Semiconductors are critical to the economy of almost every country in the world. However, the industry is facing significant challenges.

Even with fabs operating at full capacity, companies have struggled to keep pace with demand, pushing lead times to six months or longer. Moreover, the impact of the pandemic, a talent crunch and spiraling design complexity mean an industry that should be riding high is under increasing pressure.

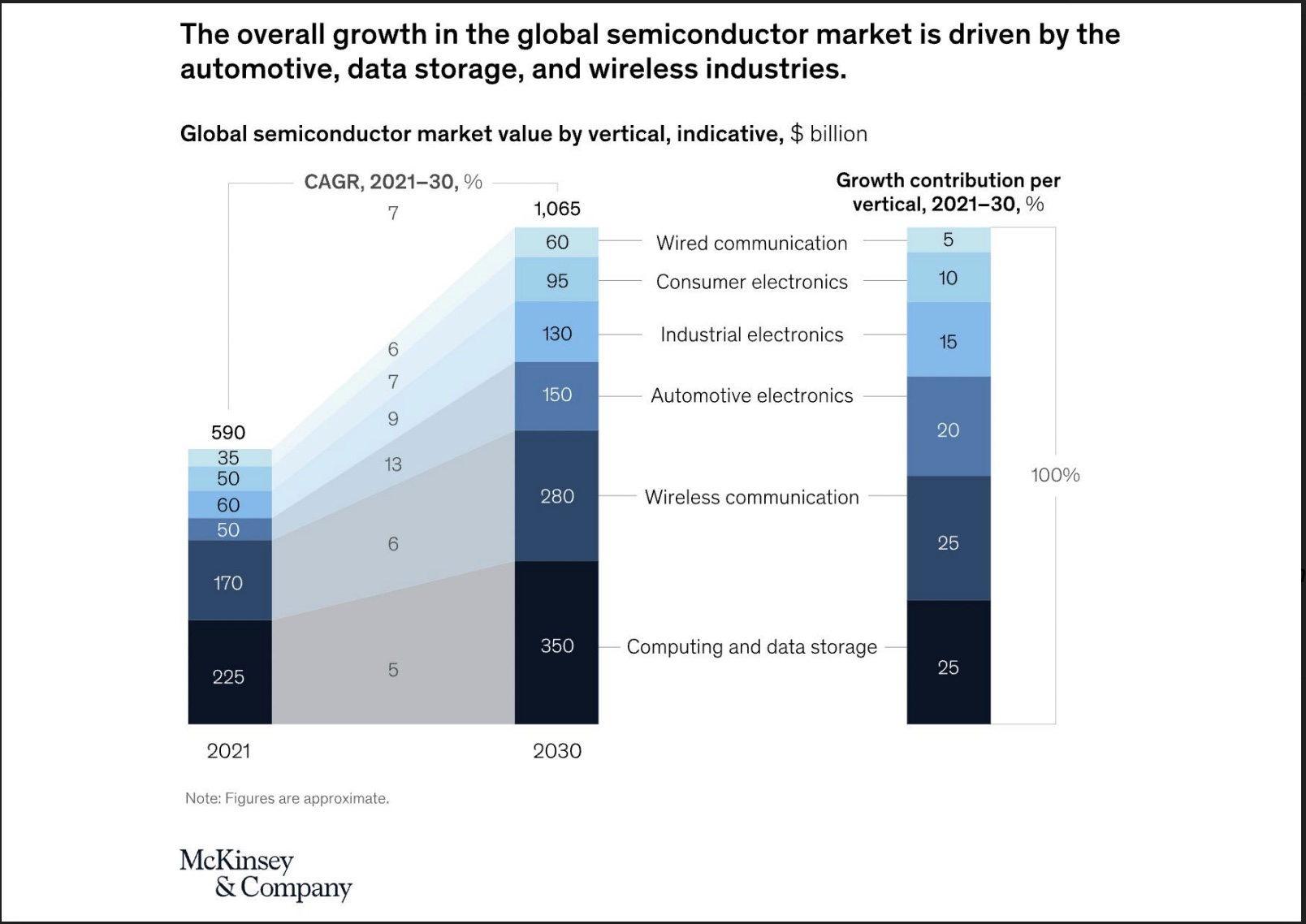

Amid soaring demand, semiconductor markets have boomed, with sales growing by more than 20% to around $600 billion in 2021. However, global chip shortages have caused manufacturing slowdowns in industries from autos to agriculture, and led to debates over the reliability of an industry that is vital to the global economy.

In the U.S., the federal government has responded with a swath of legislation, including the CHIPS for America Act, which authorizes $52 billion in funding for the expansion of the domestic semiconductor industry. The new rules aim to protect industries against supply shortages and reduce their reliance on fabrication plants in Asia. Companies including Intel, Samsung, Texas Instruments and GlobalFoundries are planning on adding more capacity in the U.S., and Europe is also seeing significant investment.

The recent ramp up in productive capacity reflects the consensus that, notwithstanding the current environment, the longer-term outlook for the semiconductor industry remains positive. From domestic kitchens to the most advanced manufacturing plants, semiconductors are embedded in modern economies. Combine that with the rise in home working, and it’s not difficult to predict the industry’s direction of travel.

We estimate 6% to 8% growth per year up to 2030, amid expanding demand for digital services, the growth of artificial intelligence and machine learning (AI/ML), and mass migration to electric mobility. On that trajectory, we predict a trillion-dollar industry by the end of the decade.

Image Credits: McKinsey & Company

English (US) ·

English (US) ·