Macroeconomics and financial markets

On the US New York stock market on the 11th, the Dow Jones Industrial Average closed 157 points (0.43%) higher than the previous day, and the Nasdaq Index closed 28.5 points (0.2%) higher.

connection:Cryptocurrency-related stocks fall sharply due to Bitcoin adjustment; US November CPI (Consumer Price Index) forecast tonight | 10th Financial Tankan

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price rose 0.05% from the previous day to 1 BTC = $ 36,404.

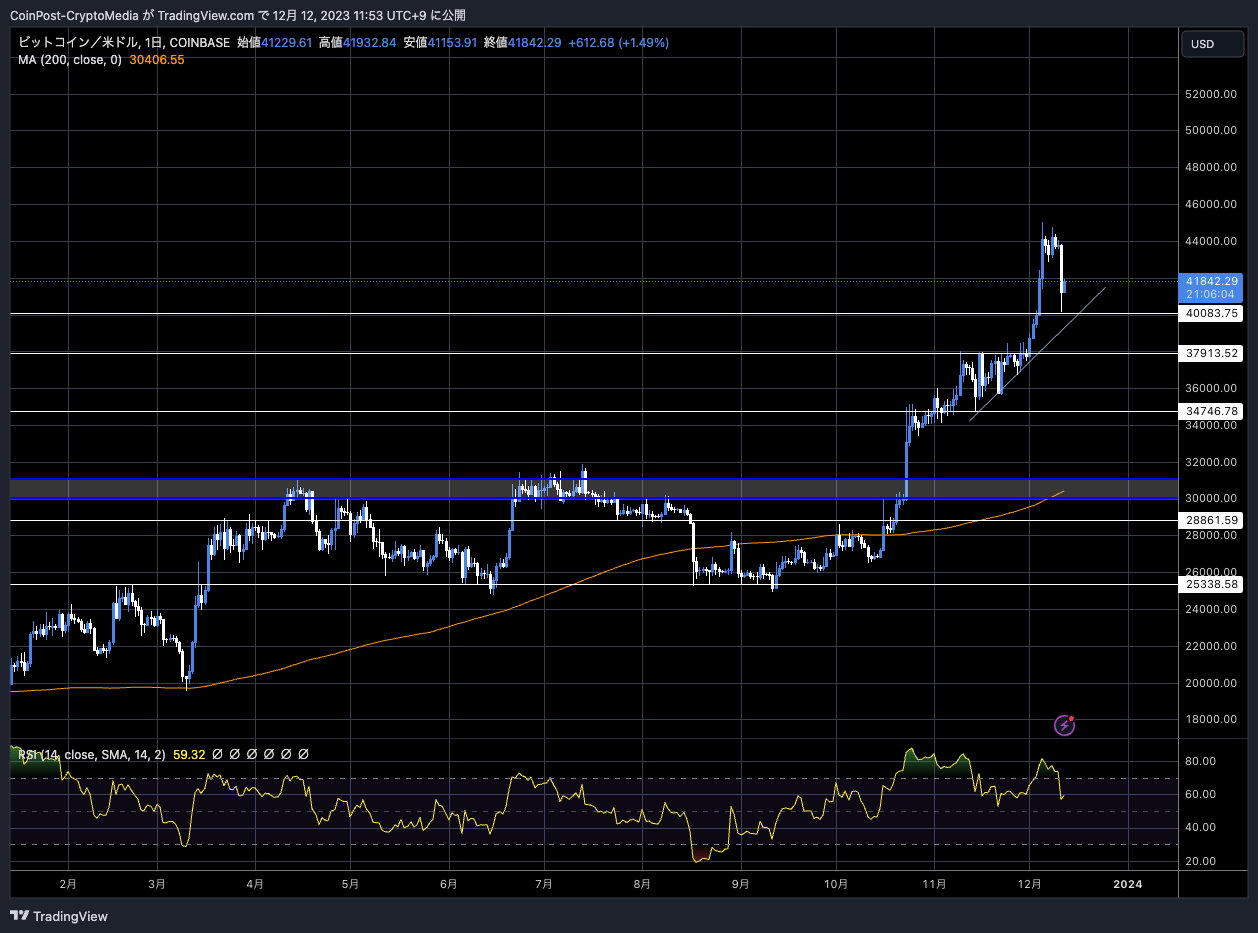

BTC/USD daily

This evening, the US Consumer Price Index (CPI), which influences decisions by the Federal Reserve System, will be announced, and at 4:00pm on the 14th, the FOMC (Federal Open Market Committee) and Chairman Powell will hold a press conference. This may have led to position adjustments and large-scale profit-taking sales as the sense of overheating intensified.

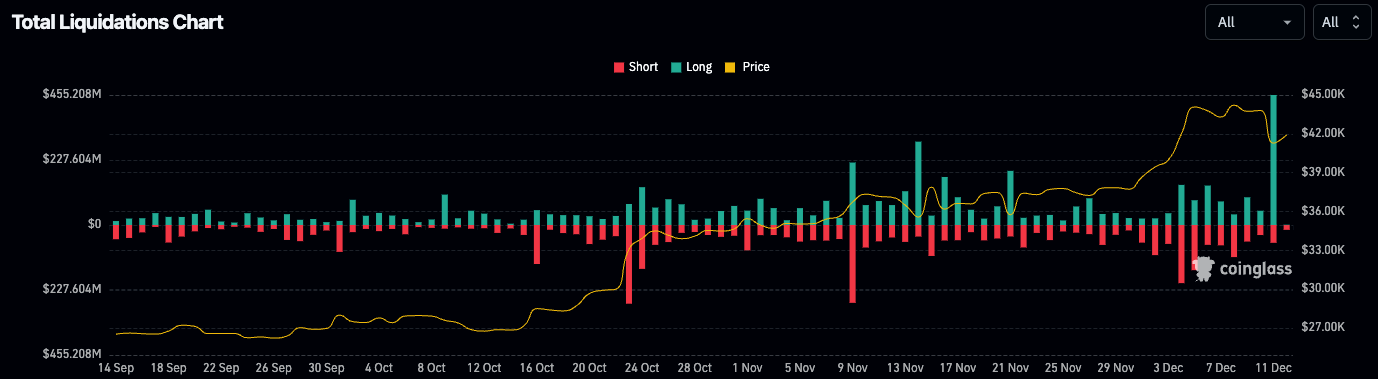

Yesterday, the stock price rebounded immediately after the sharp drop, and then looked for another dip towards the end of the night in the US time (midnight to morning Japan time). At that time, the stock fell below the low of $40,300 and continued to fall to $40,150, wiping out high leverage positions. The daily (24-hour) stop-loss (forced liquidation) amount increased from $290 million (42.3 billion yen) as of noon on the 11th, reaching $455 million (66 billion yen), one of the largest this year.

coin glass

On-chain analyst Will Clemente pointed out the largest drawdown (adjustment from peak asset value) in past bull markets, saying, “This level of adjustment is not surprising given the sharp rise in the past two months.” ” he pointed out. He expressed his view that, “Rather, the liquidation of excessively leveraged transactions will serve as a stepping stone for the company to aim even higher.”

This price action recently has been awesome, but friendly reminder that there will be sharp corrections along the way as the market shakes off greedy leveraged longs.

Can’t go wrong holding spot in cold storage. pic.twitter.com/JvWOE25bNi

— Will (@WClementeIII) December 5, 2023

Overall, this can be said to be a correction phase of the uptrend, and investors seem to have a strong desire to push the market. As expectations for Bitcoin ETF (Exchange Traded Fund) to be approved for listing increase, the top price tends to ease if it successfully passes events such as the FOMC and the supply and demand balance progresses. On the other hand, if there appears to be a negative surprise in the CPI or FOMC, it is likely to cause turmoil in the entire financial market.

