? Still holding strong Why? Because real activity is picking up on BNB Chain: – $100M in liquidity incentives brought fresh builders – Weekly support programs are boosting token liquidity – Meme coins launching on Fourmeme are

BNB bulls will likely target the resistance at $645 – $656, beyond which they can sail towards the sought-after $700.

Nevertheless, digital assets brace for uncertainty with Donald Trump announcing new tariffs on April 2.

Market volatility and the Liberation Day

April 2, 2025, is crucial for the global financial landscape.

US President Donald Trump confirmed the implementation of tariffs on what he referred to as “Liberation Day.”

The tariffs target reciprocal duties on US imports.

The aim is to solve trade imbalance issues and reduce the United States’ dependence on foreign goods.

Amid the uncertainty, analyst Michael van de Poppe remained positive.

#Bitcoin climbing upwards, good signs coming in. Tomorrow will be a volatile day and I suspect that we’ll rotate into an upwards trend from that point.

He trusts Bitcoin could extend its prevailing recoveries, with tomorrow’s volatility as a key factor.

The post Altcoins today: Cardano and BNB lead recoveries ahead of “Liberation Day” appeared first on Invezz

English (US) ·

English (US) ·