This week’s attention!

This week has been full of big news, but the biggest one is probably the withdrawal of Binance, the world’s largest cryptocurrency exchange, from the US and the payment of a huge fine of about $4.3 billion. Founder Jianpeng Zhao will also step down as CEO. Another big name in the industry disappears from the public eye.

Binance in talks to settle $4 billion in US criminal case: Bloomberg

According to a report from Bloomberg, Binance Holding Ltd., which operates the major crypto asset (virtual currency) exchange Binance, has been sued by the Department of Justice for allegedly committing multiple criminal acts. It is expected that he will be required to pay $4 billion (approximately 600 billion yen, at an exchange rate of 150 yen to the dollar) for the settlement. The company is in negotiations with the Department of Justice, and there remains the possibility that founder Changpeng Zhao may face criminal charges in the United States.

Bitcoin and BNB rise on news of Binance settlement

A major factor that had a negative impact on the crypto asset market, such as the possibility that Binance, the world’s largest crypto asset (virtual currency) exchange, may be forced to go out of business in the near future, will soon be resolved. Bitcoin (BTC) and Build and Build (BNB) are rising on this news.

Binance to ‘completely withdraw’ from US, pay billions of dollars in fine

Leading cryptocurrency exchange Binance will withdraw from the country, pay a multibillion-dollar fine and appoint a monitor for five years in order to reach a settlement with U.S. authorities. The settlement is over accusations brought by the Financial Crimes Enforcement Network (FinCEN) and the U.S. Treasury Department’s Office of Foreign Assets Control (OFAC), the U.S. Department of the Treasury’s money laundering and sanctions watchdog agency, according to a press release issued on the 21st. became.

Binance to pay $4.3 billion to settle US criminal lawsuit; Zhao pleads guilty and resigns as CEO

Binance, the world’s largest crypto-asset (virtual currency) exchange, is facing criminal charges for violating sanctions and money transfer laws, making it one of the few companies the US has ever forced accused companies to pay. They agreed to pay the “largest-ever fine” of $4.3 billion (approximately 645 billion yen, equivalent to 150 yen to the dollar).

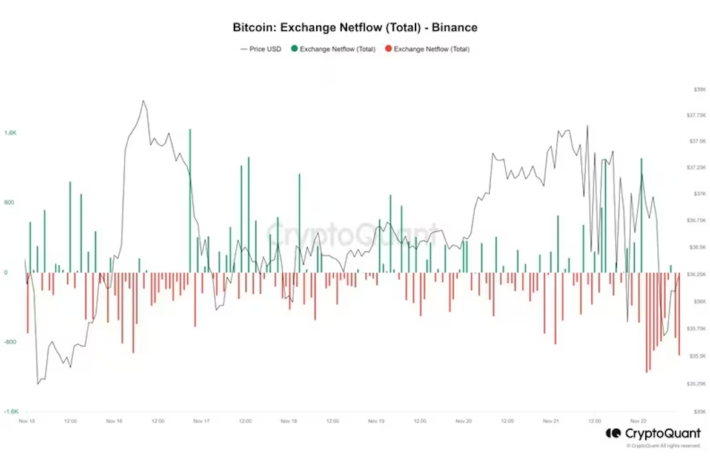

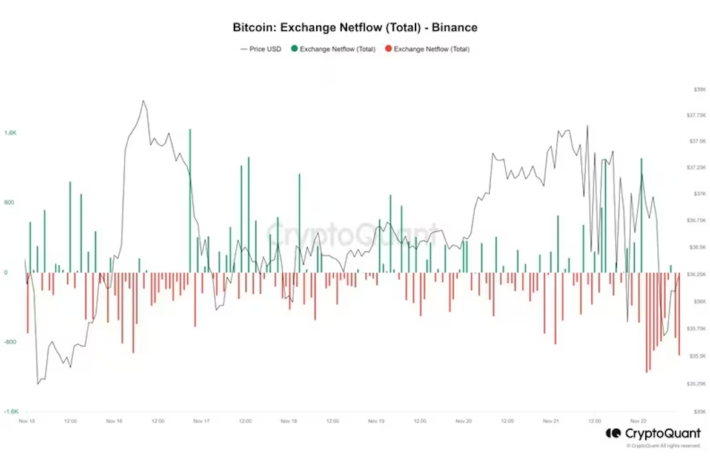

Binance Processes Approximately $1 Billion in Net Outflows

Cryptocurrency exchange Binance is facing criminal charges in the United States, and its founder Changpeng Zhao, also known as “CZ,” will step down as CEO as part of the settlement. agreed. The exchange recorded more than $950 million (approximately 142.5 billion yen, equivalent to 1 dollar = 150 yen) in outflows over the next 24 hours.

