About Binance Japan

Binance, one of the world’s largest crypto asset (virtual currency) exchanges, has announced its full-scale entry into the Japanese market. This is part of Binance’s international strategy, and the move could significantly dictate Japan’s role in the cryptocurrency industry.

As the plans for the newly-launched “Binance Japan” (provisional name) are gradually revealed, so too is the interest of investors and market players. In this article, we will analyze the presence of Binance, which is attracting attention around the world, and their concrete plans for expanding into Japan. In addition, we will delve into which cryptocurrencies will be traded, what investors expect, and Binance Japan’s impact on the Japanese market and its advantages and disadvantages.

Acquired Sakura Exchange Bitcoin

Binance Japan will be the Japanese branch of Binance, the world’s largest crypto asset (virtual currency) exchange. The new service “Binance JAPAN (tentative name)” is aiming to start after June 2023.

In the past, when Binance tried to enter the Japanese market, it was forced to withdraw once it received a warning from the Financial Services Agency in March 2018 urging it to stop providing services to customers living in Japan. However, after that, Binance acquired Sakura Exchange Bitcoin Co., Ltd. (SEBC) and obtained an official license as a Japanese cryptocurrency exchange operator.

In November 2022, SEBC announced a transfer of all shares to Binance (AP) Holdings Limited, an affiliate led by Binance CEO Changpong Zhao, and a transition to a new management structure. Under the new management system, Mr. Takeshi Chino, who previously served as the representative of Kraken’s Japanese subsidiary, was appointed as the representative director. The company profile of Sakura Exchange Bitcoin Co., Ltd. as of June 16, 2023 is as follows.

■ About Sakura Exchange Bitcoin Co., Ltd.

Company name: Sakura Exchange Bitcoin Co., Ltd.

Business description: Crypto asset brokerage business

Registration number: Crypto asset exchange (registration number Kanto Local Finance Bureau Director No. 00031)

Established: May 2017

Headquarters: 5-2-1 Roppongi, Minato-ku, Tokyo Houraiya Building 302

Representative: Takeshi Chino, Representative Director

What is the appeal of Binance as it expands globally?

Binance (global version) was launched in Hong Kong in July 2017 and officially began operations as the cryptocurrency exchange Binance.com. After that, through the process of moving bases to various places such as Japan, Malta, Bermuda, etc., it has transitioned to a complete remote work system. By the end of 2022, the number of employees will exceed 7,500, with staff of more than 100 nationalities.

In recent years, while deepening cooperation with regulators and policy makers, Binance has launched a series of platforms that meet the regulations of each country in the EU, Africa, Australia, etc.

Source: Binance

Overwhelming trading volume and diverse trading instruments

According to the END OF YEAR REPORT 2022, an annual report for 2022 published by Binance, Binance.com had about 128 million registered users at the end of the year. This number surpasses Coinbase, a major US player, with about 108 million. The average daily trading volume of the platform, including spot trading and derivative trading, is said to be $65 billion (approximately ¥9 trillion).

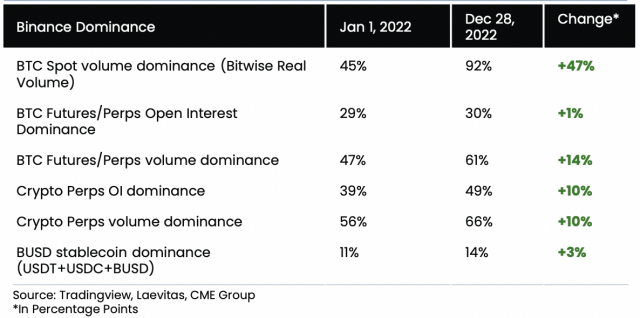

According to a report by market research firm Arcane Research, as of the end of 2022, approximately 92% of Bitcoin physical transactions (Bitwise aggregated data) were conducted through Binance.com. This is likely due to the fact that Binance lowered the Bitcoin spot trading fee to zero in June 2022 and the bankruptcy of its competitor FTX in November of the same year.

Source: Arcane Research

Binance.com handles 357 types of cryptocurrencies, actively listing multiple stablecoins such as USDC, USDT, and TUSD, and the number of tradable pairs has increased to 1,407. It can be said that this is the result of single-handedly undertaking the transaction demand of altcoins (virtual currencies other than Bitcoin = alternative coins), where trends change rapidly.

Enhanced derivative trading

Binance launched a futures market in 2019 under the name Binance Futures and has expanded to include options trading. Derivatives trading has become an attractive option for traders who want to speculate on the future price of an asset and those looking to hedge against risk.

