Traditional asset classes such as stocks and bonds versus real estate, private equity,private creditThese are called alternative assets. As concerns about a recession linger, more investors are turning to alternative markets in search of higher yields.

If the alternative asset industry moves forward with blockchain-based tokenization, it could generate $400 billion worth of new revenue. Onyx, a subsidiary of JPMorgan Chase, the largest US bank, which is working on blockchain-related projects, has compiled a report jointly with Bain & Co, a major US consulting firm.

In recent years, the alternative asset management industry, which has traditionally targeted institutional investors, has increasingly included wealthy individual investors in its customer base. However, much of the management work that handles alternative assets is done manually, tailored to the needs of specific institutional investors, and automation is needed to provide it to individual investors.

What is attracting attention is “tokenization” (the tokenization of financial assets and financial operations on blockchain), which simplifies custom-made operations that have traditionally been done manually. It becomes possible to automate. As a result, it will be possible to provide alternative asset management services not only to institutional investors but also to individual investors who belong to many high-net-worth individuals. , explains how to create a $400 billion revenue opportunity.

Private credit investment is increasing in Japan as well in search of high yields.

Blue sky and buildings

Blue sky and buildingsIn Japan, the number of investors looking for alternative assets in search of high yields is increasing. Among them,private creditInvestment demand for is strong.

Private credit is different from traditional loans that banks lend to companies. Private credit is a loan that non-bank investment funds provide directly to a specific company (borrower) after negotiating terms and conditions, and the debt is sold on the open market. Not traded in

According to a report by Morgan Stanley, the private credit market is on the rise, with the market size expected to increase to $2.3 trillion by 2027. The market size in 2023 is approximately 1.4 trillion dollars.

In Japan, where negative interest rates persist, the number of domestic investors investing in private credit reached a record high last year, Bloomberg reports. Major life insurance companies and other companies are said to be planning to increase investment in alternative assets, including private credit.