Binance maintains international dominance after US settlement: Bernstein

Binance experienced a small outflow of less than $1 billion (approximately 150 billion yen, equivalent to 1 dollar = 150 yen) after the news of the settlement with the US government, but there was no major panic among customers, and 67 billion Bernstein, an investment company, said in a research report on November 22 that it remains the internationally dominant crypto asset (virtual currency) exchange that holds customer funds worth US dollars (approximately 10 trillion yen). Stated.

Bitcoin

Bitcoin supporter Milay wins Argentina’s presidential election. Binance news also influenced Bitcoin prices.

Milay, who calls for the abolition of the central bank, wins: Argentina presidential election — Bitcoin rises about 3%

Right-wing opposition party Javier Milei won the presidential election in Argentina, a South American country. “The Argentine people have chosen a different path,” opponent Sergio Massa said on Wednesday evening.

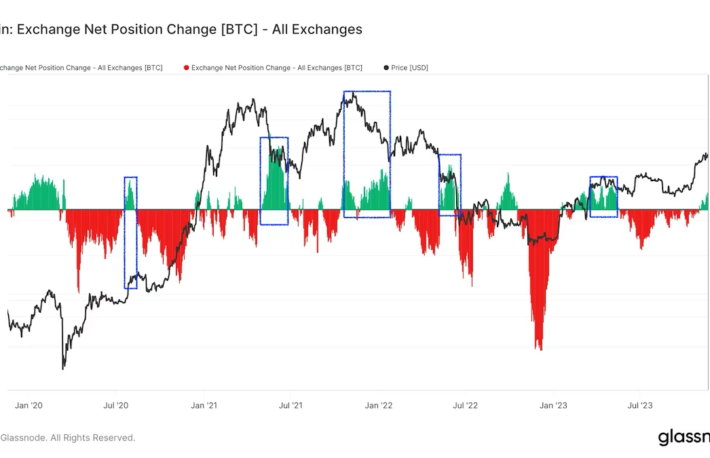

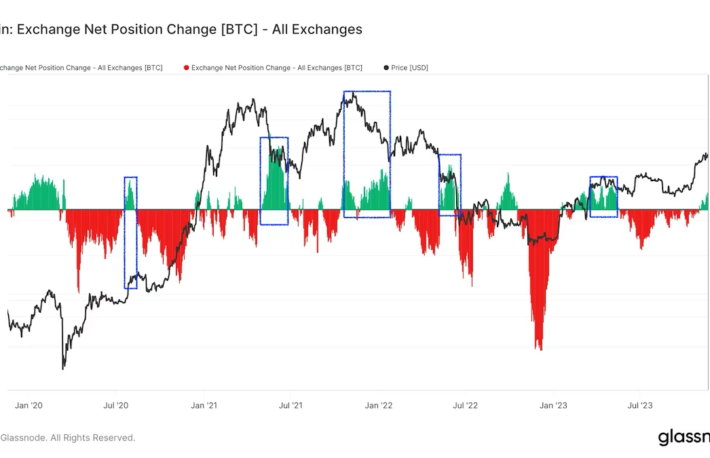

Bitcoins stored in exchange wallets are increasing at a rapid pace

Bitcoin (BTC) held in wallets tied to centralized crypto exchanges is increasing at its fastest pace since May, signaling a potential bullish pause. There is.

Bitcoin fundamentals have never been better: Bernstein

Investment firm Baan predicts that the market capitalization of Bitcoin (BTC) will quadruple by mid-2025 and emerge as a huge global asset worth over $3 trillion (approximately 450 trillion yen, equivalent to 1 dollar = 150 yen). Bernstein said in a Nov. 20 research report.

