Web3 Awareness Survey

Bitbank Co., Ltd., which operates a crypto asset (virtual currency) exchange, announced on the 12th the results of a questionnaire survey on the awareness of Web3 (distributed web).

It was found that the government’s policy to promote Web3 was received positively, and expectations were particularly high for support for startups and virtual currency tax reform.

This survey was conducted from June 2nd to 8th, 2023, and is a web3 awareness survey targeting internet users nationwide. The number of valid responses was 547, and the ratio of men and women was about 50/50.

Web 3.0 is a general term for a decentralized Internet that utilizes public blockchains (distributed networks that do not require permission) and various use cases developed on it.

With emerging use cases such as financial transactions using NFTs (Non-Fungible Tokens) and Organizational Autonomous Operations (DAOs), the ability to access applications without a central administrator is at the heart of Web3.

According to this report, 33.1% of respondents know the word Web3, which is not a majority, but among users who know Web3, the understanding of Web3 is high at about 70%. A trend was seen. Specifically, 21.6% answered that they “fully understand” Web3, and 47.9% answered that they “mostly understand”.

Web3’s main use cases include dApps (decentralized apps) including NFT games and DeFi (decentralized finance), DAOs (decentralized autonomous organizations) that proceed with projects based on governance tokens, and self-management of user data. Decentralized Identity (DID) and others.

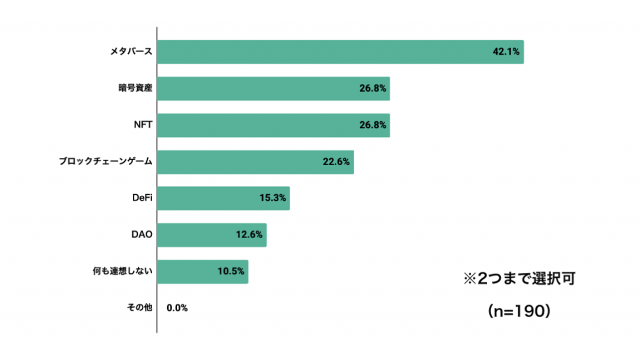

As a result of the survey, among those who knew about Web3, the first keywords that came to mind when hearing “Web3” were “metaverse”, “crypto assets”, and “NFT”, in that order.

Source: Bit Bank (same below)

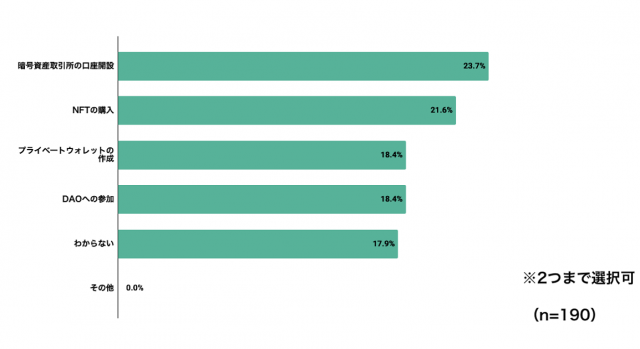

Next, 23.7% of respondents cited “opening a cryptocurrency exchange account” as the first thing to do when using Web3 services. It seems that there are a certain number of users who know that they can create their own private wallets, use wallets, or “buy NFTs” directly on the platform, which is very difficult.

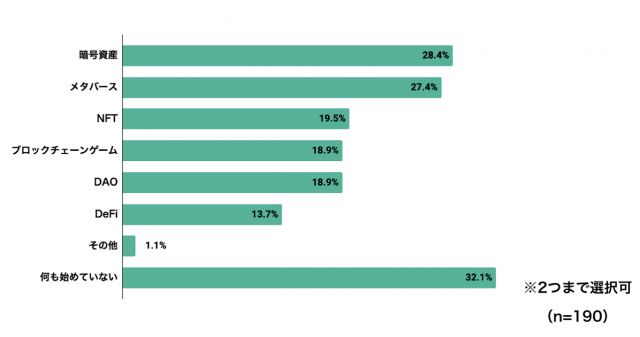

Also, among those who have already started Web3-related services, the most common was “crypto assets”, followed by “metaverse”. Since up to two can be selected, it is speculated that these users are also using use cases that have emerged in the past few years, such as NFT and DAO.

Web 3.0 provides an environment that makes it easy to do business globally, so intellectual property rights in the content industry such as pop culture such as anime, manga, and games, as well as local gourmet and tourism, are strong, especially in Japan. There is also a view that there is a high degree of affinity for the country.

In Japan, the Digital Society Promotion Headquarters of the Liberal Democratic Party established the “Web3 Project Team” (formerly: NFT Policy Review Project Team) in January 2022. The team’s recommendations have been partly incorporated into the new Prime Minister Kishida’s “new capitalism” strategy, with regulatory and tax reforms underway.

connection:Why did the Japanese government start promoting the “Web3 policy”?Summary of important points and related news

Expectations for the government’s Web3 policy

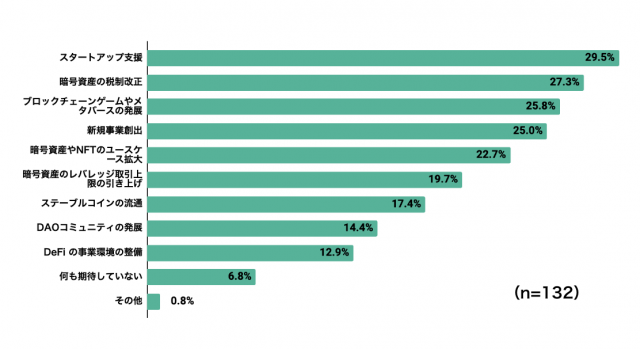

According to Bitbank, more than 81.8% of those who answered that they “understand well” or “mostly understand” Web3 expressed a positive view of the government’s promotion of Web3. Furthermore, among those who know about Web3, the largest number of respondents, about 30%, cited “support for start-ups” as an item they expect from the promotion of Web3 in Japan. Next, we know that there are many expectations for “tax reform of crypto assets” and “development of blockchain and metaverse”.

The tax system for virtual currencies is being gradually reviewed in Japan. In July 2011, the National Tax Agency issued a notification, officially establishing a rule to exclude tokens issued by companies from the period-end mark-to-market taxation. This is an important step toward a significant improvement for start-ups that have been forced out of the country.

However, under current Japanese law, all income related to crypto-asset transactions by individuals is subject to comprehensive taxation, with tax rates ranging from 5% to 45% (up to 55% if inhabitant tax is included). Critics say that this taxation system may discourage individuals from investing. Last year, the Liberal Democratic Party’s Digital Society Promotion Headquarters web3PT made a proposal for tax reform, including a “review to 20% separate taxation,” but so far no decision has been made.

connection:National Tax Agency Officially Announces Partial Revisions to Virtual Currency Corporation Tax Rules

The post Bitbank announces survey results on awareness of Web3 appeared first on Our Bitcoin News.

2 years ago

80

2 years ago

80

English (US) ·

English (US) ·