Capitalizing on bear markets and turning points in investment strategies

“Buy stock in companies that trade below their intrinsic value.” This is the heart of legendary investor Warren Buffett’s investment philosophy. The key here is “intrinsic value,” a concept that refers to the present value of cash flows that a company will generate in the future.

Buffett’s value investing is based on the principle of focusing on the intrinsic value of a company rather than the current market price.

In the spring of 2023, Mr. Buffett announced an additional purchase (additional purchase) of the stock of a major Japanese trading company that he had previously purchased (in 2020). His views attracted the attention of foreign investors, and the stock prices of the nominated companies hit historic highs.

Against the backdrop of the depreciation of the yen, the appreciation of the dollar, and the Bank of Japan’s stance toward monetary easing, the Nikkei Stock Average has also performed well, recovering to the 33,000 yen level for the first time since the bubble period in July 1990.

The secret to Buffett’s success lies in its simplicity and consistency. He chooses brands that consumers trust, profitable companies and invests in them for the long term. These principles guide Berkshire Hathaway to consistently outperform the market.

However, Buffett’s investment philosophy also includes a decision to forego investment. An example of this is his skeptical stance on cryptocurrencies, where he defines areas he does not understand as “risk” and refrains from investing in such areas.

This cautious investment style and philosophy can lead to early-stage investment opportunities in emerging stocks like Google and Amazon, but it comes from a philosophy that puts asset conservation first.

But that doesn’t mean Buffett is sticking to traditional businesses and avoiding investing in emerging technologies. He is especially active in investing in the IT field. In this column, we explore how Berkshire’s portfolio has evolved and incorporated new areas, and how Buffett has maintained his outstanding record.

one of the three major investors

Warren Edward Buffett was born in Omaha, Nebraska, in the Midwestern United States in 1930 and still lives there as a global investor. Berkshire Hathaway’s annual shareholder meeting is also held here, and he has been dubbed the “Oracle of Omaha” for his insight and influence.

Warren Buffett, George Soros, Jim Rogers. These names are widely recognized around the world as one of the three largest investors. Soros and Rogers have built extraordinary success using short selling and contrarians based on a “global macro” strategy.

Buffett, on the other hand, is a value investor who looks for stocks trading below their intrinsic value. The foundation of his philosophy is based on “value investing”, which he learned directly from economist Benjamin Graham.

Buffett focuses on a company’s intrinsic value and long-term potential, rather than focusing on short-term market trends. Buffett’s quote, “Be fearful when others are greedy, be greedy when others are fearful” epitomizes his investment philosophy.

Buffett’s investment criteria are clear: “Companies that he understands, have a sustained competitive advantage, and have management teams he can trust.” These criteria focus his investments on companies with strong business models and consistent revenue streams.

Buffett’s investment philosophy

Warren Buffett’s investment philosophy is a universal precept that has been sustained for decades and weathered the toughest of markets. Everyone deserves to learn and make their own. In this chapter, I will try to cover some of the basic points of that philosophy.

1. Determining Intrinsic Value: Buffett’s investment method focuses on assessing the intrinsic value of a company rather than just looking at its stock price. Intrinsic value refers to the true value of a company, which is judged based on fundamentals such as the company’s earning power, assets, and liabilities. Buffett says he only buys stocks that sell at a “reasonable price” for projected earnings at least five years out.

2. Find companies with moats: Buffett likes companies with competitive advantages, or moats. This refers to strong brand recognition, unique technology, cost advantages, etc. This “moat” is a factor that protects companies from competition and maintains profitability.

3. Minimize debt: Buffett tends to favor companies with low debt. This is because highly indebted companies are more vulnerable during a downturn, increasing the risk of squeezing profits.

4. Ignore short-term market volatility and hold good companies for the long term: Buffett is an avid proponent of the “buy and hold” strategy. “Our preferred holding period is forever,” he often says, reflecting his philosophy.

Many investors and analysts use the “income approach” and “owners’ profit” to calculate intrinsic value. The former is a method of converting a company’s ability to generate future profits and cash flows into a present value, while the latter is a calculation method that takes into account profits, depreciation and capital expenditures.

But Buffett’s investment philosophy goes beyond simply using these methods. Buffett makes investment decisions based on a deep understanding of the company’s structure, competitive advantage, and management team’s capabilities and philosophies. This is Buffett’s unique approach to seeing the underlying values of a company.

What is Berkshire Hathaway

Let’s take a closer look at Berkshire Hathaway, the investment firm headed by Warren Buffett. According to filings with the U.S. SEC (Securities and Exchange Commission) as of March 2023, Berkshire Hathaway holds 48 stocks with a total asset value of approximately $300 billion (41 trillion yen). We also have more than $127 billion in cash and cash equivalents.