Argentine presidential election Bitcoin exceeds $37,000 – pay attention to the Fed’s minutes

Following the victory of Bitcoin supporter Javier Milei in the Argentine presidential election, Bitcoin (BTC) rose to $37,000 (approximately 5.55 million yen, converted to 150 yen to the dollar) early on the 20th. It rose to The crypto market has also increased by nearly 2% in the past 24 hours.

Bitcoin faces headwinds as ETF optimism stalls; DOGE and SOL drop 5%

Bitcoin (BTC) price has changed little over the past 24 hours, with the major token losing some of its early November gains.

BTC was trading at just over $37,500 in the morning European time on November 21, up 0.6%. Ethereum (ETH) fell 0.5%, while Dogecoin (DOGE) and Solana (SOL) fell as much as 5% as traders likely took profit.

Bitcoin briefly drops below $36,000 due to Binance settlement; more than $200 million in futures liquidations

Binance’s settlement with the U.S. Securities and Exchange Commission (SEC) over multiple charges has spurred a market selloff, with futures traders betting on further growth the most affected.

Bitcoin price movement below $38,000 over the past three weeks is a bullish sign

Bitcoin (BTC) price growth has been stalled since November 9th, and it has proven difficult to break above $38,000. But that doesn’t mean the uptrend is over.

In fact, a closer look at price movements during this correction shows that this is not the case.

Bitcoin ETF

Expectations are high that the Bitcoin ETF will be approved by the end of the year or the beginning of the new year. Although the move seems to be based on approval, there are voices urging caution.

SEC delays approval of Franklin Templeton and Global X Bitcoin spot ETF

The U.S. Securities and Exchange Commission (SEC) has postponed a decision on the approval of Bitcoin spot exchange-traded funds (ETFs) filed by Franklin Templeton and Global X.

SEC Chairman Gensler’s political ambitions will influence Bitcoin ETF decisions: Ark’s Wood speaks

Cathie Wood, founder and CEO of ARK Investment Management, said, “Given Chairman Gensler’s familiarity with Bitcoin, there is no logic that he would prevent him from approving a Bitcoin spot ETF.” It’s hard to find a reason,” he said on CNBC.

More Bitcoin ETF rejections ‘likely’: BitGo CEO Bershe

Mike Belshe, CEO of crypto custody company BitGo, said that contrary to industry-wide optimism, the U.S. Securities and Exchange Commission (SEC) has filed a series of Bitcoin spot exchange-traded fund (ETF) applications. He said it was “very likely” that it would be rejected.

Market trends

Sam Altman’s movements also made headlines this week. It’s such a dizzying movement that I can’t even keep up with it. At one point, he was reported to be moving to Microsoft, but he eventually returned as CEO of OpenAI.

OpenAI fires CEO Sam Altman; World Coin drops 12%

OpenAI, an artificial intelligence (AI) company, has dismissed Sam Altman as CEO and director. The board of directors made the announcement on its blog on the 17th.