Binance Futures is known as one of the world’s most liquid cryptocurrency futures exchanges, with a large number of buyers and sellers at all times, making it possible to enter and exit positions quickly and easily at fair prices. It’s becoming

Binance Futures also has some of the lowest commissions in the industry, which can significantly reduce trading costs for traders. Base fees are set at 0.0120% and 0.0300% for makers and takers respectively. Lower fees than other major crypto derivatives exchanges such as BitMEX (0.02% maker, 0.075% taker) and OKX Futures (0.02% maker, 0.05% taker).

Diverse services such as IEO

The virtuous cycle that Binance is creating – user acquisition and transaction volume growth – is likely due in part to the diversity of its service offerings.

In January 2019, Binance launched a new platform, Launchpad, and pioneered the IEO (Initial Exchange Offering) in the industry. An IEO is a type of fundraising method in which an exchange brokers a new token and sells it to investors. These tokens sold by Launchpad will be tradable on Binance immediately after the sale. As a result, investors enjoy instant liquidity.

connection:5 points to note about token sales, learned from successful cryptocurrency IEOs

In the past, promising projects such as Polygon (MATIC), The Sandbox (SAND), Axie Infinity (AXS), and STEPN (GMT) have used Binance’s Launchpad. Most notably, SAND and GMT have boosted their return on investment (ROI) at IPO to a staggering 7.9x and 14x, respectively. “Binance’s massive user base is a force that attracts great projects, which in turn increases the lottery ratio for new token sales. These factors are believed to be behind the company’s performance to date.

Usability, CZ Leadership

One of the qualitative attractions of Binance is the high usability of the trading interface, including the smartphone app. Quick and hassle-free login function using QR code, customization of homepage for individual users, and even the Lite version and Pro version that can be switched according to needs, these functions are indispensable tools for traders. It is functioning.

Another feature is the leadership of Binance founder and CEO Changpong Zhao (commonly known as “CZ”). Since the collapse of FTX, while suspicion of trust in centralized exchanges has spread, Binance, which is led by CZ, has adopted methods such as disclosing customer asset holdings and is proactive in ensuring corporate transparency. efforts are underway.

Binance is also actively engaged in charity work, donating to Ukraine and Hong Kong, and supporting medical institutions throughout Japan following the heavy rains in western Japan in 2018 and the outbreak of the new coronavirus infection in 2020. It is also related to Japan, such as planning a charity activity to do. It can be said that these consistent actions have made CZ one of the most influential figures in the cryptocurrency industry and have increased the trust and recognition of market participants.

Overview of Binance’s entry into Japan

Binance announced on May 26 that it plans to open a new platform “Binance JAPAN (provisional name)” for Japanese residents to comply with Japanese laws and regulations in the summer of 23. The exact opening date will be announced in the coming months.

As interest in the new platform gathers, what is of particular interest is the stocks it handles. According to Binance, “approximately 30 stocks will be available for spot trading on the new platform.” The industry is paying close attention to whether or not Binance’s native token “BNB”, which has a market capitalization of over 5 trillion yen and ranks fourth in the market (as of June 17), will be newly listed on the Japanese market.

connection:Binance Announces Scheduled End of Global Service for Residents of Japan

Anticipation of stocks handled

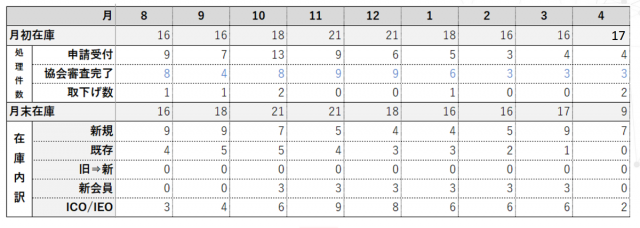

Source: JVCEA

The review process for handling crypto assets in Japan has become more efficient in recent years, and as of the end of April, there were only two cases awaiting review. In March 2010, the number of crypto assets handled in Japan was less than 50, but as of May 2011, the number had expanded to 91.

It used to take 3 months to 2 years for crypto assets to be listed for the first time in Japan, but considering that it can now be shortened to 1 month, BNB will be listed on the Japanese market in line with the opening of Binance JAPAN. It can be said that there is still a possibility.

connection:JVCEA proposes issues and improvement measures for crypto asset IEO and leveraged trading at LDP Web3PT

In addition, STEPN’s own token (GMT) for the “Move to Earn” app, which became a hot topic in 2022, was also born from Binance’s launchpad, and an official meetup is also held in Japan. I would like to expect GMT’s first listing in Japan on Binance for this project, which already has deep ties with Japan, such as partnerships with Asics and Ghost in the Shell.