Berkshire Hathaway grows by effectively reinvesting its own cash flow, not just the profits from its holdings.

Berkshire Hathaway’s largest holding is Apple, with approximately 916 million shares. It accounts for about 46% of the company’s investment portfolio and has a valuation of about $150 billion (21.59 trillion yen). In addition, the stocks in which Berkshire Hathaway invests heavily include leading companies in each industry. Some of them are introduced below.

1. Apple (46.44 of the entire portfolio)

2. Bank of America Corporation (9.09)

3. American Express (7.69%)

4. Coca-Cola (7.63%)

5. Chevron (6.65%)

6. Occidental Petroleum (4.07%)

7. Kraft Heinz (3.87%)

8. Moody’s Corporation (2.32%)

9. Activision Blizzard (1.30%)

10. Hewlett-Packard (1.09%)

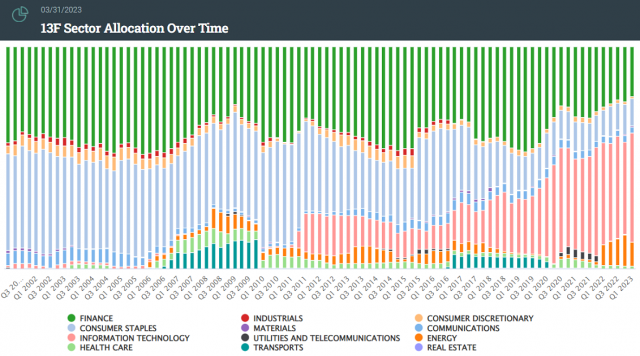

Berkshire Hathaway’s investment portfolio is heavily reliant on the top 10 stocks, holding 90.15% of the total. By sector, information technology accounts for the largest share, accounting for about 49% of the total.

The financial sector is followed by about 22% of the total. The consumer goods sector accounts for about 12% of the total, and the energy sector just over 10%. These numbers show Berkshire Hathaway’s commitment to diversification in its investments, while demonstrating strong faith in specific sectors and stocks.

Berkshire Hathaway’s weighting by sector Source: whalewisdom

At that time case to Coca-Cola

To understand how Warren Buffett invested, look at his investment in Coca-Cola in 1988. After the stock market crashed, Buffett saw Coca-Cola’s strong brand and stable business model, and invested about $1 billion to acquire a 6.2% stake in the company. That investment has now grown to more than $22 billion and holds a 9.2% stake in the company.

In the financial sector, Buffett sold stakes in US Bancorp and BNY Mellon in the January-March 2023 quarter. We feel that some companies are ignoring basic principles in the pursuit of profit and have decided to moderate our exposure to this sector. The decision comes at a time when the failure of Silicon Valley Bank has fueled industry unrest and sent stock prices down.

Buffett’s investment strategy is also reflected in the performance of Berkshire Hathaway, whose stock has grown at a compound annual rate of 19.8% from 1965 to 2022, well above the 9.9% growth of the S&P 500.

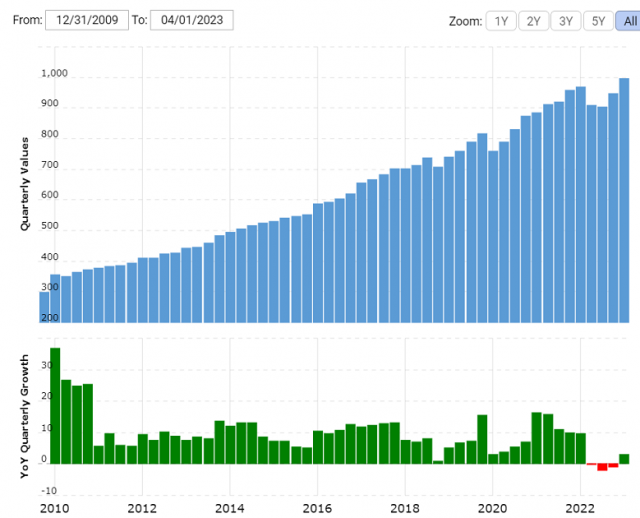

Berkshire Hathaway’s balance sheet shows a similar expansion. Total assets in 2009 were 297,119 million dollars, but in the January-March period of 2023, they will expand to approximately 997,072 million dollars (140 trillion yen).

Berkshire Hathaway Total Assets Source: macrotrends

Negative attitude towards cryptocurrencies

Warren Buffett’s investment philosophy is based on the belief that you should only invest in things that you can understand and grasp. As he describes himself as a “Circle of Competence,” he invests only in areas in which he has a deep knowledge and understanding, thereby minimizing risk and maximizing the future potential of the companies he invests in. can be evaluated accurately.