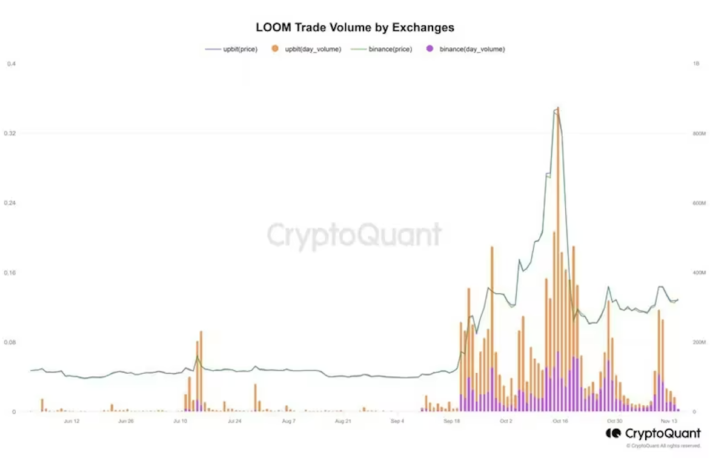

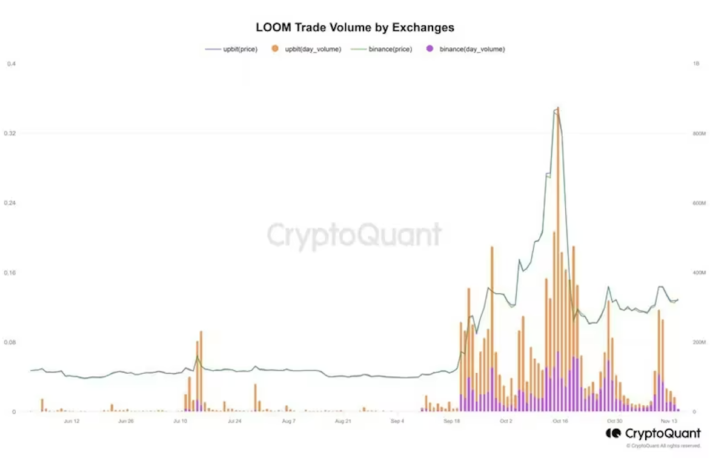

The recent surge in altcoins is due to Korean traders: CryptoQuant points out

Analysts at on-chain data analysis firm CryptoQuant revealed in a November 17 memo to U.S. CoinDesk that spot trading volume on South Korean cryptocurrency exchange Upbit has nearly doubled since September. I made it. Upbit, which accounts for more than 85% of South Korea’s trading volume, grew by 82% in October compared to September, with trading volume of $32.8 billion (approximately 4.92 trillion yen, converted at 1 dollar = 150 yen) It increased from $59.8 billion (approximately 8.97 trillion yen).

Sam Altman joins Microsoft — Worldcoin rises 10%

OpenAI’s former CEO Sam Altman, co-founder and president Greg Brockman, and other former staff members will join Microsoft. CEO Satya Nadella made the announcement in a post on X.

Industry trends

A mixture of positive and negative news. If the excitement from the Hanshin Tigers’ victory can be channeled into the Expo being held in Osaka, it might be a positive thing for the Japanese economy.

Will Dogecoin go to the moon in December?

Dogecoin developers posted on X on November 16th that a physical Dogecoin (DOGE) may go to the moon on a mission by Pittsburgh-based space venture company Astrobotic. did.

Global standard-setting body for securities markets releases recommendations on crypto asset regulation

On November 17, the International Organization of Securities Commissions (IOSCO) released its long-awaited recommendations for regulating cryptoassets (virtual currencies).

SEC sues Kraken for unregistered operations, including confusion of customer assets

The U.S. Securities and Exchange Commission (SEC) alleges on the 20th that the U.S. cryptocurrency exchange Kraken operated as an unregistered broker, clearinghouse, and dealer, as well as commingled customer and corporate funds. did.

Cerezo Osaka official NFT “CEREZO OSAKA SUPPORTERS NFT”, INO implemented as Coincheck INO’s second project

As the second project of “Coincheck INO”, which handles NFT collections for sale for the first time, Coincheck is selling the official generative NFT “CEREZO OSAKA SUPPORTERS NFT (abbreviation: Ceresapo NFT)” of the professional soccer club “Cerezo Osaka”. Perform INO. The company announced this on the 21st.

Bittrex Global to shut down – trading will cease on December 4th

Bittrex Global, a crypto asset (virtual currency) exchange, announced on the 20th that it will suspend trading on December 4th. Bittrex had suspended the operations of its American corporation Bittrex US (Bittrex.US) in April following a lawsuit from the U.S. Securities and Exchange Commission (SEC), but this time the global division will be shut down.

