There are very few situations in our daily life that make us think about Maslow’s Hierarchy of Needs. It is a triangle with five layers of desires that humans seek for success. But when the desires at the bottom are not satisfied, it immediately becomes worrisome.

A simple explanation of this theory is that at the bottom of the hierarchy are the “physiological needs” for nutrition, rest, and shelter, which are the basics for survival. On top of that, “security needs”, “social needs” for belonging, and “recognition needs” for self-affirmation overlap. Desire.

Incidentally, it is well known that many scholars do not agree with Maslow’s views, and that Maslow himself did not represent the pyramid.

Some may find it disturbing that there is no hierarchy of “trust” in the pyramid. Trust is a prerequisite at all levels: you need to trust food that it won’t kill you, you need to trust that your house won’t be blown away, you need to trust that friendship will lift your spirits. It can be said that it is

Trust is most relevant to ‘safety needs’, where I understand it to be classified. Trust, which expresses the belief that one feels safe or can act, is a core component of nearly all personal and civilizational progress.

In other words, trust is essential to safety (safety is meaningless without trust in safety) and safety is essential to trust (nothing can be trusted if basic safety is not guaranteed).

So what happens when our beliefs about what it means to be “safe” start to change?

Changing “safe” investments

In the financial world, what is safe and what is not is beginning to change. Let’s take a look at what a “safe, well-thought-out investment” looks like.

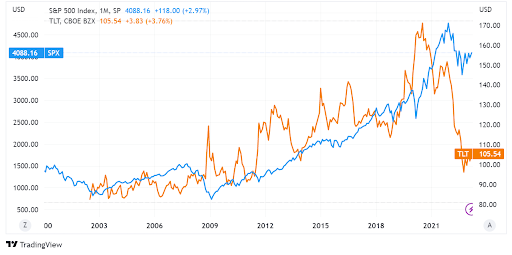

US Treasuriesis considered the safest asset in the market. Because the U.S. government will never default on its debts (right?). But in April, Treasury volatility reached its highest level since the 2008 financial crisis. In a year of the fastest rate hikes since the 1980s, the risk of rate hikes is higher than ever. Bonds have plummeted in value, and the cost of a U.S. government default has risen to a decade high. It doesn’t seem safe.

US Treasury Volatility (TradingView)

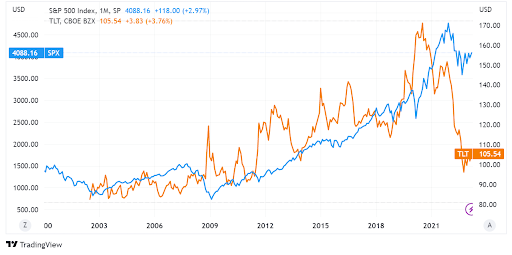

US Treasury Volatility (TradingView)stockwhat about Stocks are said to be the riskiest asset, but in the long run they are trending upwards. The chart below is an overlay of the S&P 500 and long-term US Treasury indices. Which one looks safe?

Blue: S&P500, Orange: US Treasury Bond 20+ Year ETF (TradingView)

Blue: S&P500, Orange: US Treasury Bond 20+ Year ETF (TradingView)Diversification of investmentThere is also wisdom. The idea is that if you imitate a large index, the returns will be more diversified. But dig deeper and you’ll find that high-risk tech stocks make up about 30% of the S&P 500 and the top six market capitalization rankings. More centralized than decentralized, the risks are even higher.

60/40 PortfolioIf you’ve ever talked to an investment advisor, you’ve heard the term. Rather than investing in either stocks or bonds alone, the idea is that investing in both at a 60/40 ratio will yield more consistent returns. However, the 60/40 portfolio underperformed last year by 18% in nominal terms. It was almost the same as the damage of the S&P500. it wasn’t safe.

housingIs it safe then? US house prices are falling, according to data released yesterday. January is down 0.2% from December and down 3% from June last year. That may seem small compared to last year’s decline in stock prices, but a home is often the biggest investment in a household’s finances, and a fall can be devastating. However, it can be said that houses provide safety as a place to live.

goldis the oldest “safe haven” known to mankind, a durable metal with a liquid market and (theoretically) unmanipulable supply. However, there are times when you can’t be sure that what you have is really gold, and it takes time and effort to store it and prevent it from being stolen. Although it is highly unlikely, there is a possibility that the value of the gold you hold will become zero. It doesn’t look very safe.

Of course, the “safest” is to avoid the stock market altogether andBank accountsentrust all property to Despite official claims by regulators that the U.S. banking system is “strong and resilient,” depositors have concerns. For now, however, withdrawals appear to have calmed down. But the increasing digitization of the banking system means that situation could change in an instant. It is not yet known if all deposits will be protected.

and,Bitcoin (BTC). It’s not safe at all, even called “dangerous”. But even during the crash and turmoil of the past year, Bitcoin kept going. The price fell, but Bitcoin didn’t stop. Moreover, in times of turmoil, hard-to-seize, easy-to-move assets feel a renewed sense of security for many displaced from their homes and many worried about being shut out of traditional payment systems. would have been

Is safety really important?

Just when we began to realize that it was time to re-examine what “safety” means, whether it meant return, continuity or independence, we started a culture shift asking why safety matters. have experienced.

Trust in institutions was waning even before the COVID-19 pandemic, and political polarization around the world has eroded trust in governments to protect them. Especially since the planet itself is in trouble, as we are constantly reminded.

Then there is the “gamification” of investments. A screen full of confetti or at least some kind of praise for your investment decisions. Fun generally trumps safety. Especially when the future that young people are supposed to be saving for looks bleak.

Add to this the growing interest in new types of assets that are completely outside the existing system and highlight growing demands for independence, flat communities, and skepticism about the goodwill of authorities.

All of this leads to the inevitable realization that Bitcoin and other crypto assets are much more than just “risky” investment assets. Crypto assets represent a shift in investment philosophy appealing to an increasingly independent generation of investors. It also represents a cultural and political shift that weakens the power of authorities to enforce safety rules that no longer make sense.

Let’s go back to Maslow’s pyramid, where trust and security are interconnected.

If one changes, the other changes as well. That’s why the changes in the investment framework we’re witnessing go far beyond portfolio allocation. It’s a bigger social change, and wisdom that has been built up over generations shouldn’t be thrown out just because it’s ‘traditional’, but questioning conventions can make cultures more flexible and resilient. It means to

Withdrawing from the new increases vulnerability. Not safe at all.

Mr. Noelle Acheson: Former head of research at CoinDesk and Genesis Trading.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: Bitcoin and the Changing Definition of ‘Safety’

The post Bitcoin and changes in the definition of “safety”[Opinion]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

99

2 years ago

99

English (US) ·

English (US) ·