In a recent interview with Markets with Madison, MicroStrategy Co-Founder Michael Saylor revealed his motivation for investing heavily in Bitcoin.

Saylor’s intention to leave his substantial wealth to the world has garnered attention, particularly within the crypto community.

Inspired by Bitcoin’s mysterious creator, Satoshi Nakamoto, Saylor envisions Bitcoin’s role in the future as revolutionary, likening its significance to innovations like steel and electricity. He said:

I’m a single guy. I have no children. When I am gone, I’m gone. Just like Satoshi left a million Bitcoins to the Universe, I’m leaving whatever I’ve got to the civilization but it occurs to me that 8 billion people with crypto steel or economic steel can build something much grander in the 21st century that all the 20th-century economists struggling with clay and cotton candy.

While many perceive Bitcoin as an investment, Saylor views it as a “wealth for humanity” endeavor.

With no direct heirs, his commitment to philanthropy is grounded in a deep admiration for Nakamoto’s vision.

This perspective has shaped Saylor’s strategic decisions at MicroStrategy, making it one of the largest Bitcoin holders globally.

His goal is to transform MicroStrategy into a ‘Bitcoin Bank,’ securing Bitcoin’s place as a stable store of value amidst economic uncertainties.

Why Saylor’s admiration for Satoshi Nakamoto matters

Saylor’s dedication to Bitcoin extends beyond mere investment returns.

His inspiration from Satoshi Nakamoto reflects a belief in Bitcoin’s potential to drive significant societal change.

For Saylor, Nakamoto’s decision to remain anonymous underscores a selfless pursuit of creating a decentralized financial system.

Saylor’s alignment with this ethos is evident in his decision to channel his wealth into supporting Bitcoin’s ecosystem.

Many in the crypto industry see this as a defining feature of his strategy, aiming for a broader impact on the digital asset landscape.

MicroStrategy’s Bitcoin holdings

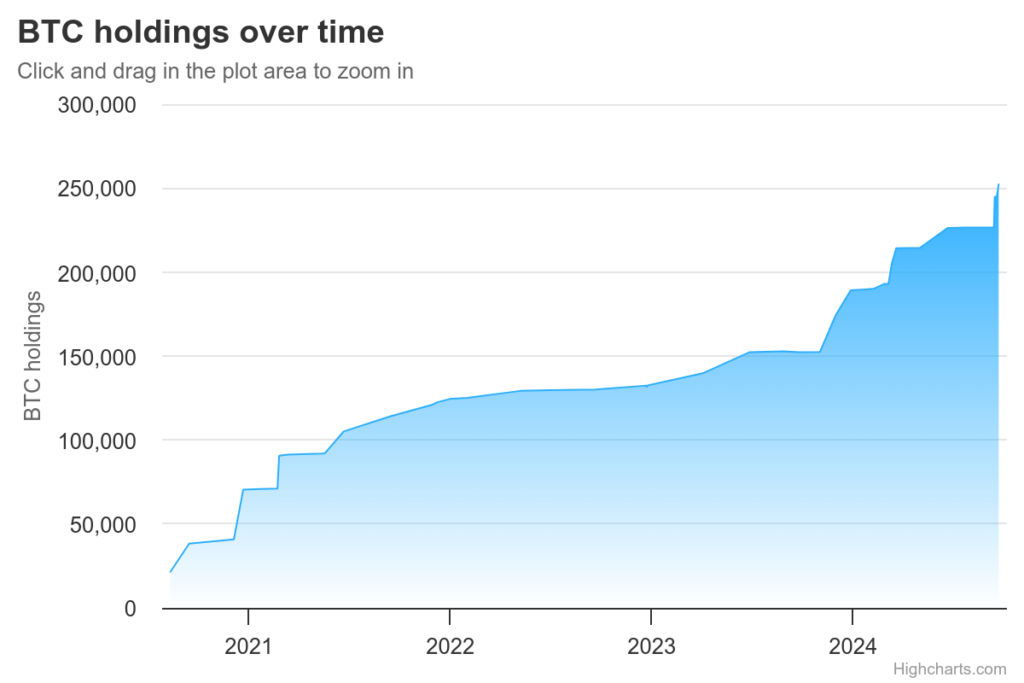

MicroStrategy’s aggressive acquisition strategy has positioned it as a leading public company in Bitcoin ownership.

As of now, the firm holds around 252,220 BTC, valued at approximately $16.89 billion. This represents about 1.201% of the total Bitcoin in circulation.

Source: Coinpedia

Since August 2020, MicroStrategy’s holdings have grown steadily, starting with 21,454 BTC and reaching over 91,000 BTC by mid-2021.

By January 2022, the company’s holdings had doubled to 125,051 BTC, demonstrating a long-term bullish stance on Bitcoin.

Between November 2023 and July 2024, MicroStrategy’s holdings surged from 152,400 BTC to 226,500 BTC, showcasing its persistent belief in Bitcoin’s potential.

In just the past month, the company purchased an additional 25,720 BTC, reflecting growing confidence in the digital currency’s future.

Saylor’s enthusiasm for Bitcoin as a store of value is built on a critical perspective of fiat currencies.

He argues that traditional currencies inevitably lose value over time due to inflationary pressures.

Bitcoin, in contrast, is viewed by Saylor as a “battery that never loses its charge,” making it a potentially stable asset in uncertain economic climates.

He believes Bitcoin’s unique properties could address many of the global economic challenges, providing a new form of financial stability for future generations.

Transforming MicroStrategy into a ‘Bitcoin Bank’

A key part of Saylor’s vision involves evolving MicroStrategy into a ‘Bitcoin Bank.’

This shift from its roots as a software company is driven by the belief that Bitcoin offers unparalleled long-term potential.

By accumulating substantial Bitcoin reserves, MicroStrategy aims to leverage its position in the crypto market, potentially redefining how companies integrate digital assets into their business models.

This transformation highlights the firm’s strategy to become a major player in the Bitcoin ecosystem, providing both corporate clients and individual investors with access to this new form of financial asset.

Saylor’s plan to leave a lasting impact on the world through Bitcoin is poised to inspire the next generation of crypto enthusiasts and leaders.

His focus on building a long-term vision rather than merely short-term gains sets him apart from many in the digital asset space.

By prioritizing the larger potential of Bitcoin, Saylor’s approach could encourage more companies to explore innovative strategies within the cryptocurrency sector, ultimately driving broader adoption and understanding of Bitcoin’s role in the global economy.

The post Billionaire Michael Saylor: 'Just like Satoshi, I’m giving my Bitcoins to civilization' appeared first on Invezz

English (US) ·

English (US) ·