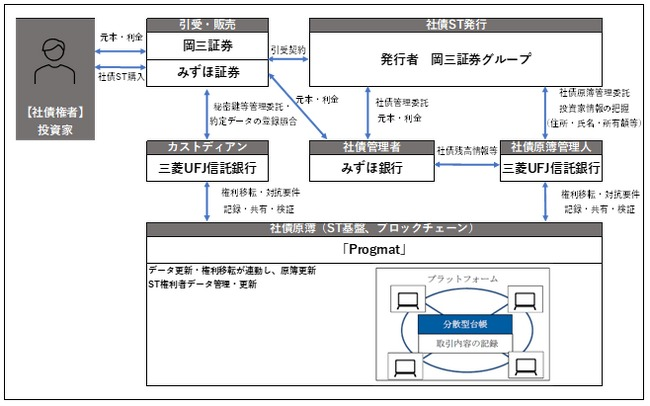

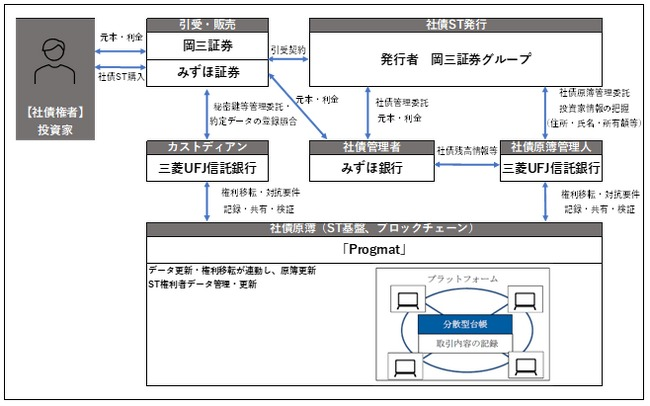

Okasan Securities Group issues security token bonds ─ 2 billion yen, the largest ever for individuals, using Progmat as the foundation

On the 22nd, Okasan Securities Group, which will celebrate its 100th anniversary in April 2023, collaborated with Okasan Securities, Mizuho Securities, Mizuho Bank, and Mitsubishi UFJ Trust and Banking to release the Okasan Securities Group 100th Anniversary Security Token Bond. announced that it would publish “.

“EXPO 2025 Digital Wallet” and JR West collaborate to hold “Osaka Loop Line NFT Station Stamp Rally”

HashPort, in collaboration with West Japan Railway Company (JR West), will hold the “Osaka Loop Line NFT Station Stamp Rally” from November 30th, 500 days before the opening of the Expo, as one of the business collaboration services of “EXPO 2025 Digital Wallet”. .

One More Things

Osaka Digital Exchange (ODX)’s “START”, the first domestic secondary market for security tokens (ST), will begin trading. Further expansion of the ST market, which has grown steadily this year, is expected.

Japan’s first security token secondary market ODX’s “START” begins trading on December 25th

“START,” a private trading system (PTS) related to security tokens (ST) of Osaka Digital Exchange (ODX) and the first ST secondary market in Japan, will be traded on December 25th. Start trading. On November 20th, the company announced the scheduled start date for sales transactions.

Kenedix, SMBC Trust Bank, and Daiwa Securities collaborate on real estate security tokens – ST will be available on ST’s first secondary market ODX “START”

Kenedix, SMBC Trust Bank, and Daiwa Securities announced on November 20th that they will collaborate on the issuance and operation of real estate security tokens (ST). The target is Kenedix Realty Token Dormy Inn Kobe Motomachi (digital name rewriting method), which is the 9th real estate ST for the Kenedix Group.

Ichigo, Mitsubishi UFJ Trust and Banking, and SBI Securities announce collaboration on real estate security tokens – ST will be handled in Japan’s first secondary market ODX “START”

Ichigo, Mitsubishi UFJ Trust and Banking, and SBI Securities, which operate real estate, clean energy, and asset management businesses, are collaborating on the public offering and operation of asset-backed security tokens (ST) for investment in rental properties in Tokyo. do. The three companies made the announcement on November 20th.

Finally, there was news of the acquisition of CoinDesk in the US. As CoinDesk itself quotes the WSJ report, CoinDesk JAPAN currently does not know anything beyond the report. The management team will remain in place, and there will be no change in the operation of the news site. We will notify you as additional information becomes available.

US CoinDesk acquired by cryptocurrency exchange Bullish: Report

The Wall Street Journal (WSJ) reported on the 20th that crypto asset (virtual currency) exchange Bullish has acquired US CoinDesk.

Bullish, led by former New York Stock Exchange (NYSE) president Tom Farley, has acquired CoinDesk from Digital Currency Group (DCG) in an all-cash deal. Details of the transaction were not disclosed.

|Written and edited by Takayuki Masuda

|Photo: Shutterstock

The post Binance to “completely withdraw” from US, pay billions of dollars in fine / Will Dogecoin go to the moon in December?[Weekly Review: 11/18-11/24]| CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

143

1 year ago

143

English (US) ·

English (US) ·