The market capitalization of the crypto asset (virtual currency) exchange Binance stablecoin “Binance USD (BUSD)” continues to decline.

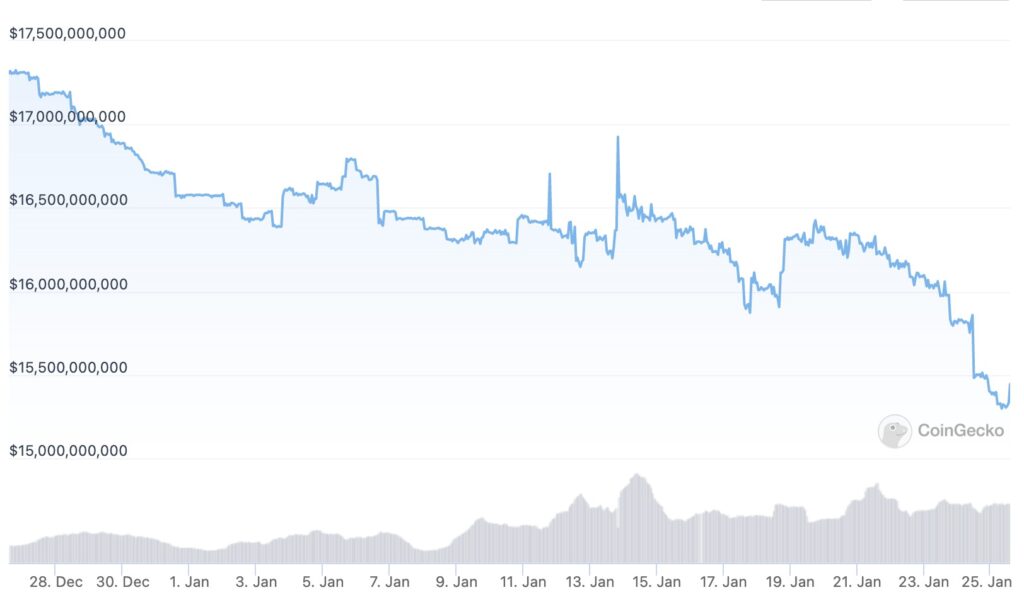

According to CoinGecko, the market cap of Binance USD fell to $15.4 billion on Jan. 25, a decline of $1 billion in a week and $2 billion in a month.

Binance USD’s market capitalization has been declining due to the impact of the FTX collapse and the December announcement by auditing firm Mazars to suspend operations related to Binance’s Proof of Reserve (PoR). It hit a record $23 billion in November last year.

Related article: Demand for Binance USD Declining, Stablecoin Race Enters New Phase – Could It Be a Killer Use Case for Crypto Assets?

Binance USD Market Cap Drops to $15.4 Billion (Source: CoinGecko)

Binance USD Market Cap Drops to $15.4 Billion (Source: CoinGecko)The decline comes after Bloomberg reported a blunder regarding the exchange’s “Binance-Peg Tokens” (B Tokens), in which some of the reserves were erroneously stored in the same wallet as customer funds. was a factor.

Also earlier this month, blockchain research firm ChainArgos announced that Binance USD was not always fully backed by reserves in 2020-2021. Binance confirmed the issue and said it has now been remedied.

These issues keep BinanceUSD behind its fiercely competitive rivals.

