Ethereum Selling Pressure Analysis by Binance

The research division of major cryptocurrency exchange Binance has released a report on the Ethereum (ETH) “Shanghai” upgrade on the 16th. I mainly analyze the selling pressure after the release of Shaghai.

Many of the stakers already have liquidity, so selling pressure will be limited, he said.

Binance first points out that most of the people currently staking Ethereum (ETH) (stakers) have unrealized losses, so there is little financial incentive to sell at the current ETH price. bottom.

On top of that, Binance states that with the Shanghai upgrade, the Ethereum and staking rewards deposited in the staking contract can be withdrawn, but there are two ways to withdraw. These are “partial withdrawal” and “full withdrawal”.

“Partial withdrawal” refers to the amount other than 32 ETH (for staking reward) initially deposited by the staker on the beacon chain, in which case the user continues to function as a validator.

According to Binance, the total staking reward for Ethereum is 1.03 million ETH (equivalent to 230 billion yen in market value), and even if all of these are withdrawn and become selling pressure, they will be distributed over several days or weeks. explained that it would

Given that Ethereum’s daily trading volume is currently close to around ¥1.1 trillion to ¥1.3 trillion ($8-10 billion), these partial withdrawals will not have a significant impact on the Ethereum price. I am analyzing.

What is a validator

As an approver, it has a role such as verifying transaction history, and if you fulfill that role, you will be rewarded with virtual currency. A node that verifies the validity of data recorded on the blockchain.

Cryptocurrency Glossary

Cryptocurrency Glossary

We also consider the case of withdrawing both the principal of 32 ETH and the staking reward as a “complete withdrawal”. It is estimated that a maximum of 1,575 validators can exit per day, and at that time, a maximum of 32 ETH x 1,575 people = 50,400 ETH (market value of about 11 billion yen) will be generated.

Liquid staking service tops market share

However, Binance said 57% of Ethereum stakers already have access to liquidity, so there is little reason to sell, so there is no reason to worry too much about selling pressure.

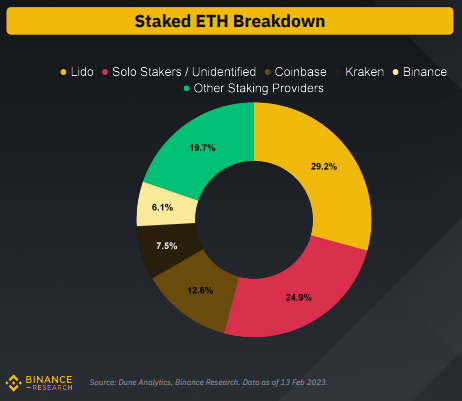

We also focused on where the staking takes place. The largest ETH staking service is liquid staking provider Lido, which has staked around 5 billion ETH, accounting for around 29% of the ETH staking market share.

Source: Binance Research

This is followed by major US exchanges Coinbase, Binance, and Kraken with a combined market share of 26%, followed by individual staking at 25%.

Binance points out that among these, Lido, Coinbase, and Binance issue tokens corresponding to users who stake ETH, and users are getting liquidity.

Lido, for example, provides users with stETH tokens representing staked ETH. Users can use stETH as collateral for lending or operate it on DEX (distributed exchange).

connection: ETH staking major Lido, V2 to implement withdrawal function etc.

Shanghai could lead to buying pressure

Binance also noted the potential buying pressure from Shanghai. By being able to withdraw, the liquidity risk of the lockup (deposit) period is removed, so investors who have been watching the situation so far may try to participate in staking.

In particular, he said it could create buying pressure for Ethereum if it can attract institutional investors.

US Coinbase also announced on the 14th that the selling pressure after the Shanghai upgrade was “limited”.

connection: US Coinbase “Ethereum selling pressure after Shanghai upgrade is limited”

connection:What is the ETH “Shanghai” upgrade?Summary of each company’s view on staking cancellation and ETH selling pressure

The post Binance Research Analyzes Selling Pressure After Ethereum Shanghai Upgrade appeared first on Our Bitcoin News.

2 years ago

102

2 years ago

102

English (US) ·

English (US) ·