- Bitcoin price takes a short break after last week’s surge

- Asset managers increase long positions in anticipation of higher prices

- Trading volume is below the moving average line at the timing of the short break

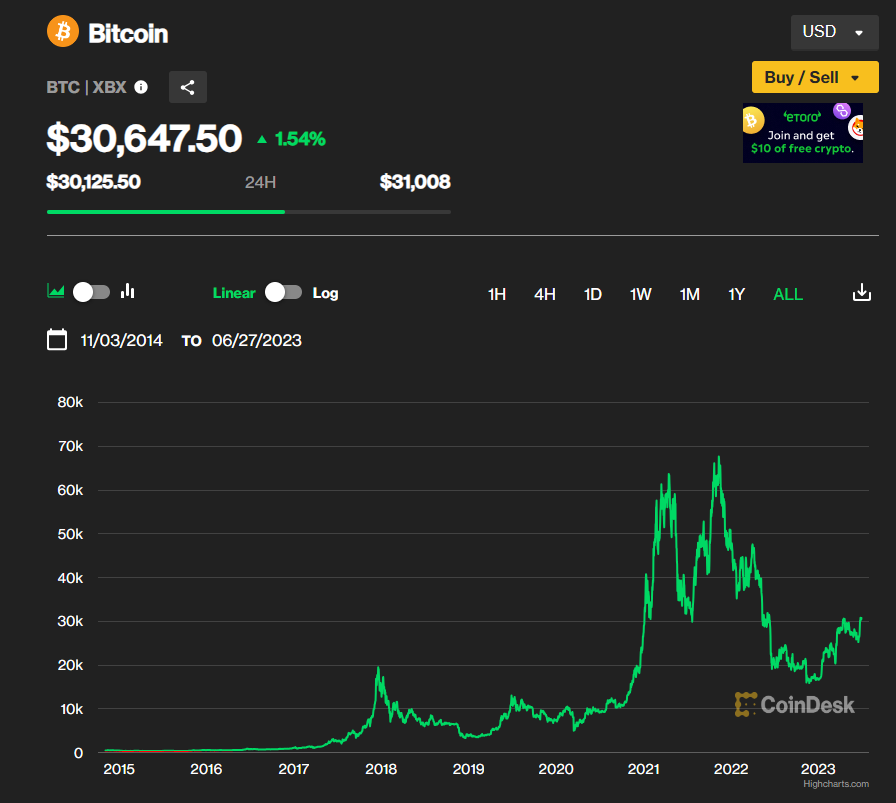

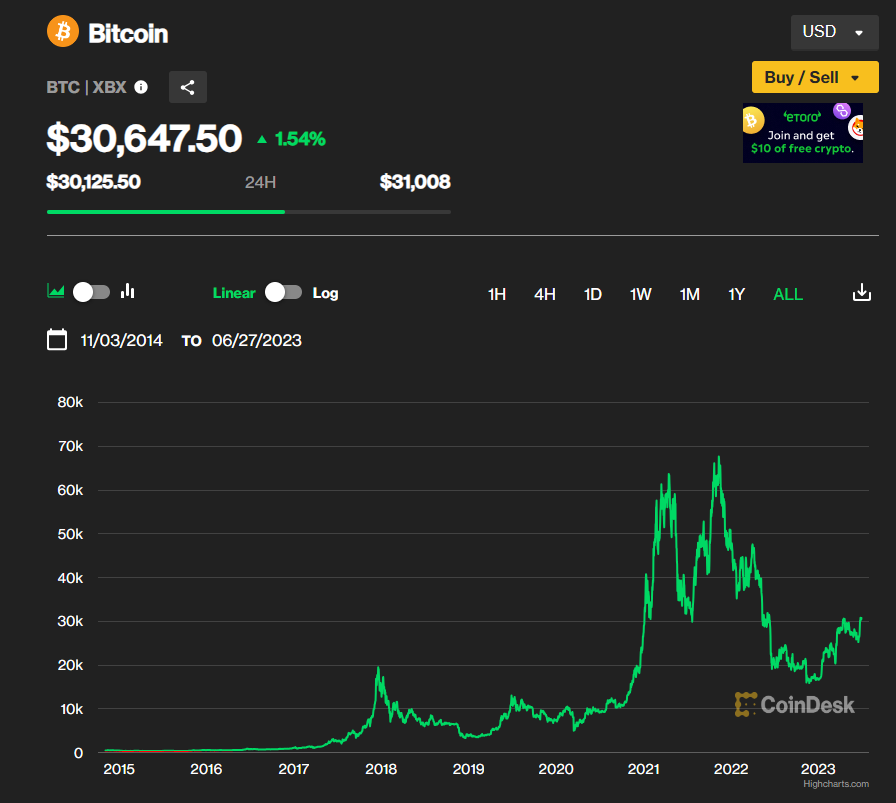

Bitcoin (BTC) price is taking a break after gaining 21% from June 15-23. Buying activity in the spot market seems to have stalled, but the weekly COT report (position information) released by the US Commodity Futures Trading Commission (CFTC) suggests that demand for long positions is increasing in the derivatives market. .

The COT report provides a proxy for sentiment as it reveals open interest and position direction for bitcoin futures trading by institutional investor category.

Institutional investors increase long positions

Asset managers increased their long Bitcoin positions by 495 last week, according to the latest COT report. Leveraged funds, on the other hand, added 1,449 contracts to their long positions after losing 538 contracts last week.

The breakdown of positions held by asset management companies is 94.87% long positions. In previous COT reports, it was 99%. The breakdown of leveraged fund positions is 19.58% long and 80.42% short.

The increase in long positions is a natural reaction to recent market developments. The potential approval of a Bitcoin exchange-traded fund (ETF) is driving prices higher in the spot market, and a similar trend is taking place in the derivatives market.

The open interest put/call ratio for options is 0.32, according to data analytics firm CoinGlass. A put/call ratio below 1.0 indicates a higher demand for long positions than for short positions.

I don’t see any sales

While it’s not a definitive sign of what’s next for the price, the lack of bearish expectations after Bitcoin’s 20% rally suggests investors aren’t looking to sell in the recent rally. showing.

The Bitcoin chart has fallen for the third day in a row. However, the trading volume on the day of the drop was below the 20-day moving average, suggesting that the momentum of the decline was relatively weak. Part of the decline was a byproduct of the weekend’s lower trading volume, but the trend continued into the week’s opening 27 days.

Levels to watch out for on the downside are $30,000 and $27,800. $30,000 is the widening support line and marks a psychologically significant level where buy and sell orders are likely to converge. The $27,800 level is in line with Bitcoin’s current 20-day moving average and could be a target for traders who expect it to converge there.

|Translation: coindesk JAPAN

|Editing: Rinan Hayashi

| Image: CoinDesk Indices

|Original: As Prices Consolidate in Spot Markets, Asset Managers Increase Long Positions in Derivative Markets

The post Asset management company increases long positions in bitcoin derivatives market ── spot market remains flat | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

109

2 years ago

109

English (US) ·

English (US) ·