Most people are optimistic about the outlook for the next 10 years

On June 30, major crypto asset (virtual currency) exchange Binance released a report on the outlook of the crypto asset (virtual currency) sector by institutional investors.

88% of the institutional investors who responded said the outlook for cryptocurrencies over the next 10 years is positive.

The survey was targeted at Binance’s institutional clients and VIP users. Conducted from 31 March to 15 May 2023, 208 institutional customers have responded.

For cryptocurrencies, 63.5% of respondents said the outlook for the next 12 months is positive. The 10-year outlook was even more optimistic, with 88% saying they were positive.

50% also said they expect to increase their allocation of crypto assets over the next 12 months, while 45.7% said they would maintain the current amount. Only 4.3% said they would cut it.

Factors and risks that boost cryptocurrencies

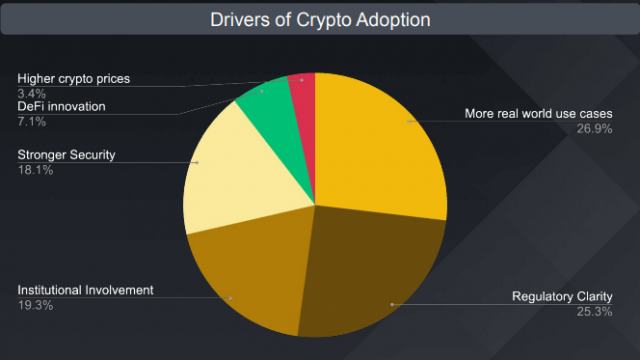

Binance also asked about the key factors for the adoption of cryptocurrencies in society.

Source: Binance

The most common responses were demand for real-world use cases (26.9%) and regulatory clarity (25.3%). These were followed by participation such as banks and other financial institutions (19.3%) and security enhancements such as fraud detection and secure custody (18.1%).

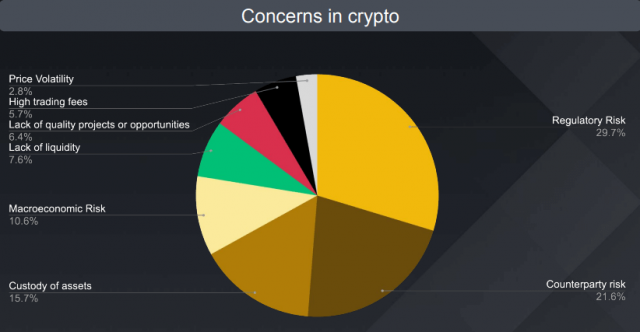

Source: Binance

In terms of concerns about cryptocurrencies, regulatory risks were the most common response, accounting for 29.7%. This is followed by counterparty risk (21.6%), custody risk (15.7%) and macroeconomic risk (10.6%).

On the other hand, only 2.8% cited high volatility. “Volatility does not appear to be keeping institutional investors away from cryptocurrency investments,” Binance said.

Uses for investing in cryptocurrencies

Regarding the use of cryptocurrencies, 44.7% of the institutional investors who responded to the survey said they are trading on a daily basis. This is followed by obtaining long-term investment exposure at 17.3% and earning interest at 11.1%.

In terms of assets under management, more than 50% of responding institutional investors had less than about ¥3.6 billion ($25 million). On the other hand, 22.6% managed cryptocurrencies worth about ¥14.4 billion ($100 million) or more.

Binance explained that many investors in funds with more than 10.8 billion yen ($75 million) in assets under management cited “portfolio diversification” as their motivation for investing in cryptocurrencies.

More than half of the responding institutional investors, 58.2%, cited centralized exchanges as their storage location for cryptocurrencies. This was followed by 20.2% who said they would entrust their money to a custody company.

In addition, 14.9% of respondents said they store their money in self-managed cold wallets.

What is a self-custody type wallet?

A wallet that is used to manage private keys and hold assets by yourself instead of an exchange. It is sometimes called “self-hosted” or “self-managed”.

Cryptocurrency Glossary

Cryptocurrency Glossary

The post Binance Survey: Majority of Institutional Investors Optimistic About Crypto Future appeared first on Our Bitcoin News.

1 year ago

73

1 year ago

73

English (US) ·

English (US) ·