Advantages and disadvantages of entering Japan

merit

One of the advantages of Binance’s expansion into Japan is that the expansion of a global platform into the country may bring Japanese users and trading volumes back to the country. As a result, tax revenue is expected to increase, and by circulating domestic funds, Japan’s trading environment will improve and the ecosystem for domestic projects will expand.

In addition, Binance, a global standard platform, may become a black ship for the industry, and overall innovation as a trading service may lead to a raise. Binance’s characteristics, such as expanding the number of stocks, providing functions with excellent usability, and revitalizing with various campaigns, are expected to stimulate competition in services among domestic exchanges.

connection:Why did the Japanese government start promoting the “Web3 policy”?Summary of important points and related news

The combination of these movements is expected to revitalize the web3 industry in Japan and Asia as a whole and to gain international competitiveness. Meanwhile, the United States under the Biden administration has emphasized strict regulations on cryptocurrencies and blockchain technology, which has had a negative impact on the development of web3.

In contrast, in Japan, the Liberal Democratic Party’s Web 3.0 promotion team has led the policy formulation and has clearly announced the promotion of Web 3. In addition, Hong Kong has begun aggressive efforts to establish itself as a global cryptocurrency center by improving its regulatory environment.

Demerit

There are also disadvantages to Binance entering the Japanese market. One of them is that users living in Japan who are currently using the global version will not be able to use it. This could undermine Binance’s strengths with its wide variety of trading currencies and massive trading volumes.

Due to Japanese regulations, after November 30, 2023, users residing in Japan will be restricted from using the global version of Binance. The period for identity verification (KYC) for users to newly migrate to the Japanese version of the platform is set from August 1st to November 30th of the same year.

In addition, the Japanese version of Binance handles only 30 different currencies compared to the global version. In addition, since the trading environment is different, such as the existence of market makers, it is expected that it will be difficult to secure the same level of liquidity in the Bitcoin spot market from the beginning of the service while making the most of the Binance brand.

Japan has historically accounted for a large percentage of the world’s bitcoin trading volume. In April 2017, the “Revised Payment Services Act” came into force, establishing a legal framework that enables safe transactions of virtual currencies. At the same time, China tightened regulations on cryptocurrencies, and the Japanese yen’s share of BTC trading volume was about 60 (October 2017 “CryptoCompare” data).

connection:Bitcoin trading volume, Japanese virtual currency exchange ranks first in the world = bitFlyer

\Bitcoin transaction volume world No. 1 /

/

As of 4:23pm on August 4th, we have the world’s highest Bitcoin trading volume (last 24 hours). (According to Coinhills) Thank you for your continued support of bitFlyer.

Coinhills: https://t.co/XJOmRY3ULG pic.twitter.com/QAPXlcFxed

— bitFlyer (@bitFlyer) August 4, 2020

BitFlyer, which was the world’s top trading volume in 2020, is currently ranked 21st in terms of daily trading volume (approximately 3,000 BTC/day) (according to “Coinhills”). The daily bitcoin spot trading volume at major exchanges such as coincheck and bitbank has stabilized at around 1,000 BTC (approximately 380 million yen) each (according to the “Bitcoin Japanese Information Site”).

As of June 17, 2023, the launch schedule for Binance Japan has not yet been confirmed. The U.S. Securities and Exchange Commission (SEC) sued Binance.com, its U.S. subsidiary, Binance.US, and CEO Changpong Zhao on June 5, 2023, for violating U.S. securities laws. The SEC has filed a total of 13 lawsuits, alleging that Binance.US ignored the regulatory structure to protect investors and made insufficient information disclosure.

Binance has outright denied the SEC allegations in its official statement, but we should expect the lawsuit to drag on and affect the launch of Binance Japan.

connection:Binance and Coinbase SEC Lawsuit |

The post Binance advances into Japan What is “Binance Japan (tentative name)”?Thorough explanation of expectations and impact appeared first on Our Bitcoin News.

2 years ago

249

2 years ago

249

![Plasma [XPL] price prediction – $1.44 target in sight ONLY IF…](https://ambcrypto.com/wp-content/uploads/2025/09/Erastus-2025-09-26T102302.550-min.png)

English (US) ·

English (US) ·