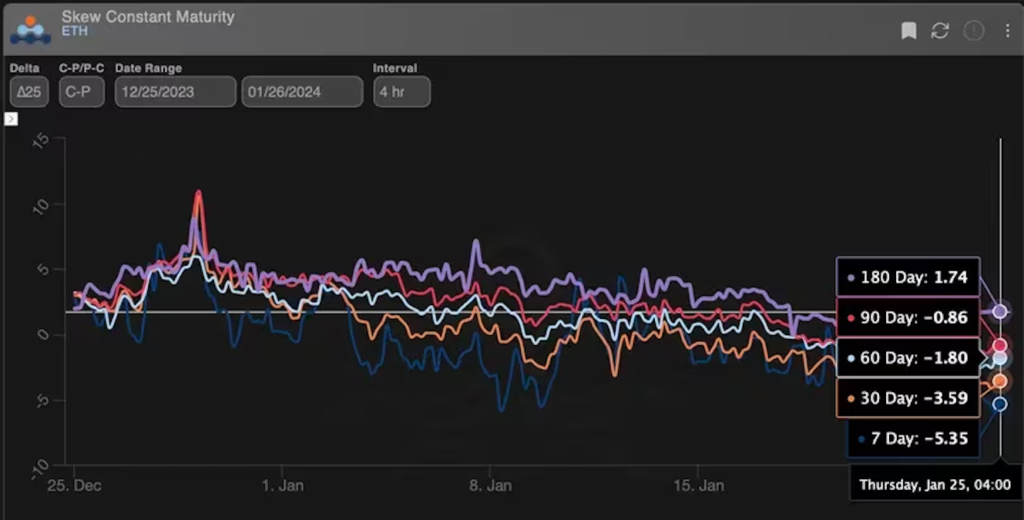

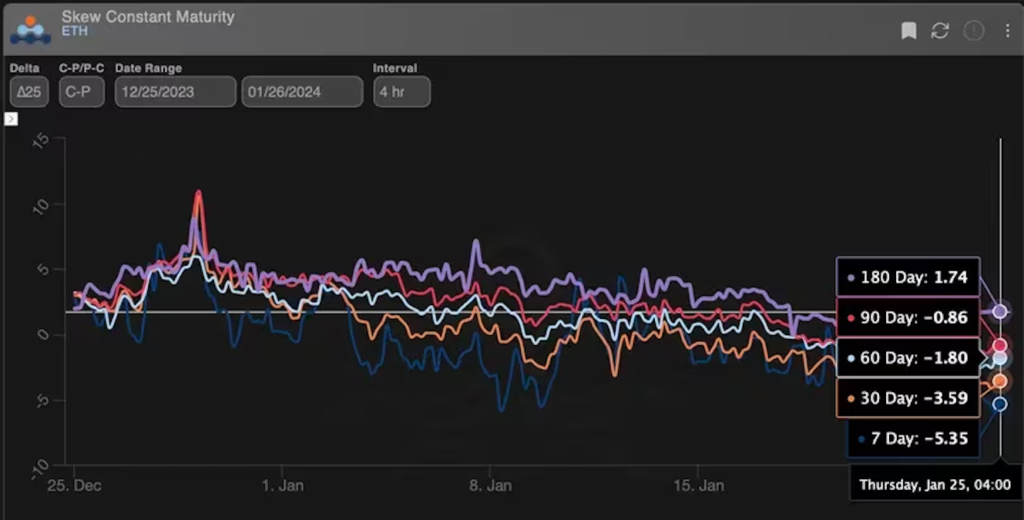

Ethereum (ETH) could become the market leader in the coming months, analysts said in early January. The native token of the Ethereum blockchain qualifies as the core of a decentralized crypto asset portfolio. But for now, the options market doesn’t seem to share that sentiment.

According to Amberdata, options linked to ETH have shown a bearish bias for three months and a slightly bullish bias for the following months.

Options are derivative transactions that allow buyers to profit from or hedge against rising or falling prices. Call options help you profit from rising prices, while put options provide protection from falling prices.

ETH’s one-week call-put skew (a measure of demand for calls versus puts expiring in seven days) fell to almost -8 on January 24, the lowest in three months. This indicates that the prevailing view is that the price of Ethereum will fall.

Observers say the relative abundance of ETH puts is due to ETH’s move below key supports and investor interest in selling calls to gain additional yield.

Imran Lakha, founder of Options Insights, said: “The sudden increase in ETH puts is due to the impact of call selling and the breaking of the key technical support at $2,400, pushing the price to $2,200. “This reflects the downward pressure on the market,” crypto options exchange Deribit said in a blog post.

Rakuha further added, “The key support level for ETH is $2,150, a break above which could lead to further declines. “Therefore, demand for hedging is increasing.”

Ethereum call-put skew. (Amberdata)

Ethereum call-put skew. (Amberdata)|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Amberdata

|Original text: Ether Options Out of Sync With Bullish Sentiment on Street

The post Analysts are bullish on Ethereum, but the options market is not | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

64

1 year ago

64

English (US) ·

English (US) ·