How to tell when a bull market is entering

On the 7th, the research department of Binance, a major crypto asset (virtual currency) exchange, released a report titled “Are we entering a bull market? 10 scenarios to follow.” We explained the scenarios and indicators to keep an eye on as we look ahead to the coming months.

Since October, the global crypto market cap has risen by nearly 50%, with #Bitcoin seeing a 61% increase.

In our latest #Binance Research report, we explore the top 10 narratives to follow as we enter this new stage of the cycle.

Have a read  https://t.co/8HK5nCimzg

https://t.co/8HK5nCimzg

— Binance Research (@BinanceResearch) December 7, 2023

Since October of this year, the total market capitalization of the cryptocurrency market has increased by nearly 50%, with Bitcoin increasing by 61%.

In the latest Binance Research Report, we explore the top 10 scenarios to follow as we enter a new phase of the cycle.

Binance is focusing on the following points:

- A series of Bitcoin-related reports

- Stablecoin supply recovery

- Increase in NFT transaction volume

- Cryptocurrency protocol fees rise

- Revitalization of DeFi (decentralized finance) activities

- Development of L1 alternative chain

- Emergence of Social Fi

- Trends in Real World Tokenization (RWA)

- Development of ZK (zero knowledge proof) technology

- Possibility of global interest rate decline

Market capitalization rise and stable coins

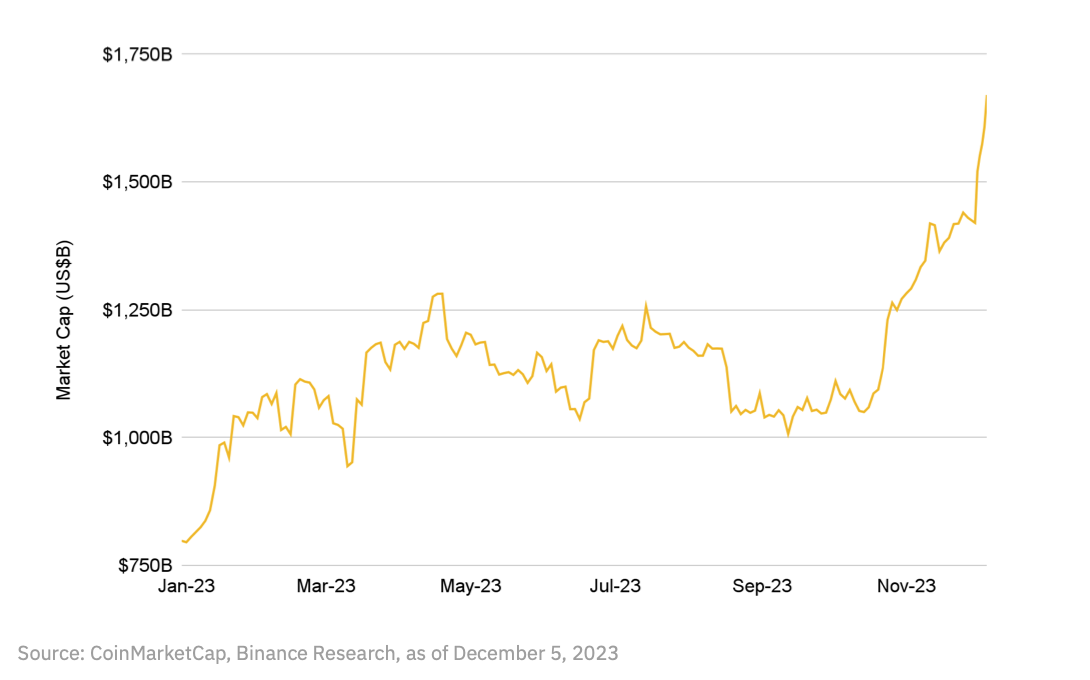

At the beginning of the report, Binance notes that the market capitalization of the virtual currency market has recorded a significant increase in assets of $870 billion (126 trillion yen) since the beginning of the year, achieving rapid growth of approximately 110%. It is noteworthy that the growth rate has increased by 55% ($596 billion ≒ 86.6 trillion yen) just up to the present in the fourth quarter.

It also pointed out that the net change in supply of the top five stablecoins based on market capitalization turned positive this quarter for the first time since Q1 of 2022. The report concluded that this trend “can be seen as a positive sign” as stablecoin supply is a measure of the amount of capital available for crypto investments.

connection:SBI signs basic agreement with US Circle, aiming to handle stablecoin USDC