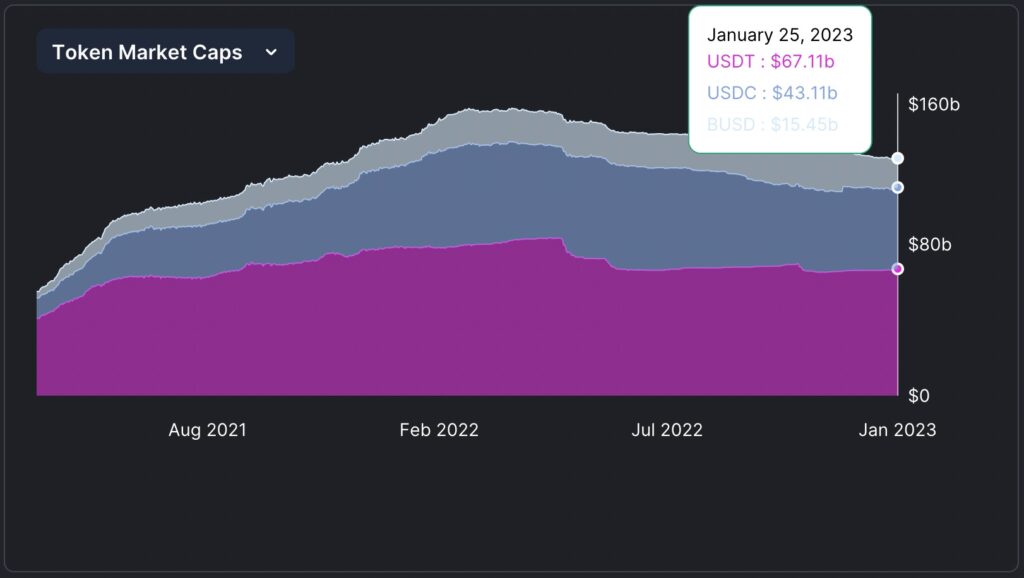

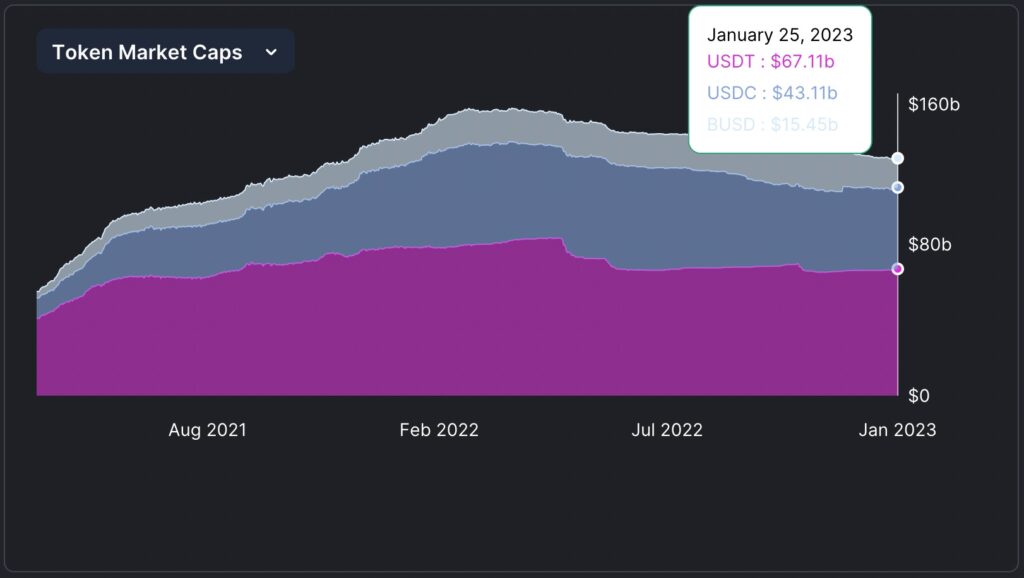

According to data site DefiLlama, Binance USD has lost 11.3% of its market cap in a month. Meanwhile, Tether (USDT) increased by 1.3% and USD Coin (USDC) decreased by 1.9%. Binance USD was the only one among the top three stablecoins to grow in market cap until last year.

Source: DefiLlama

Source: DefiLlamaAccording to CryptoCompare, the market cap of all stablecoins fell for the 10th straight month in January to $137 billion. Stablecoin dominance in the cryptocurrency market fell to 12.4% from a record high of 16.5% in December, reflecting traders shifting funds from stablecoins to risk assets, CryptoCompare said. ing.

|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

|Image:

|Original: Binance USD Stablecoin Sees $2B Reduction in a Month Amid Token Mismanagement

The post Binance USD market capitalization drops by $2 billion in a month | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

132

2 years ago

132

English (US) ·

English (US) ·