From this perspective, Buffett’s skepticism about Bitcoin and other cryptocurrencies is understandable. These assets lie outside his knowledge and understanding, or “circle of competence.”

connection:Buffett’s Camp Criticizes Bitcoin Again: “Shit Trading” “Rat Squaring”

In the past, Buffett famously described Bitcoin as having “no intrinsic value” and even calling it “rat poison squared.” This is probably because Buffett sees the volatility of bitcoin’s price and the fact that it is difficult to see a specific source of value as a big departure from his easy-to-understand business model.

In a 2020 interview with CNBC, Buffett also said that “cryptocurrencies themselves don’t produce anything, they don’t give birth to anything, they can’t really do anything.”

And now, even in 2023, Buffett does not have a positive view of asset classes such as Bitcoin. He consistently avoids investments he doesn’t understand or where he doesn’t see intrinsic value.

But on the other hand, if you can understand it, you have the potential to change your opinion. One example is Apple stock, which is now a big investment.

Policy change on IT investment

Warren Buffett continues to evolve his investment strategy with the changing times without compromising his basic investment principles. A typical example of this is investment in the IT sector.

Buffett’s negative view of the IT field is known at the 1998 general meeting of shareholders, when he said, ‘I will not participate in games where there are people who are more advantageous than me.’ However, Berkshire Hathaway’s investment portfolio now accounts for approximately 49% of its total investment in information technology.

The turning point is said to be when Buffett acquired a large stake in Apple for the first time in the January-March quarter of 2016. Buffett saw Apple not just as a technology company, but as a consumer business with a loyal customer base.

In addition, there is an advantage to continuing to hold Apple stock because Apple’s profits are converted into cash and returned to shareholders. Apple has taken the form of returning profits directly to shareholders by paying dividends that started in 2012 and repurchasing its own shares that started the following year.

As of June 2023, Apple’s annual dividend per share is $0.96. Calculating from Berkshire Hathaway’s approximately 916 million shares, the company earns about $880 million in annual dividend income from Apple. It is an important source of working capital for Berkshire.

Buffett and his partner Charlie Munger, vice chairman of Berkshire Hathaway, are aged 92 and 99, respectively, and are always innovative when choosing investments. Their approach to flexibly evaluating investment targets and discovering potential without being bound by stereotypes has been one of the reasons for their long-term success.

Interest in Japanese trading companies

It’s an interesting development that Warren Buffett’s investment focus is now on Japan’s five largest trading stocks. Mitsubishi, Mitsui & Co., Sumitomo, Itochu and Marubeni through their Berkshire Hathaway subsidiary and insurer National Indemnity Company’s shareholding in outstanding shares will increase from an average 7.4% shareholding reported in April. It has been raised to an average of just over 8.5% (as of June 12, 2023).

The total amount of shares held by the five companies has reached approximately 2.8 trillion yen. Buffett intends to hold stakes in these trading companies for the long term, and has indicated that he may increase his stake in these five companies to as high as 9.9%.

The diversified business model of Japan’s major trading companies shows what he has in common with Berkshire Hathaway, which he leads. Berkshire is a conglomerate and major Japanese trading company with a variety of businesses including insurance (GEICO), rail transportation (BNSF), power (BHE), manufacturing (industrial, construction and consumer products) and retail (McLane). is similar to

Buffett appreciates that trading companies like this are doing business within the bounds of his understanding and making steady profits. In an April 2023 CNBC interview, he said, “These trading companies are big companies, but their business is understandable and they have diversified interests similar to Berkshire. It was being traded at an unacceptable price,” he said.

In an April 2023 interview with CNBC, Buffett praised trading companies for being “understandable” businesses and their ability to generate consistent profits.

I thought these were big companies. A company that knew what they were doing. It has some similarities to Berkshire in that it owns many different interests. And they were trading at prices that I couldn’t believe, especially compared to interest rates at the time.

Buffett’s strategy is already paying off big. Since Berkshire’s ownership announcement in August 2020, Marubeni’s share price has quadrupled and four others have more than doubled. This proves that Buffett’s unique investment philosophy is still valid today and that his investment eye is solid.

connection:Buffett’s Berkshire to increase stake in Japan’s five largest trading companies

The post Berkshire’s Ever-Evolving Investment Portfolio Explores Warren Buffett’s Secrets to Success appeared first on Our Bitcoin News.

1 year ago

135

1 year ago

135

English (US) ·

English (US) ·