Expectations for smart contracts

ARK Investment Management (ARK Invest) has given a lot of attention to the future potential of smart contracts in its annual report titled “Big Ideas 2024.”

The company positions smart contracts as the backbone of the Internet financial system, and provides concrete figures to demonstrate the scope of their application and the spread of their influence.

In particular, the market size of decentralized applications built using smart contracts could grow from $775 billion in 2023 to $5.2 trillion in 2030, at an annual rate of 32%.

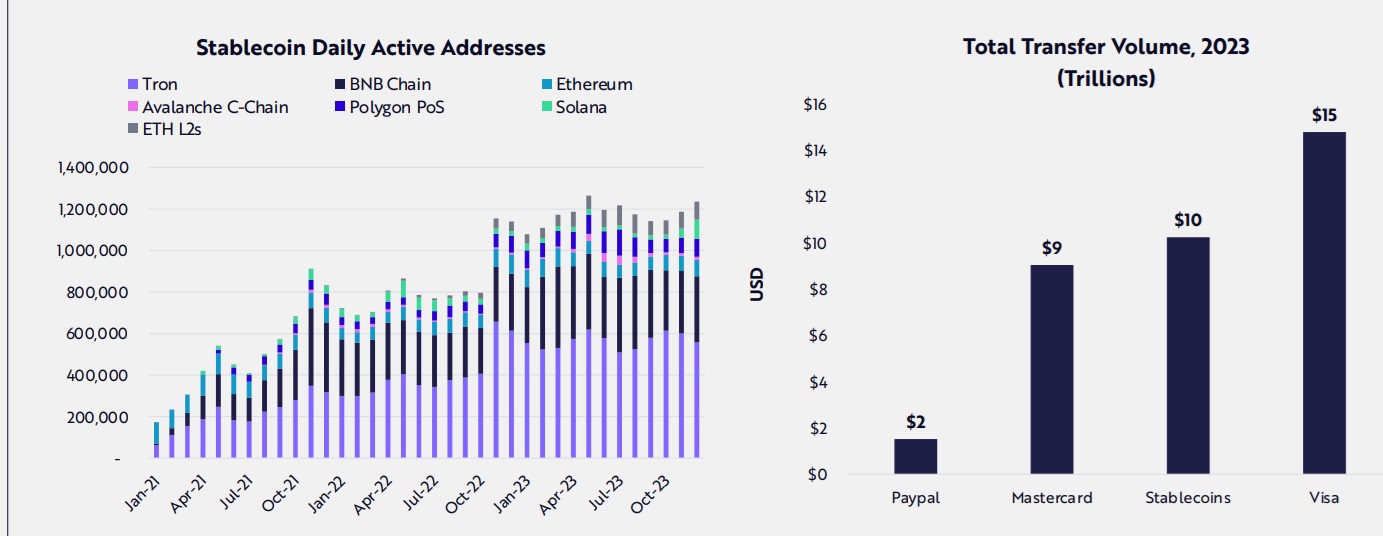

The expansion of this technology is coupled with hyperinflation in emerging markets, with the number of daily stablecoin addresses increasing at an annual rate of 93% over the past three years. Its influence is clearly visible in daily transactions.

Source: Ark Invest (all below)

In addition, the role of smart contracts will be essential in the ever-evolving areas of real-world asset (RWA) tokenization, protocol development, and layer 2 networks.

ARK points out that smart contracts have the potential to revolutionize the financial services industry. From 2000 to 2020, while the value of financial assets increased dramatically, operating costs also increased. However, smart contracts have the potential to significantly reduce the fees associated with traditional financial services, making decentralized financial services more efficient and cost-effective.

connection:What is AMM (Automated Market Maker)? Explaining the mechanism and risks

Advantages of Solana

In this context, ARK CEO Cathie Wood praises the efficiency and cost performance offered by monolithic chains like Solana (SOL). Just as Ethereum was faster and cheaper than Bitcoin, Solana offers even better performance than Ethereum. It is expected that such technological advances will have a major impact on the future of the crypto asset market.

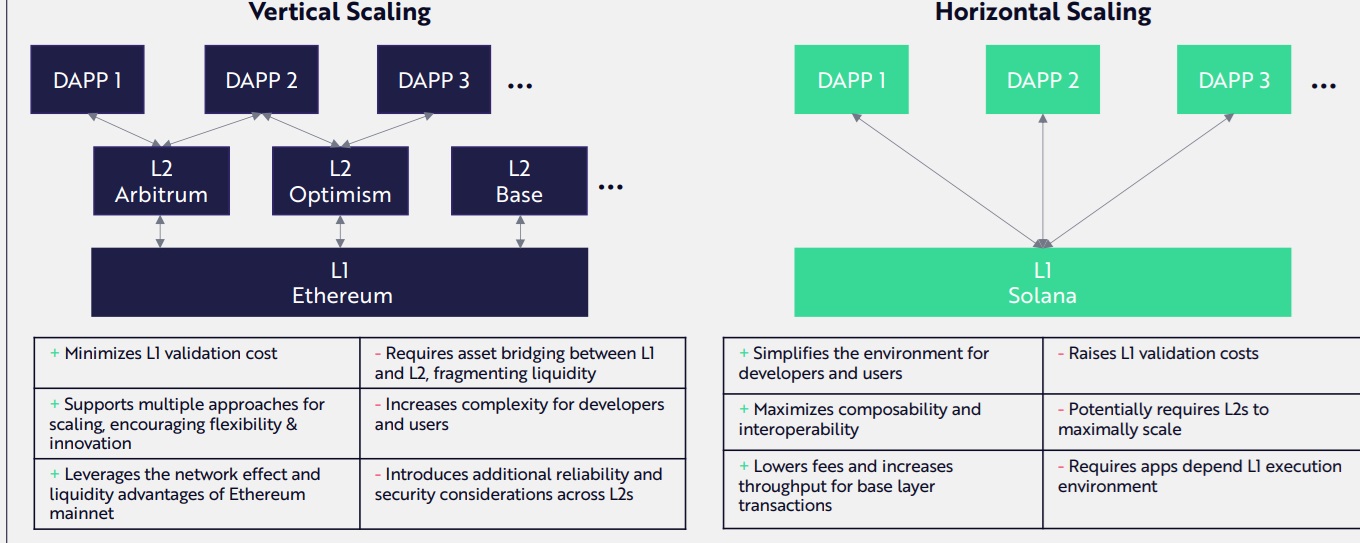

Solana has emerged as an alternative to vertical scaling and has gained widespread support by prioritizing scalability in a single layer, providing a simple architecture for users and app developers.

On the other hand, Ethereum emphasizes base layer decentralization and chooses to scale to the second layer (Layer 2), building a more complex ecosystem.

Furthermore, Ethereum’s data layer rivals such as Celestia and EigenLayer have also been attracting attention recently.

connection:What is the next trend for modular (connected) blockchains? Explaining Celestia airdrop case study and EigenLayer ecosystem

Solana (SOL) special feature

The post Ark Invest Interested in the potential of smart contracts and Solana “Big Idea 2024” appeared first on Our Bitcoin News.

1 year ago

78

1 year ago

78

English (US) ·

English (US) ·