Liquid staking token “WBETH”

Major crypto asset (virtual currency) exchange Binance announced on the 24th that it has introduced a new liquid staking token “WBETH” to its Ethereum (ETH) staking service.

This Wrapped Beacon ETH (WBETH) will allow users to participate in DeFi (decentralized finance) projects outside of Binance while receiving Ethereum staking rewards.

What is Liquid Staking?

A DeFi (decentralized finance) mechanism that allows you to operate alternative assets (staking proof tokens) while receiving cryptocurrency staking interest. There is an advantage that the liquidity of assets that have been locked up in the past can be released. Lido Finance, the largest service provider, stakes ETH and receives the bond token stETH, which can be used as collateral for lending or operated on DEX (distributed exchange).

Cryptocurrency Glossary

Cryptocurrency Glossary

Since December 2020, Binance has issued a token “BETH” that supports Ethereum 2.0 staking.

“BETH” corresponds 1:1 with the Ethereum deposited by the user when using the staking service. Binance also distributes “BETH” to users as a staking reward.

Binance has just started accepting redemptions of BETH into ETH following the completion of the implementation of the major upgrade “Shapella” that enables staked Ethereum withdrawals.

connection: Binance to support ETH staking withdrawals

In the future, users will be able to obtain WBETH, a wrapped token tied to the value of BETH tokens, or convert WBETH back to BETH tokens on Binance’s ETH staking service. This is expected to be free of charge.

The value of WBETH is expected to increase with the APR (annual yield) on Binance’s Ethereum staking. So initially, WBETH and BETH will be exchanged 1:1, but this ratio is expected to change later.

Also, BETH is basically deployed on the BNB smart chain, but WBETH can also be used on other networks such as the Ethereum network, making it easier to access the DeFi protocol.

What is a wrapped token

A virtual currency that is tied to the value of another virtual currency. By creating a token backed by the original deposited assets, it becomes possible to utilize that token in virtually any blockchain.

Cryptocurrency Glossary

Cryptocurrency Glossary

Benefits of the “Shapella” Upgrade

Charmyn Ho, head of crypto analytics at crypto exchange Bybit, said that “liquid staking” would benefit the most from Ethereum’s “Shapella” upgrade.

Liquid staking tokens allow traders to earn staking rewards while retaining the power to move their funds freely. For this reason, it is more capital efficient and flexible compared to general staking tokens.

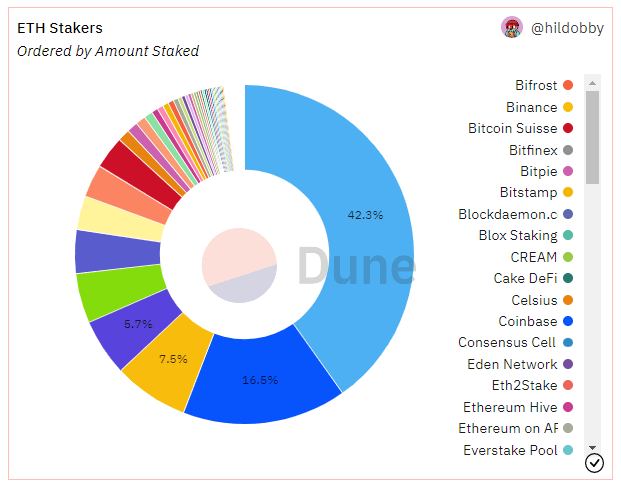

According to cryptocurrency data site Dune, Lido Finance, the largest liquid staking protocol, currently dominates the Ethereum staking market. It accounts for about 42% of the total staked token volume.

Source: Dune

The second place is coinbase with about 17%, and the third place is about 8% with Binance.

The post Binance Launches WBETH Liquid Staking on Ethereum appeared first on Our Bitcoin News.

2 years ago

88

2 years ago

88

English (US) ·

English (US) ·