Active activity related to Bitcoin

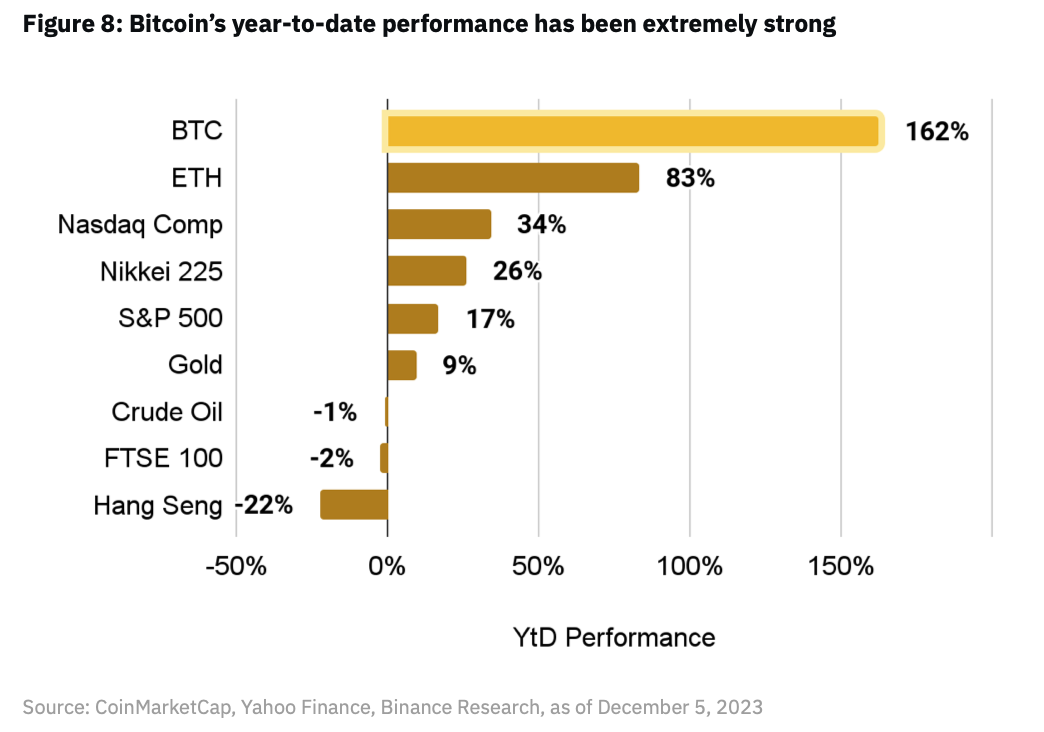

The report said 2023 will be a year of a number of developments for Bitcoin that will appeal to all types of investors, from crypto experts to institutional investors. As a result, Bitcoin’s market capitalization has increased 162% since the beginning of the year, far outpacing other asset classes.

Binance listed the following as key Bitcoin scenarios to watch:

- Possibility of approval of Bitcoin spot ETF (Exchange Traded Fund)

- Bitcoin halving (around April 2024)

- Impact of Bitcoin version of NFT “Ordinals”

A total of 13 Bitcoin spot ETF applications are currently under review by the U.S. Securities and Exchange Commission (SEC), with approval deadlines ranging from January to August 2024, but market participants are predicting that they will be approved in the coming weeks. We expect multiple ETFs to be approved. If approved, the inflow of funds into Bitcoin is expected to increase significantly as it will make investing in Bitcoin more convenient and reliable.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Binance also believes that the Bitcoin halving will essentially increase the scarcity of Bitcoin, thereby reinforcing the scenario of Bitcoin as “digital gold.”

The Bitcoin version of NFT “Ordinals” has created a market frenzy, with the trading volume of Ordinals exceeding $375 million (54.5 billion yen), exceeding the Ethereum version of NFT trading ($348 million ≒ 50.6 billion yen). Ta. As a result, many new developers are entering the Bitcoin ecosystem, and various ideas are being generated.

Summing up, the report said that Bitcoin is “in the midst of the most exciting period in its history” and that its developments should be watched closely.

connection:SEC’s Bitcoin ETF review in final stage – Reuters report

connection:Sotheby’s holds first auction for Bitcoin version of NFT “Ordinals”

Macroeconomic impact

Furthermore, the report also analyzes from a macroeconomic perspective. Among them, US monetary policy (interest rates) is pointed out to be one of the most important factors influencing the evaluation of risky assets. In a situation where interest rates are high, safe assets such as U.S. Treasuries tend to be preferred, and interest in risk assets such as stocks and virtual currencies tends to decline.

On the other hand, once the next interest rate cut cycle begins, which is expected to occur after the middle of next year, investors will turn to high-growth sectors such as technology and cryptocurrencies in search of higher returns, which could be a major blow to the crypto market. The report assesses that this will be a tailwind.

The latest forecast from the US Federal Reserve suggests lower interest rates from mid-2024 to 2025. The People’s Bank of China has already lowered the one-year lending rate, and in Europe, expectations are rising for an early interest rate cut by the European Central Bank (ECB) as inflation rates decline.

The post Binance Research lists “10 scenarios” to follow in the cryptocurrency industry appeared first on Our Bitcoin News.

1 year ago

130

1 year ago

130

English (US) ·

English (US) ·