Arrenda, a Mexico City-based fintech company, is offering digital financial services to the real estate market of Latin America and closed on $26.5 million in a pre-seed round of equity and debt.

The funding round was a mix of $1.5 million in equity and $25 million in debt financing. Fasanara Capital led the investment and was joined by Kube Ventures, ODX, Toehold Ventures, Wharton Fintech, Lightspeed Venture Partners Scout Fund, PRMM Inmobiliaria and a group of angel investors.

Joe Merullo, founder and CEO, grew up in Boston and started his first business in real estate at 19 years old. He was recruited to June Homes, a startup in the proptech space that integrates technology into the residential real estate industry, specifically rentals. While there, he had the opportunity to work in Mexico, and the difficulty in finding a place to live gave him the idea for Arrenda.

The company, formerly known as ViveFácil, started in 2021 providing insurance, similar to a Jetty or Rhino, but for Mexico, Merullo told TechCrunch. That concept failed, but led Merullo and his team to credit. The company pivoted to Arrenda in 2022.

Its first service is Adelanta, a revenue-based financing offering that leverages Arrenda’s proprietary technology to enable landlords in Mexico to advance up to a year of future lease receivables in 24 hours or less.

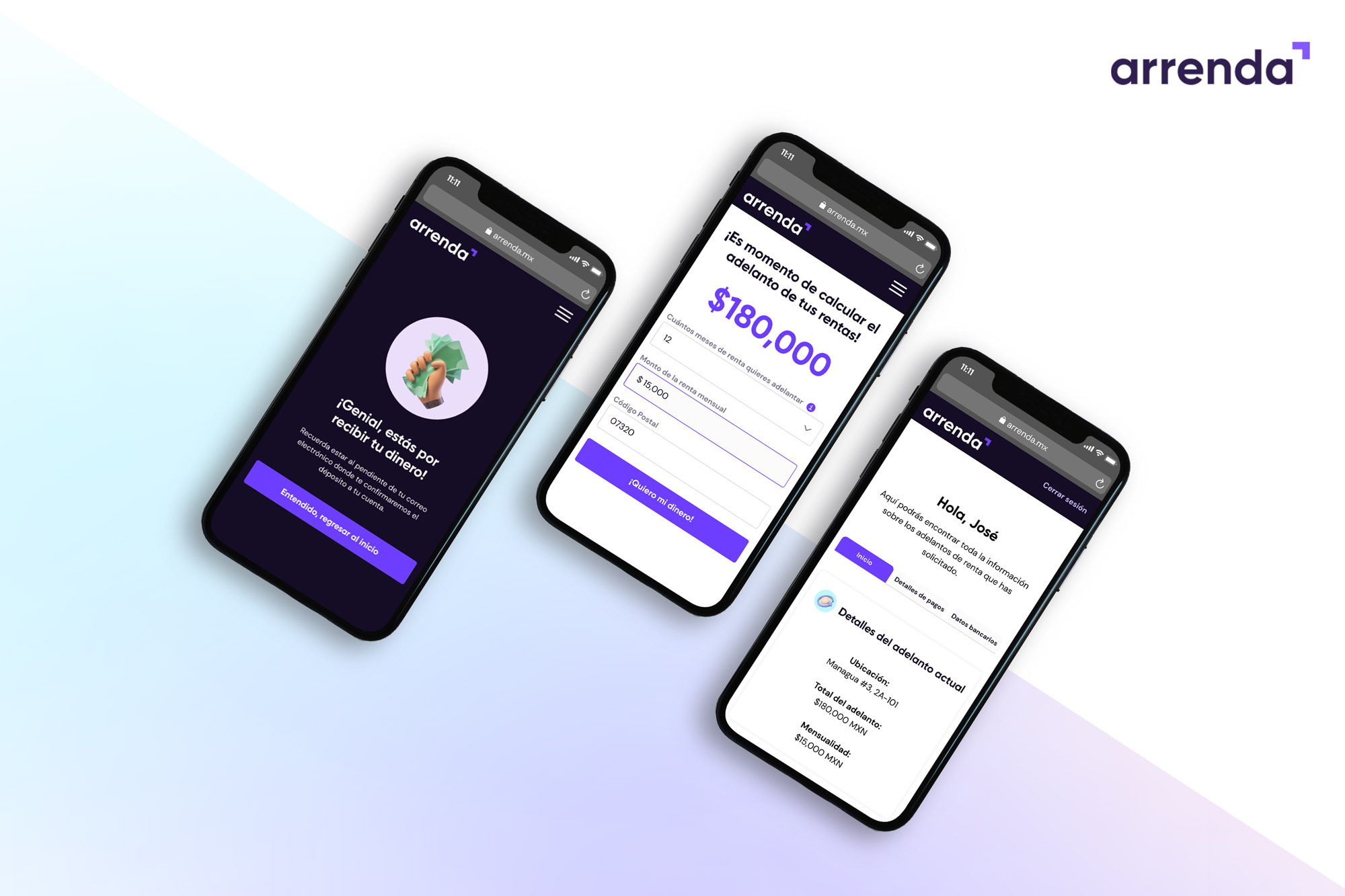

Arrenda’s smartphone app for landlord lending tool. Image Credits: Arrenda

Merullo believes this is a unique company within Mexico, which has 5.5 million renting households, and where traditional financial institutions are still the dominant place to go for credit. However, where he sees Arrenda differentiating itself is through its proprietary underwriting process that quickly provides financing terms.

“We’ve developed the risk model that enables us to gather data through various touch points, like bank accounts, credit bureaus, tax bureaus and criminal bureaus, to understand the risks associated with the financing, and then make a decision to give them credit based on this,” Merullo said. “We’ve combined that in turn with underwriting of the receivables that we find inside the lease contracts in order to make determinations in that 24-hour window.”

The company is pre-revenue and rolling out its website now with 900 people on its waitlist. It is signing financial contracts from $250 to $10,000 per month with an average financing amount of around $12,000 over a 10-month period.

Merullo plans to use the debt portion of the new funding for loans and financings issued. The equity will go toward adding to Arrenda’s 18-person employee base. The company has grown two people per month since February and is hiring more. He also plans to expand into more of the largest metropolitan hubs in Mexico and establish distribution channels with industry groups.

Up next, the company aims to reach $1 million in annual recurring revenue by the fourth quarter of this year. There are also plans to expand the financing offering into the commercial real estate space to landlords of warehouses, offices and shopping centers.

“We’ve got amazing feedback from these types of folks who are working on building the underwriting model to support these people right now,” Merullo said. “In addition to that, we’re going to be pursuing products for tenants. In 2023, we plan to roll out a number of products to help make rent easier for tenants as we originally did from the insurance side of things, for example, on ‘rent now pay later’ types of credit products.”

English (US) ·

English (US) ·