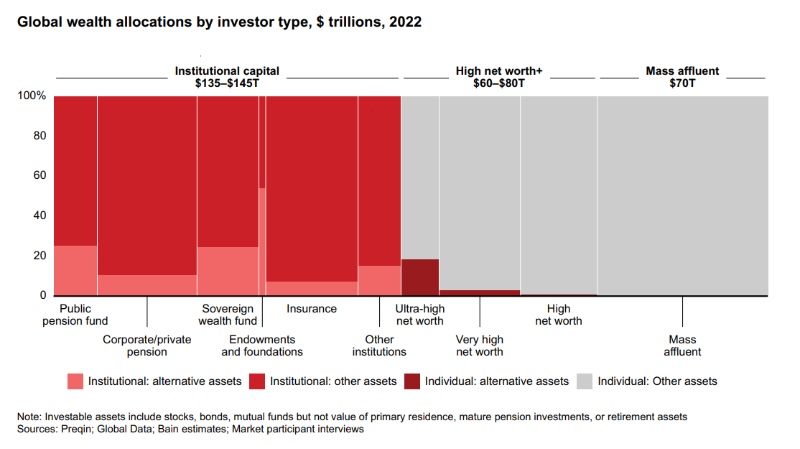

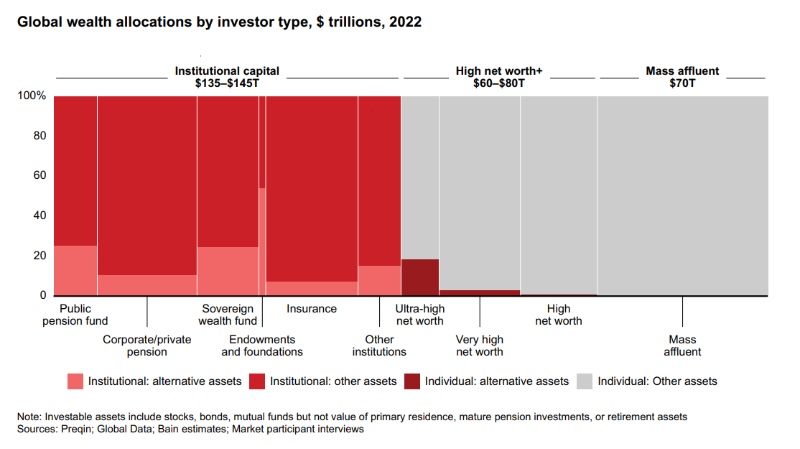

Only 5% of global personal wealth is invested in alternatives

Breakdown of investment portfolios of institutional investors (red area on the left) and individual investors (gray area on the right)/Source: From a report by JP Morgan and Bain

Breakdown of investment portfolios of institutional investors (red area on the left) and individual investors (gray area on the right)/Source: From a report by JP Morgan and BainIn 2022, Bain will target high net worth individuals with investable assets of $1 million to $5 million, high net worth individuals with investable assets of $5 million to $30 million, and ultra high net worth individuals with investable assets of $30 million or more. A survey was conducted among 418 individual investors.

Of these, 53% of respondents said they plan to increase their investment in alternative investments over the next three years. The most common goal among investors (60%) was to diversify their asset portfolio, followed by 25% who wanted to “pursue higher yields.”

Of the approximately $290 trillion in total global wealth, $150 trillion is held by individuals, but only 5% of that is invested in alternative assets, according to a joint report by JPMorgan and Bain. state

Against this backdrop, major US companies that manage alternative assets, such as Blackstone, KKR, Carlyle, and Apollo, are seriously considering offering services that focus on individual investors.

How to implement tokenization technology in the alternative asset industry

So, how can tokenization technology using blockchain be implemented in the alternative asset management industry?

Currently, the alternative asset management industry is comprised of multiple participants, with significant fragmentation among participants and non-standardized processes. The core of tokenization is to enable the creation of shared platforms and workflows that enable seamless and automated order processing, payments, ownership tracking, and data management (JPMorgan Onyx and Bain joint report) book).

Tokenization is on the blockchain.smart contractIt is known as a programmable code that represents ownership of an asset. Smart contracts are characterized by an asset ownership record (how much each investor owns) and programmable, automated rules for updating that record (e.g., defining how and when an asset can be bought or sold). computer logic).

In the context of alternative assets, the assets that are tokenized become the interests of the investors (limited partnerships, LPs) in the alternative funds. The actual process of tokenization requires specialized software that can use the embedded information to create smart contracts.

This fund token functions as an alternative system of record that can be used in place of traditional name transfers. When combined with other types of tokens, such as escrow tokens, on the same blockchain, they can enable automated, instant payments, eliminating the traditionally siled and costly data matching associated with data matching. It can significantly improve lengthy multiparty processes.

Giving all participants access to programmable, on-chain record data in the alternative asset management industry will lead to greater automation and less operational friction. It will be possible to build a system that can be managed seamlessly from end to end.

In 2023, “tokenization of RWA” has become a buzzword. If real world assets (real assets = RWA) are tokenized on a blockchain, the traditional financial system can be upgraded on a large scale, and asset class markets that have been said to be difficult for individuals to access can also be created. It becomes accessible.

In the field of RWA tokens, JPMorgan, Citigroup, the Monetary Authority of Singapore (MAS), and others have been running pilot projects. In Japan, financial giants such as Nomura Holdings, Daiwa Holdings, Mitsubishi UFJ Trust and Banking, and SBI Holdings are tokenizing assets such as single real estate and developing new digital financial products for individuals.

|Text: Shigeru Sato

|Image: Shutterstock

The post “Alternative assets” sought by ultra-rich people, economic effect of over 50 trillion yen due to tokenization – Alternative investments are rapidly increasing in Japan | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

118

1 year ago

118

English (US) ·

English (US) ·