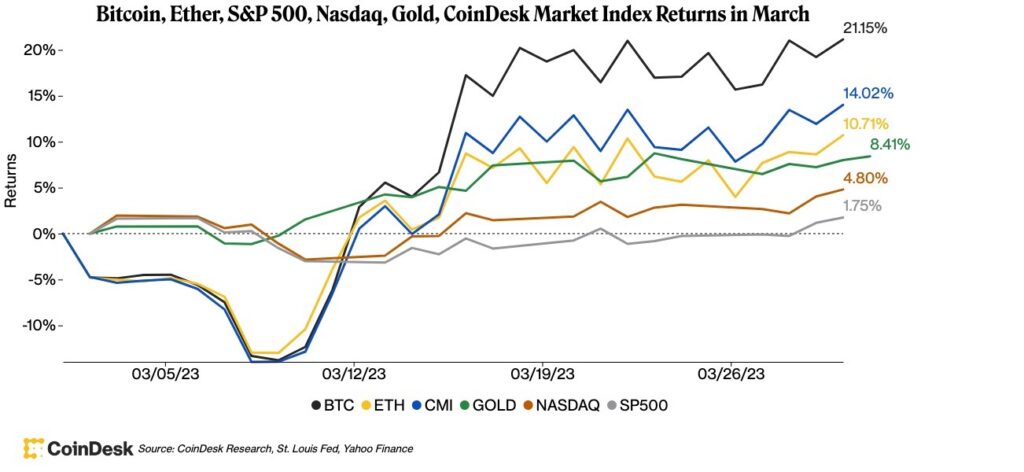

Bank failures, rising inflation and macro-environmental headwinds swept investors through March. But in the end, the result favored crypto assets, such as Bitcoin (BTC), which are supposed to be a store of value that is not subject to disruption.

Bitcoin rose more than 21% in March. On the 29th, it briefly exceeded $ 29,100, the highest price since June 2022. It has outperformed the S&P 500, Nasdaq and other traditional assets broadly. The Nasdaq was up more than 4% in March.

CoinDesk Research, St. Louis Fed and Yahoo Finance

CoinDesk Research, St. Louis Fed and Yahoo Finance“In March, the macro environment was very positive for ‘alternative money,’” Greg Magadini, director of derivatives at crypto analytics firm Amberdata, told CoinDesk in an email, adding that Bitcoin and secure It added that the asset gold showed “explosive information volatility” in March.

According to Magadini, after the collapse of crypto-friendly Silvergate Bank and Silicon Valley Bank, Bitcoin’s volatility in the options market is not as dramatic as the collapse of crypto firms such as FTX in 2020. said to be very different.

“Bitcoin is exploding,” he continued. rice field.

This month’s gains come as the crypto industry endures a flurry of deregulation and the collapse of crypto-friendly Silvergate and Silicon Valley banks. Last week, the U.S. Commodity Futures Trading Commission (CFTC) sued Binance and its founder and CEO Changpong Zhao. The impact of the banking crisis hit several stablecoins in early March, while other crypto assets were largely unaffected.

Ben McMillan, chief investment officer at cryptocurrency manager IDX Digital Assets, says regulatory volatility and regulatory uncertainty is the top concern for institutional investors, not “market volatility around Bitcoin.” He told CoinDesk ahead of news of the Binance lawsuit.

Ethereum (ETH) rose 13% in March. It started the month at $1,861, its highest level since August 2022.

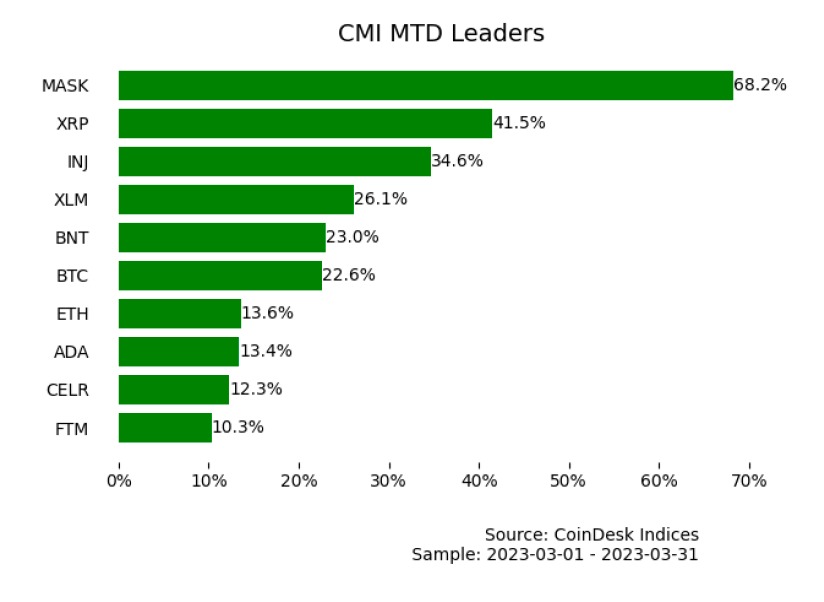

winner

Crypto-messaging protocol Mask Network (MASK) has risen the most among 160 crypto assets on the CoinDesk Market Index (CMI), rising nearly 68% in March.

