In the rapidly shifting cryptocurrency world, Bhutan is steadily establishing its footprint with a unique and calculated approach to digital assets.

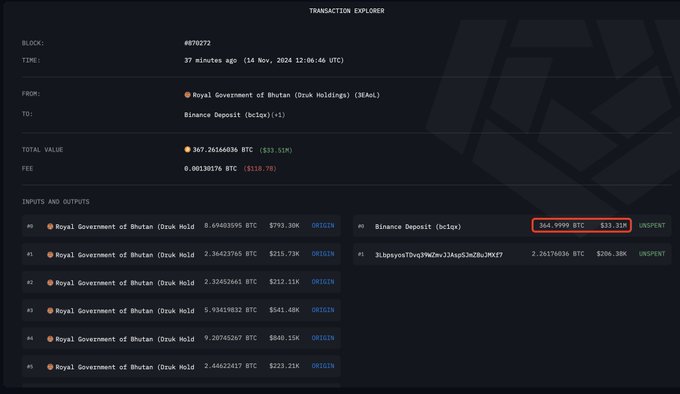

This small Himalayan nation recently caught the attention of crypto-watchers worldwide when it deposited 365 Bitcoin (BTC), valued at approximately $33.31 million, into Binance, the world’s largest cryptocurrency exchange.

On November 14, 2024, Lookonchain, a transactions tracker, shared the news on X (formerly Twitter), bringing to light Bhutan’s activity in the cryptocurrency market.

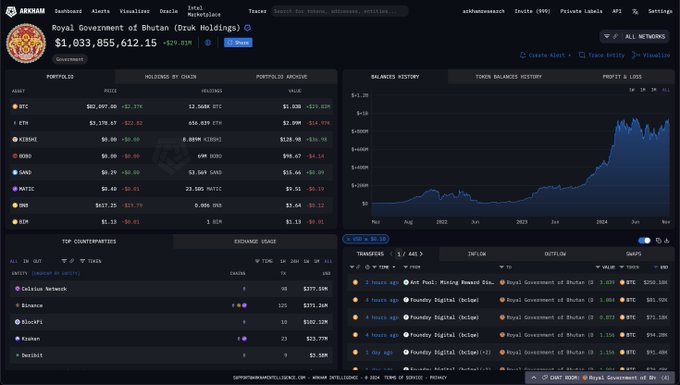

This transaction underscores Bhutan’s sizeable BTC holdings, which are now valued at over $1.15 billion, and highlights the government’s progressive involvement in the cryptocurrency space.

Bhutan government’s latest BTC move

The Royal Government of Bhutan’s Bitcoin deposit on Binance raises intriguing questions about its strategy.

While the exact reason for this $33.31 million deposit remains undisclosed, it could reflect profit booking or possibly signal a reallocation.

The timing is notable, as Bhutan’s BTC holdings peaked when Bitcoin reached its all-time high, surpassing $1 billion in value.

Such a move might hint at Bhutan’s intention to leverage its digital asset holdings for alternative financial activities, whether staking, swapping, or other market-related transactions.

The Royal Government of Bhutan now owns $1 Billion in Bitcoin.

Bhutan’s BTC holdings rank fourth among governments globally

This transaction slightly decreased Bhutan’s total BTC reserve to 12,573 BTC, maintaining its position as the fourth-largest Bitcoin-holding government globally.

These holdings, currently valued at $1.15 billion, underscore Bhutan’s consistent activity in the BTC market.

The government has accumulated BTC and Ethereum (ETH) holdings since it entered the crypto market in 2021, reflecting a calculated yet bold approach that is uncommon among sovereign entities.

Along with Bitcoin, Bhutan holds approximately 656 ETH, valued at $2.11 million.

Bhutan’s active investment in cryptocurrency, particularly Bitcoin mining and strategic purchases, reflects its resilience and long-term commitment to building a cryptocurrency reserve, despite the market’s volatility.

Bitcoin’s open interest rises as trading momentum builds

Bitcoin’s open interest has also seen a marked increase, rising 4.82% in the past 24 hours and 2.9% over the last four hours.

This uptick highlights a renewed interest from traders and investors, likely driven by factors such as BTC’s price stability, Bhutan’s strategic moves, and increased market momentum.

The heightened open interest could signal that more investors are positioning themselves for Bitcoin’s next major price shift, indicating positive sentiment within the crypto space.

Bhutan’s involvement in the cryptocurrency world reveals a forward-looking strategy.

Its significant holdings of BTC and ETH, as well as its calculated transactions, suggest a deliberate approach to cryptocurrency that sets it apart from other nations.

By actively mining Bitcoin and building reserves, Bhutan is not only diversifying its financial portfolio but also positioning itself as a unique player on the global crypto stage.

As Bhutan continues its crypto journey, its actions could inspire other governments to explore digital assets.

The nation’s calculated moves might serve as a blueprint for other countries considering cryptocurrency reserves as part of their fiscal strategy.

Bhutan’s strategy aligns with the growing trend of digital asset adoption by national governments, potentially influencing how governments view and manage digital currencies in their reserves.

The post Bhutan government transfers $33.31M in BTC to Binance appeared first on Invezz

English (US) ·

English (US) ·