The post Binance Buying Millions in Bitcoin, But Analysts Predict 50% Drop for BTC appeared first on Coinpedia Fintech News

Bitcoin is once again sitting on a knife-edge. Despite reports of Binance buying millions worth of BTC, top crypto analysts are starting to raise red flags that a sharp 50% correction might be closer than most expect.

The price of BTC briefly crossed $111,000, but many traders fear this surge might be a trap, a setup before a major correction hits.

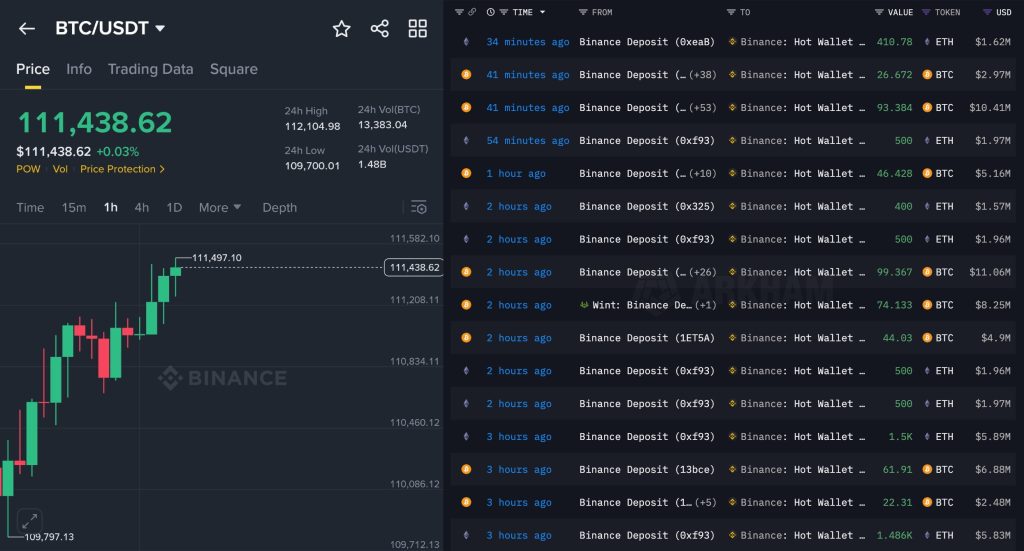

Binance Short Squeeze or Smart Accumulation?

Crypto trader CryptoNobler recently spotted unusual activity on Binance, the world’s largest exchange. He noted that Binance has been buying millions of dollars’ worth of Bitcoin, with some transactions exceeding 400 BTC.

Although on-chain data shows the same wallets repeatedly moving funds, a pattern often observed when exchanges manage internal liquidity or attempt to influence market moves.

Tom Lee Sees 50% Correction For BTC

Adding to the concern is long-time Bitcoin bull Tom Lee, co-founder of Fundstrat Global Advisors, who has cautioned investors about short-term risks.

In his latest interview, Lee said Bitcoin remains vulnerable to face the possibility of 50% price corrections, especially with its strong correlation to global stock market volatility.

Despite over $20 billion flowing into Bitcoin ETFs since early 2025, Lee believes such drawdowns are part of Bitcoin’s nature.

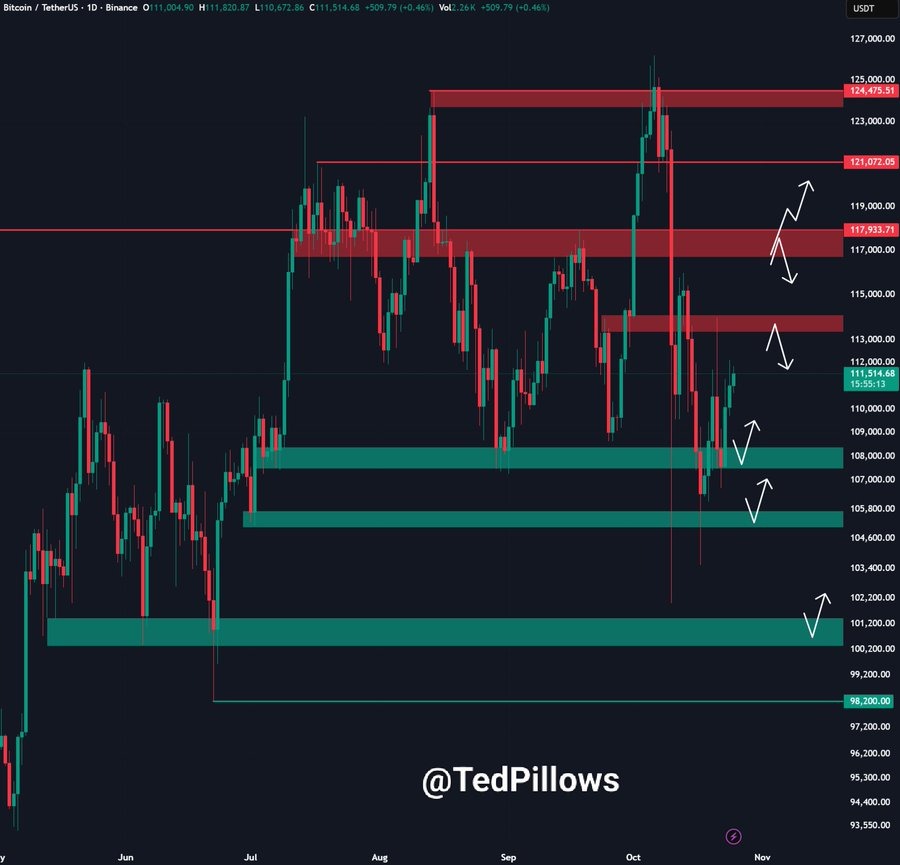

Bitcoin’s Key Level To Watch

Social media quickly filled with speculation. Well-known crypto analyst Ted pointed out that Bitcoin might have recently bounced from its $110,000 support level, but the next key test lies at $112,000.

“If Bitcoin gets rejected again, expect a sharp correction toward the $108,000–$110,000 range.”

A rejection from $112K could open the door for deeper downside, especially if Binance’s aggressive wallet movements turn out to be strategic liquidity plays rather than organic accumulation.

As of now, Bitcoin price is trading around $111,590, reflecting a slight jump seen in the last 24 hours.

3 hours ago

7

3 hours ago

7

English (US) ·

English (US) ·