CBDC Experiments Take the Next Stage

The Bank of Japan announced on the 17th that it will conduct a pilot experiment of the central bank digital currency (CBDC) from April 2023.

The “proof of concept” to confirm whether the basic idea is technically feasible will be completed in March as planned. In the pilot experiment, we will verify the technical feasibility that cannot be verified by the proof of concept, and utilize the technology and knowledge of private companies that are useful for verifying the technical and operational aspects.

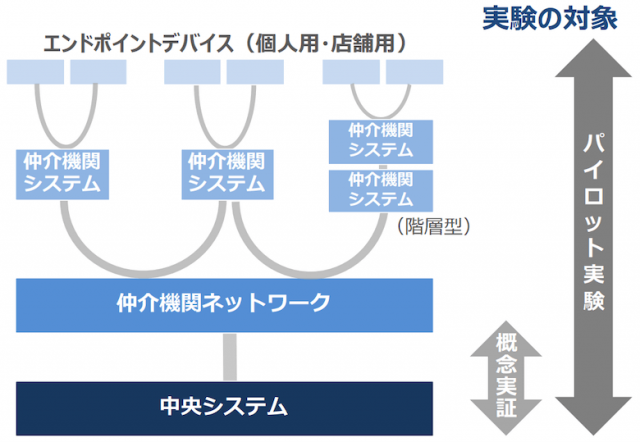

Specifically, an experimental system was constructed as an integral implementation of everything from the central system to the intermediary network, intermediary system, and endpoint devices. So far, proof-of-concepts have essentially been built for central systems only.

In pilot experiments, this experimental system will be used to check the end-to-end processing flow, and to examine and sort out issues and countermeasures for connecting with external systems.

Source: Bank of Japan

The above image is the material that the Bank of Japan describes in this announcement. Although the endpoint device is described as “for personal and store use”, it is currently a pilot test and it is not expected to conduct actual transactions involving consumers and stores.

In addition, the Bank of Japan has requested the provision of information regarding the utilization of technology and knowledge of private companies. Companies that develop systems or provide products/services are requested to provide related information and materials for reference in pilot experiments.

The Bank of Japan has also announced the establishment of the CBDC Forum. In order to appropriately design the system, he said that private companies involved in payments for individuals and companies (retail payments) will be invited to participate, and that they will discuss and consider a wide range of themes.

It is still undecided whether CBDC will be introduced in Japan. It has indicated that it will decide whether to actually introduce it through national discussions, and to contribute to such discussions, it will proceed with preparations so that it can respond to various changes in the environment.

connection: The number of central banks working on CBDC demonstration experiments is increasing worldwide = Bank of Japan report

Finally, the Bank of Japan explained that in FY2023, it plans to select participants and contractors involved in the construction of experimental systems, and to proceed with discussions and examinations with participants and development of experimental systems. He said that the verification status of the experiment and the contents of the discussions and examinations with the participants will be announced in due course.

After the pilot, the company said it plans to incrementally expand the scope of the experiment and the range of participants if needed.

connection: The next Governor of the Bank of Japan is revealed, next week will be the US CPI | 11th Financial Tankan

What are CBDCs

A digital currency issued by the central bank of a country or region. The big difference from crypto assets (virtual currencies) such as Bitcoin (BTC) is that CBDC is a digital legal currency.

Cryptocurrency Glossary

Cryptocurrency Glossary

connection: What is Central Bank Digital Currency (CBDC) | Differences from Bitcoin and Main Advantages

Proof of concept results

On the 17th, the Bank of Japan released the opening remarks by Executive Director Uchida at the “Communication Council on Central Bank Digital Currencies.” In it, Director Uchida describes his experiments so far.

In “Phase 1” of the proof of concept that started in April 2021, an experimental environment was built around the “CBDC ledger” that is the foundation of the CBDC system. It has been confirmed that the high processing performance required for high-frequency small-lot payments can be achieved in a series of transactions such as issuance, withdrawal, and transfer, which are the basis of payment methods.

Then, from April 2022, “Phase 2” will start. He said that after adding more complex peripheral functions to the basic functions confirmed in phase 1, he verified the technical feasibility and processing performance.

For example, if one user has multiple accounts, the system can also handle peripheral functions that are difficult to implement, such as a function that determines whether the holding amount, transaction amount, and number of transactions do not violate the upper limit. It is said that it has confirmed that the processing performance can be maintained.

connection: Bank of England and Treasury “It is likely that a digital pound (CBDC) will be needed”

The post Bank of Japan Begins Pilot Experiment of Central Bank Digital Currency (CBDC) in April appeared first on Our Bitcoin News.

2 years ago

120

2 years ago

120

English (US) ·

English (US) ·