Macroeconomics and financial markets

In the US NY stock market on the 13th, the Dow Jones Industrial Average rose by $145 (0.43%) from the previous day, rising for six consecutive days. The Nasdaq Index closed 111 points (0.83%) higher.

As the CPI (Consumer Price Index), an inflation indicator, fell short of market expectations, there was growing speculation that the Federal Reserve (Fed) would leave its policy interest rate unchanged at the U.S. Federal Open Market Committee (FOMC). rice field.

In the interest rate futures market, expectations for a halt to rate hikes surged from 79.1% the day before. Currently 95.4% woven.

connection:US CPI, lowest growth since March 2021 US stocks continue to rise | 14th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 0.52% from the previous day to $25,986.

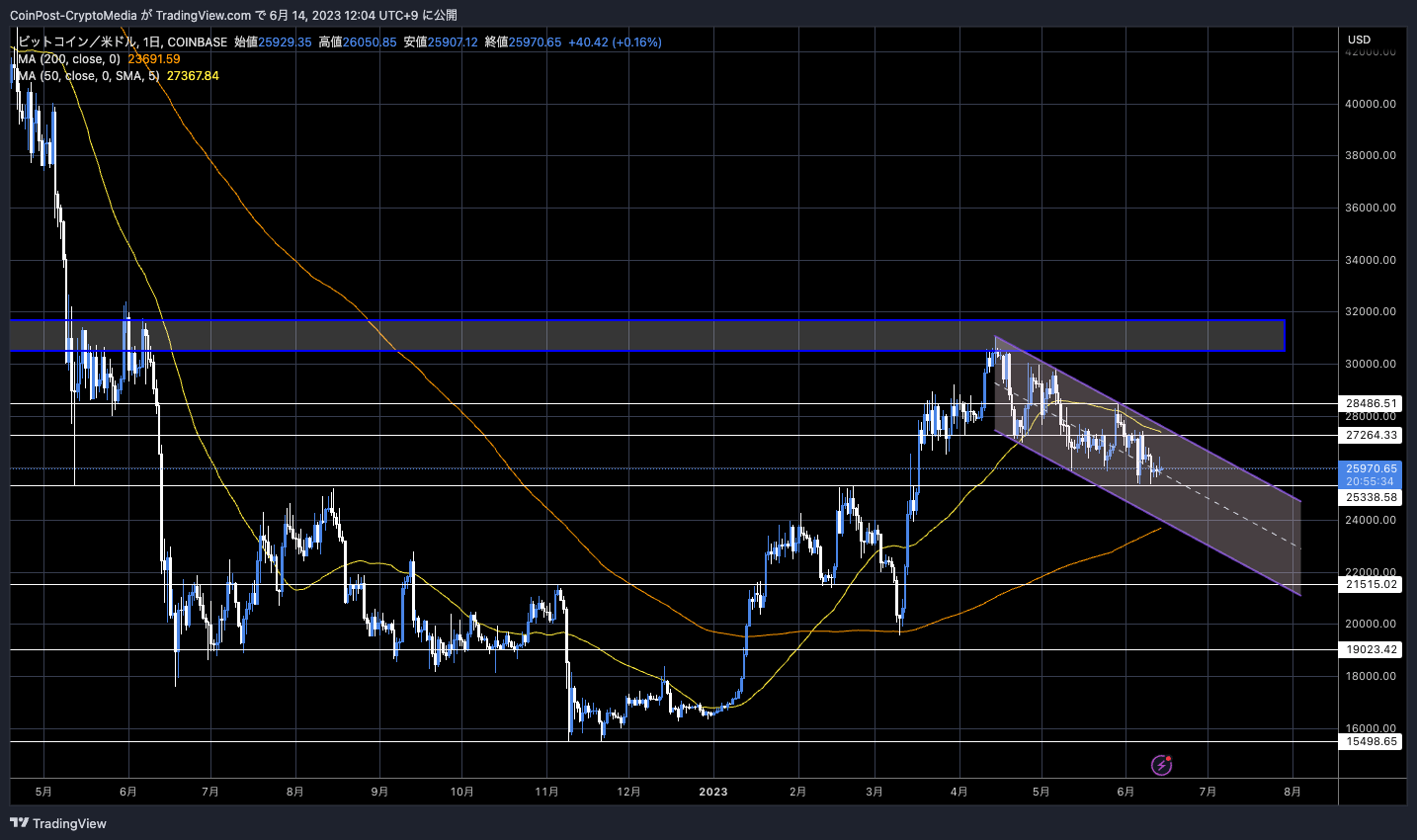

BTC/USD daily

“Bitcoin is lagging behind the Nasdaq stock market,” said analyst Tony The Bull. The S&P 500, the major U.S. stock index, hit a 52-week high, while Bitcoin prices have been sluggish recently.

