Cryptocurrencies display mixed performances as altcoins seemingly decouple from Bitcoin.

BTC plunged to $82K as bearish sentiments grew with Trump tariffs denting the global financial space.

However, some altcoins recorded substantial bounce-backs within the past day, signaling the upcoming selective altcoin season.

APT soared nearly 15% from daily lows of $5.5411 to $6.3695.

While altcoins look to lead the market rebound amid BTC’s struggles, asset manager Bitwise supercharged Aptos’ recovery.

The company has taken the initial step toward introducing a spot Aptos exchange-traded fund via Delaware’s trust.

Bitwise becomes the first firm to pursue an exchange-traded fund linked to Aptos.

Bitwise’s initial step towards introducing spot Aptos ETF

The filing is the first step before the company registers with the United States SEC.

Thus, the move doesn’t guarantee imminent fund’s launch or regulator’s approval.

Next, the asset manager will send a formal request to the SEC.

The application to the securities regulator will outline details about the ETF structure, APT tracking mode, and investment strategy.

The SEC will evaluate the ETF application and issue a verdict, either requesting modifications, rejecting, or approving, in the upcoming months.

APT price prediction

Aptos recorded substantial recoveries as Bitwise’s ETF move ignited investor interest.

The alt soared nearly 9% on its daily price chart to trade at $6.13.

Chart by Coinmarketcap

Chart by CoinmarketcapThe impressive daily trading volume increase confirms notable bullish activity within the Aptos ecosystem.

Technical and on-chain indicators support the shifting sentiments to bullish.

The Chaikin Money Flow has recovered from -0.18 on Feb 24 to +0.03 at press time.

That highlights increased money entering the Aptos ecosystem within the past 72 hours.

Significant inflows are crucial for sustained uptrends.

The 4H Moving Average Convergence Divergence indicates notable bull presence.

The visible bullish divergence with the signal line demonstrates buyer control.

Such trends position APT for extended gains before possible bearishness.

Sentiments in the entire crypto space and SEC’s response will likely determine Aptos’ price trajectory in the upcoming weeks and months.

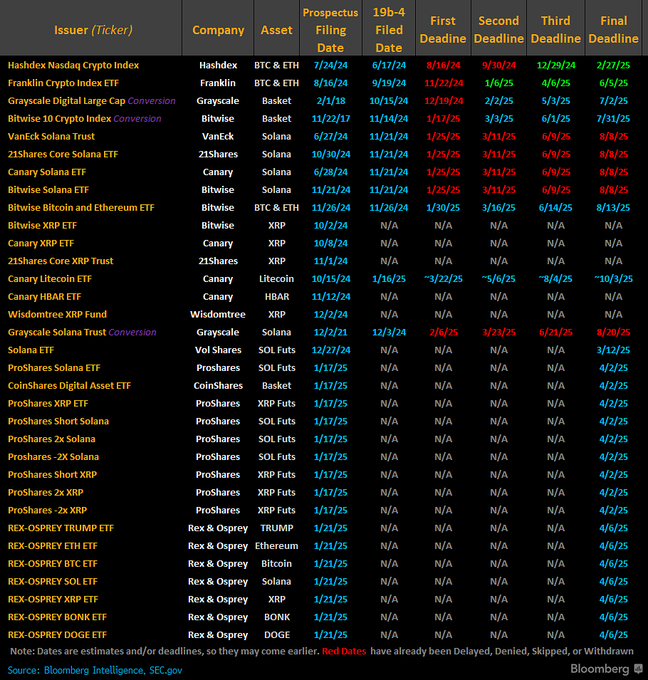

Meanwhile, Bitwise’s application comes as altcoin exchange-traded funds gain traction.

Multiple asset managers are pursuing crypto investment products beyond BTC and ETH, exploring Solana, EXP, Cardano, Litecoin, Hedera, and Dogecoin ETFs.

More Altcoin ETFs – New crypto ETFs are being planned beyond Solana, XRP, and Litecoin. Filings now focus on Polkadot (DOT), Cardano (ADA), and Hedera (HBAR). – Nasdaq filed a 19b-4 for Grayscale’s Polkadot ETF. 21Shares also made a similar proposal. DOT has a $7 billion…

Moreover, Aptos’ ETF interest comes as the SEC adopts a friendlier stance on crypto regulation.

The watchdog has dropped multiple lawsuits against crypto entities lately, including cases against Uniswap, Robinhood, and Coinbase.

An authorized APT ETF will likely unlock the altcoin to institutional adoption as retailers, pension funds, and hedge funds gain exposure to Aptos without depending on cryptocurrency exchanges.

An exchange-traded fund would improve price stability and boost liquidity while improving Aptos’ mainstream appeal.

The post APT price jumps 15% as Bitwise files for Aptos ETF, seeks early SEC approval appeared first on Invezz

English (US) ·

English (US) ·