Uptrends in past bull markets have often been punctuated by large corrections like this. For example, Bitcoin (BTC) first reached $20,000 in May 2017, which was called the “first year of cryptocurrencies,” and experienced a significant drop of -36%. Furthermore, in March 2020, the entire financial market crashed due to the impact of the corona shock, and BTC recorded a -62.6% drawdown.

Recently, the head of research at ETC Group pointed out a sharp increase in the balance of crypto assets (virtual currency) on exchanges. Glassnode data shows +14,000 BTC net inflows to the exchange, suggesting profit-taking activity by investors.

According to ETC Group, as of the 10th, approximately 88.3% of BTC addresses and 77.6% of ETH addresses had unrealized gains.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

altcoin market

While many stocks fell against Bitcoin (BTC), the rebounds were notable in Build and Build (BNB), which rose 9.2% from the previous day, and Avalanche (AVAX), which rose 21.8%.

AVAX became active in the middle of last month when it was announced that it would link Avalanche Evergreen Subnet, which allows the creation of individual chains in the Avalanche ecosystem, with US financial giant JP Morgan’s blockchain platform Onyx.

Onyx by @jpmorgan and @apolloglobal have announced a collaboration under Project Guardian, leveraging @LayerZero_Labs to connect Onyx with a permissioned Avalanche Evergreen Subnet, which facilitated subscriptions and redemptions for funds offered by @WisdomTreePrime. pic.twitter.com/AjQtLNKCKG

— Avalanche  (@avax) November 15, 2023

(@avax) November 15, 2023

According to CoinShares’ latest report, while institutional investors’ interest remains focused on Bitcoin (BTC), they have offered exposure to Solana (SOL) and Avalanche (AVAX) among altcoins. The funds saw inflows of $3 million/week and $2 million/week, respectively.

On December 7th, Coincheck, a major crypto asset (virtual currency) exchange, announced the listing of Avalanche (AVAX), the eighth such exchange in Japan. SBI VC Trade and Binance Japan also handle it. In Japan, in September of this year, the operating company of the common point service “Ponta” announced plans for a consortium chain using subnets.

connection:“Avalanche” adopted by Japanese company as Web3 service platform, Ponta’s loyalty marketing, etc.

connection:What is Avalanche that even beginners can understand? Explanation of noteworthy points and future prospects

In addition, in September of this year, US payment giant Visa announced that the stablecoin “USDC” used for trial operations in cross-border stablecoin payments will be based on Solana (SOL) instead of the conventional Ethereum (ETH)-based USDC. It has been announced that the functionality will be expanded so that USDC can also be used. This will allow Visa issuers and merchant management companies to take advantage of Solana Chain’s high speeds and extremely low fees.

The market seems to be benefiting from the expansion of use cases, such as Shopify’s introduction of Solana Pay.

connection:“Altcoin season” has arrived, with meme coins BONK, ORDI, PoW-based KAS, etc. achieving record increases

Bitcoin ETF special feature

Due to the soaring price of Bitcoin, the number of downloads and MAU of the CoinPost official app is rapidly increasing.

In addition to virtual currency news, crypto indicators can also cover future materials. By using the My Coin function and Crypto Alert, you can quickly check for sudden rises and falls in altcoins.

■Explanatory article https://t.co/9g8XugH5JJ pic.twitter.com/gYtpheMykj

— CoinPost (virtual currency media) (@coin_post) December 6, 2023

[Recruitment]

CoinPost, Japan’s largest crypto asset media, is currently recruiting human resources due to business expansion (possible full-time positions)

Editorial Department: Student interns interested in web3 and writers familiar with crypto assets

Sales department: Those who are good at English conversation and those with sales experience are welcome.

webX management: People who have strong research skills and are good at English conversation https://t.co/UsJp3v7P39

— CoinPost (virtual currency media) (@coin_post) November 24, 2023

Click here for a list of past market reports

The post As Bitcoin continues to fall, the size of the loss cut is 66 billion yen, one of the largest this year, and AVAX is up 21% from the previous day appeared first on Our Bitcoin News.

1 year ago

132

1 year ago

132

English (US) ·

English (US) ·