Macroeconomics and financial markets

In the US NY stock market on the 14th, the Dow Jones Industrial Average fell 232 points (0.68%) from the previous day and the Nasdaq Index closed at 53 points (0.39%) higher.

The US Federal Open Market Committee (FOMC) has decided to keep the policy interest rate unchanged (suspend rate hikes) for the first time in 15 months.

The interest rate futures market had already factored in this, but the dot chart suggested two additional interest rate hikes within the year, and Chairman Powell warned that “the possibility of a rate cut is about two years away.” was perceived as a negative factor, and there was also a phase in which the Dow plunged.

The FOMC is likely to resume rate hikes in July, but Chairman Powell has refrained from saying so.

What is a dot chart (interest rate forecast distribution chart)?

Dots indicate interest rate levels that FOMC participating members consider appropriate, and visually indicate the outlook for policy interest rates and the direction of monetary policy. Published in March, June, September and December of each year.

CoinPost Glossary

CoinPost Glossary

connection:FOMC interest rate hike pause, but additional interest rate hikes may resume US stocks and Nasdaq slightly higher |

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 3.65% from the previous day to $25,036.

BTC/USD daily

It fell below the support line (lower support line) of $25,300 and temporarily fell to $24,821.

Among the major alts, Ethereum (ETH), which has the second largest market capitalization, fell 5.4% from the previous day, and XRP, which had risen due to speculation about the publication of the Hinman document, fell 6.8%.

Recent years have exposed low liquidity and weak sentiment. It can be said that there is no buyer.

In addition to the bankruptcy of FTX in November last year, the U.S. SEC (Securities and Exchange Commission) sued Binance and Coinbase, the largest crypto asset (virtual currency) exchanges, for violating securities laws in June this year. Many of the altcoins with the highest market capitalization have been designated as “unregistered securities,” and the investment app Robinhood has decided to delist the relevant issues, further increasing the sense of uncertainty about the future.

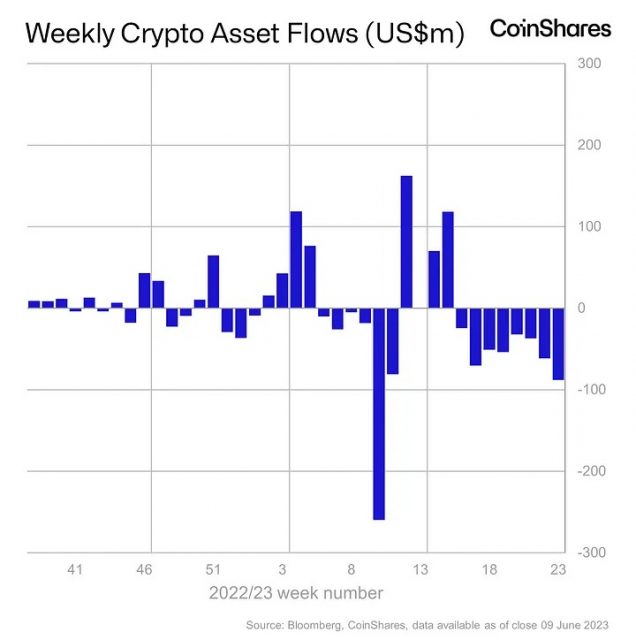

CoinShares reports that digital asset fund flows have been net selling for eight consecutive weeks, with a total outflow of $417 million.

CoinShares

Significant deterioration in investor sentiment

The Bitcoin Fear & Greed Index, which indicates investor sentiment, fell to the 40 level, the “fear” level, for the first time in three months since early March.

Crypto Fear & Greed Index

Below 25 is Extreme Fear, above 56 is Greed.

The record low was recorded in June 2010 when the cryptocurrency market crashed due to the Terra (LUNA) shock, and recorded “7 (Extreme Fear)”, which is lower than the corona shock in March 2020.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin after FOMC, support line cuts to $ 24,000 level, market sentiment to fear level appeared first on Our Bitcoin News.

2 years ago

110

2 years ago

110

English (US) ·

English (US) ·