CoinDesk Indices

CoinDesk IndicesThe second place is X R P (XRP) with about 42% or more. The rise was partly due to widespread speculation that the issuer, Ripple, could win a lawsuit with the U.S. Securities and Exchange Commission (SEC).

“XRP has been in legal trouble for a while, but the fact that we may finally reach a legal conclusion is driving XRP higher,” said Magadini of Amberdata.

By sector, the CoinDesk Currency Index gained the most with a 21% increase. The Smart Contract Platform sector followed with a 9% gain.

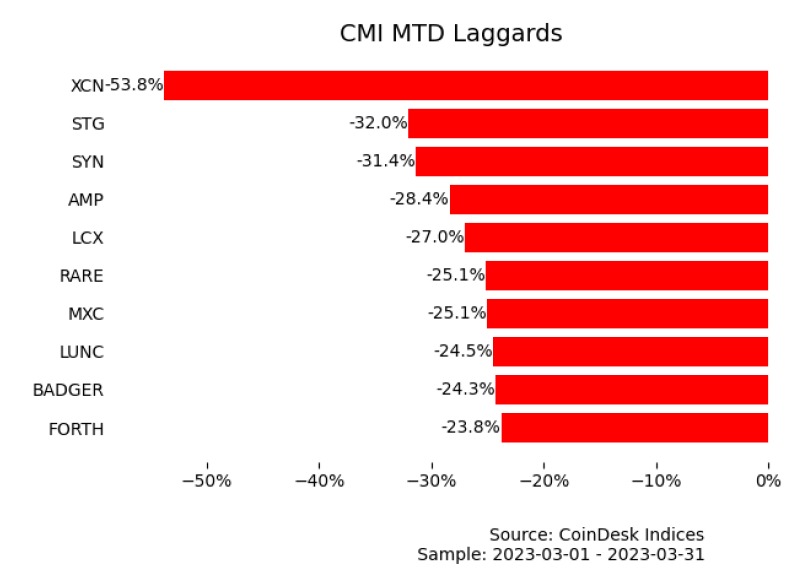

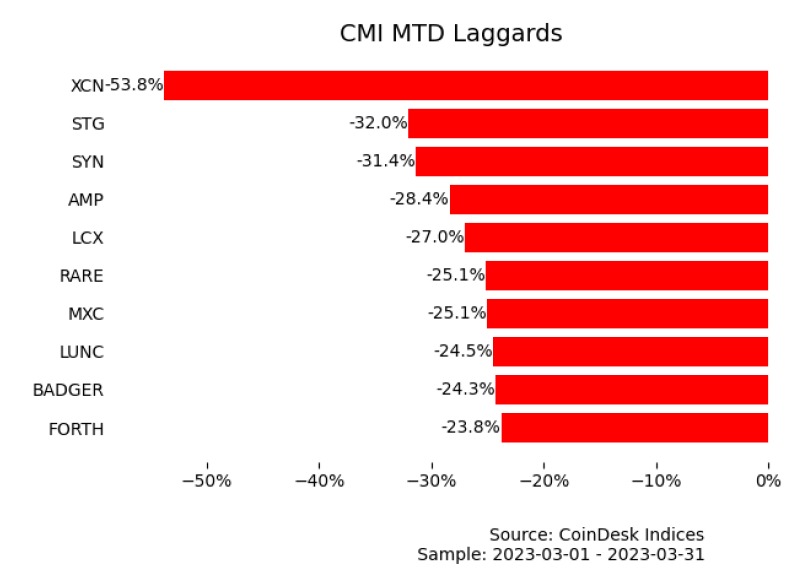

loser

CMI’s currency sector Chain (XCN) fell more than 53% in March.

CoinDesk Indices

CoinDesk IndicesAccording to CoinGecko, the DeFi (decentralized finance) sector’s cross-chain bridge protocol Stargate Finance (STG) has fallen more than 32%.

the next deployment

Stefan Rust, CEO of crypto investor and data aggregator Truflation, said in an email to CoinDesk on March 29 that traditional finance (TradFi) has reached a tipping point. “People seem to realize that the banking crisis isn’t really over.”

Rast said the bank failures robbed investors and others of a valuable resource to participate in the crypto ecosystem, citing increasing regulatory pressure that may be a hurdle to the industry’s growth. touched.

But he added that the recent tumultuous relationship between DeFi and TradFi is likely to stabilize.

“In the long term, we will see a whole new on-ramp/off-ramp system between DeFi and crypto assets and fiat currencies as trust in centralized, sanctioned financial institutions arguably collapses.” “You no longer have to keep all your money in one bank or one centralized financial institution. Who knows what will happen to those institutions and your assets,” Magadini said.

“Markets always need a little time to readjust, regain confidence and find new ways and money streams. But money always goes uphill.”

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: CoinDesk Indices

|Original: Crypto Market March Roundup: Bitcoin Rises Amid Banking Uncertainties, Macro Headwinds

The post Bank uncertainty, bitcoin rising amid macro headwinds: March review | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

125

2 years ago

125

English (US) ·

English (US) ·