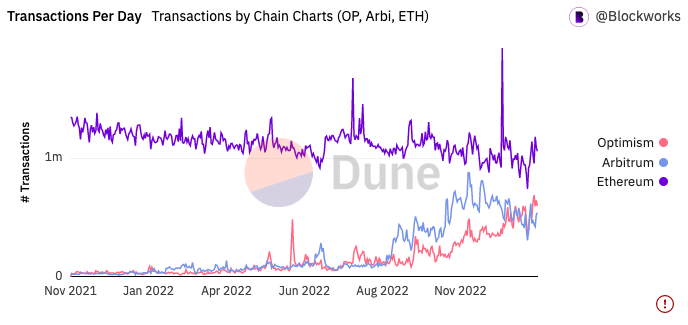

Two Layer 2 Ethereum scaling solutions, Arbitrum and Optimism, surpassed transactions on the Ethereum mainnet on January 10. While L2s are trending upward, Ethereum usage is declining.

After the collapse of FTX, we have seen an increase in DeFi usage as trust in third parties has decreased. Arbritrum and Optimism account for nearly 80% of all Layer 2 solutions. With increasing interest from users, seeking faster and cheaper transactions compared to the Ethereum mainnet, these two L2 giants combined have displaced the mainnet in daily transaction volume.

Related: DEX vs. CEX: Uniswap overtakes Coinbase in Ethereum trading

According to Blockworks Research’s findings on Dune Analytics, this L2 uptrend saw Optimism with 597,023 and Arbitrum with 542,180 combined daily transactions overtake the Ethereum mainnet with its 1,061,055.

Comparative table by chains (OP, Arbi, ETH), Blockworks Research, Dune Analytics

Comparative table by chains (OP, Arbi, ETH), Blockworks Research, Dune Analytics To add, Optimism overtook Arbitrum by transactions per day and daily active addresses, as you can see in the table above.

As of the current market analysis, Arbitrum One holds a dominant position in terms of total value locked (TVL), with an estimated collateral of $2.34 billion and a market share of 52.5%. Coming in second is Optimism, with a TVL of $1.28 billion and a market share of 28.6%.

This overhaul of the Ethereum mainnet can be explained by recent developments in the ecosystems. For example, Arbitrum’s update, Nitro, has increased the ecosystem’s transaction speed 10-fold compared to the Ethereum mainnet. Some projects onboarded on the network include Cask Protocol and OpenSea.

As for Optimism, Nansen data journalist Martin Lee said:

We’re seeing a similar trend where DeFi protocols are one of the key drivers of adoption of the chain — Perpetual Protocol, Velodrome, Pika Protocol. Another key driver for both chains is Galxe, the on-chain identity and credentials project.

2 years ago

125

2 years ago

125

(@WestieCapital)

(@WestieCapital)

English (US) ·

English (US) ·