All of crypto Twitter right now:#Bitcoin is showing such weak correlation with the Nasdaq”

Meanwhile, the correlation coefficient remains at a “very strong” 0.85 positive correlation on the monthly chart

There is just a little catching up to do pic.twitter.com/AbaJPhNx8U

— Tony “The Bull” (@tonythebullBTC) June 13, 2023

The correlation coefficient of the monthly chart is “0.85”, which shows an extremely strong correlation, but the correlation has been diverging due to the uncertainty regarding the recent outlook for crypto-asset regulations in the United States.

In response to the recent designation of altcoins as securities by the US SEC (Securities and Exchange Commission) and litigation against cryptocurrency (virtual currency) exchanges, many investors have reduced their exposure to altcoins and reduced the proportion of legal currencies and bitcoins. seen to be increasing.

Institutional investors tend to leave

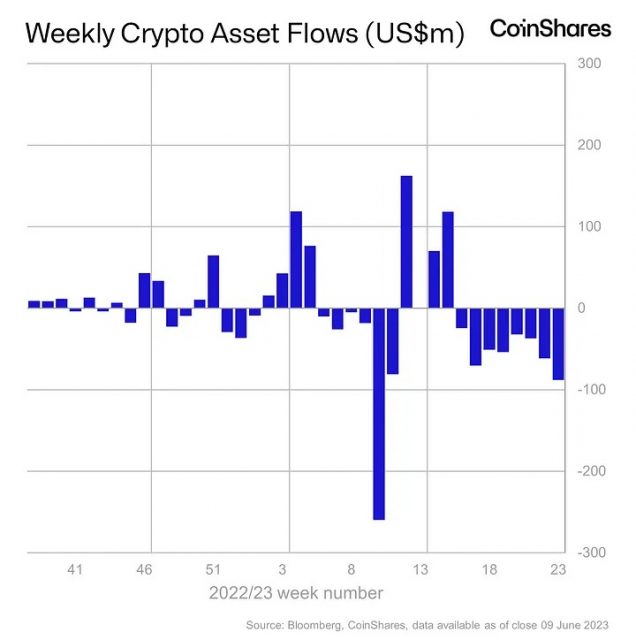

According to a weekly report from asset management firm CoinShares, institutional investors’ capital flows into digital assets such as cryptocurrency mutual funds have posted net outflows for the eighth straight week.

CoinShares

The total outflow for eight weeks reached $417 million. Bitcoin accounted for $254 million, or 1.2% of total assets under management (AuM).

While BTC dominance, which indicates the dominance rate of Bitcoin in the bad news of altcoins, has risen to the 50% level for the first time in two years, it suggests that institutional investors are withdrawing from the crypto asset market itself.

altcoin market

There was a scene where the price of XRP rose.

Hinman documents related to a June 2018 speech by former SEC Corporate Financial Services Director William Hinman have been made public following a court order.

Hinman has served as director of the SEC’s corporate finance division since 2017 and is a pioneer in devising regulatory guidance for cryptocurrencies.

At the same performance, he expressed the view that “virtual currencies with more decentralized networks are less of a securities”, and mentioned that Bitcoin and Ethereum should not be classified as securities. However, this is my personal opinion and does not fall under the SEC’s official guidance.

In December 2020, the U.S. SEC (Securities and Exchange Commission) sued Ripple for selling XRP as an unregistered security, and is fighting in court.

connection:Summary of the “Ripple Trial” filed by the US SEC (December 2020-April 2023)

In addition, a U.S. federal judge dismissed an asset injunction against Binance.US by the U.S. SEC (Securities and Exchange Commission). BNB, which had fallen sharply, rebounded more than 7% from the previous day after allowing Binance’s US division to continue operating while coordinating with regulators.

BNB/USD

BNB is Binance’s native token. Affected by the Binance lawsuit, BNB’s OI (open interest) in the futures market has ballooned to its highest level since the beginning of the year.

connection:Countdown to the next Bitcoin half-life less than a year away, market trends and expert predictions?

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Bitcoin also moves slightly as CPI passes, BNB sharply rebounds after sharp decline appeared first on Our Bitcoin News.

2 years ago

179

2 years ago

179

English (US) ·

English (US) ·