The post AVAX Rally Imminent? Whale Transaction Volume Soars by 71% appeared first on Coinpedia Fintech News

The overall cryptocurrency market sentiment appears negative, amid this, Avalanche (AVAX) has gained significant attention from investors and whales, as reported by the on-chain analytics firm IntoTheBlock.

Large Transactions Volume Soars by 71%

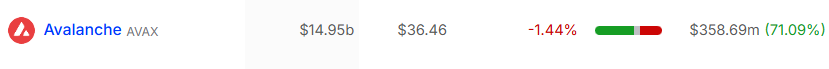

Data from IntoTheBlock reveals that the large transaction volume on AVAX has surged by 71.09% in the past 24 hours.

Source: IntoTheBlock

Source: IntoTheBlockThis significant rise in transaction volume indicates heavy participation from whales, who have also shown strong interest and confidence in the token. This could create substantial buying pressure and drive further upside momentum.

Additionally, data from the on-chain analytics firm Coinglass’s spot inflow/outflow reveals that exchanges have experienced an outflow of a significant $5.15 million worth of AVAX. This suggests that whales and investors are taking advantage of the recent price decline and have been continuously accumulating.

Source: Coinglass

Source: CoinglassAVAX Price Action and Key Levels

However, this volume from the on-chain analytics firm and the significant outflow occurred when the AVAX price reached a crucial support level of $36, where the altcoin previously gained a 25% rally. In addition to the horizontal support, AVAX is also receiving support from the 200 Exponential Moving Average (EMA) on the daily time frame.

Source: Trading View

Source: Trading ViewSince December 2024, AVAX has reached this level multiple times, and each time, it has witnessed a price rally of over 25%, reaching the $44.5 mark. It appears that whales, observing this historical rally, maybe the reason behind their participation.

RSI Signal Upside Rally

Based on the recent price action, if AVAX holds above the $35 level, there is a strong possibility it could soar by 25% to reach the $44 level. Currently, AVAX’s Relative Strength Index (RSI) is near the oversold area, suggesting potential upside momentum.

Current Price Momentum

Currently, AVAX is trading near $36.35 and has experienced a price decline of over 2% in the past 24 hours. However, during the same period, its trading volume jumped by 10%, indicating a modest rise in participation from traders and investors.

5 months ago

53

5 months ago

53

English (US) ·

English (US) ·