- Initial unemployment claims have fallen sharply, fueling fears of inflation.

- Risk markets such as Bitcoin and Ethereum were relatively undisturbed even as the job market continued to perform well.

The cryptocurrency (virtual currency) market was unfazed by economic data that showed a robust labor market tightening and unexpectedly strong quarterly economic growth.

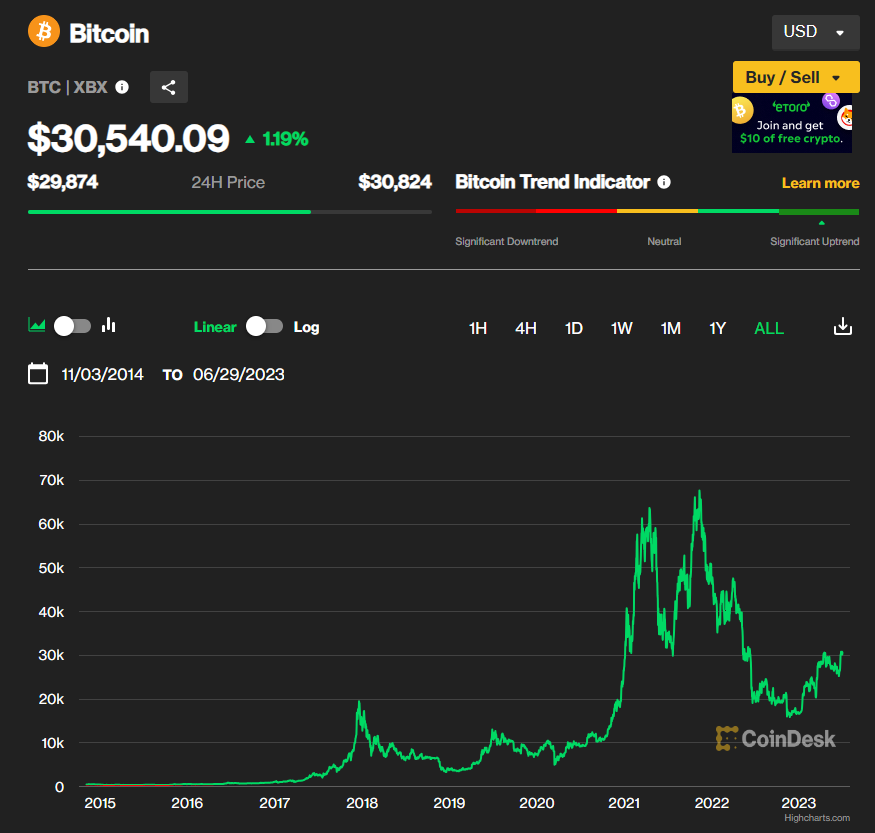

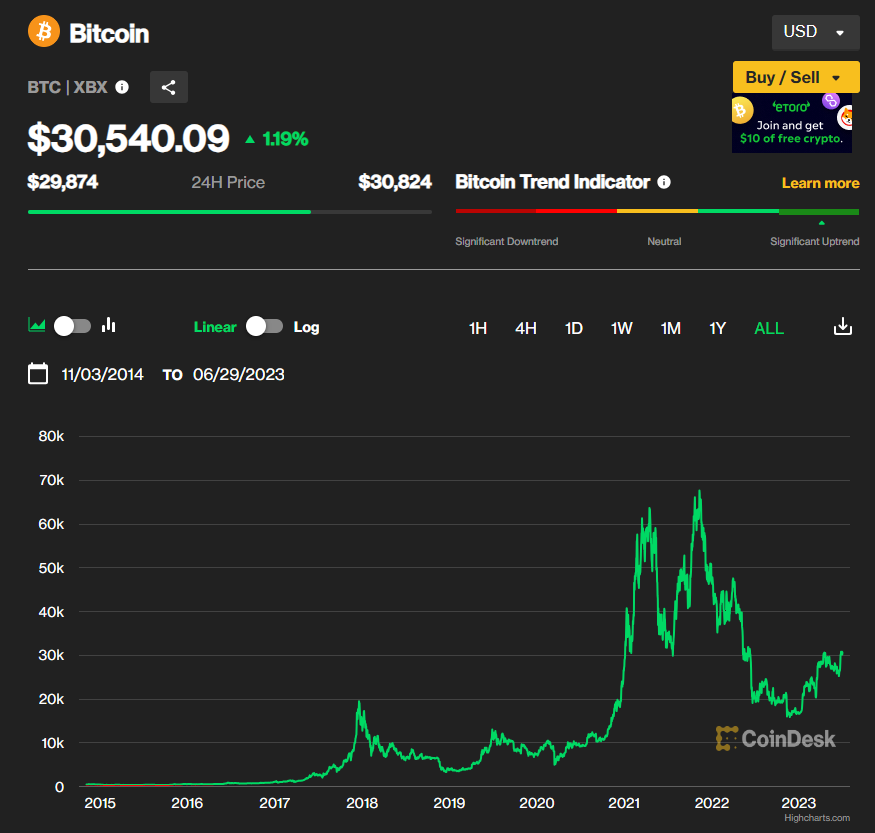

Bitcoin (BTC) is trading at around $30,500, up more than 1% over the past 24 hours. Most major crypto assets, such as Ethereum (ETH), are also slightly higher. Inflation fears weigh heavily on investors, who fear central banks will be forced to raise interest rates again, pushing the economy into recession.

The data released Wednesday serve as a preliminary rationale for what the Federal Open Market Committee (FOMC) has already said, but it was only after the fact.

Economic growth beats expectations

US GDP grew 2% in the first quarter, beating expectations of 1.4%. Meanwhile, initial jobless claims for the week ending June 24 decreased by 26,000 to 239,000. It was the biggest drop since October 2021 and better than the expected 265,000.

These data appear to be the latest evidence that the Federal Open Market Committee (FOMC) will take a hawkish stance again in July after pausing interest rate hikes in early June.

The FOMC has raised its 2023 peak interest rate forecast to 5.6% from 5.1%, suggesting two more rate hikes this year. Fed Chairman Jerome Powell said in a recent statement that the FOMC could raise interest rates further.

And while initial jobless claims were better than expected, the four-week average of 257,500 was above consensus expectations of 251,270. Moving averages help smooth out fluctuations that can occur in individual published values.

Initial unemployment claims are generally on the rise, suggesting the FOMC’s much-needed easing in the labor market.

the market remains unmoved

Across the board, price movements in risk markets seem to indicate that the results of economic indicators have been factored in. The Dow Jones Industrial Average, Nasdaq Composite Index and S&P 500 all ignored the news on the 29th and rose slightly.

Bitcoin has settled into a sideways trading pattern over the past week, trading above the $30,000 support line.

Bitcoin’s Visible Volume Profile (VRVP), which started in April 2023, shows a high-volume tier around $30,000. High-volume tiers indicate areas where buying and selling were consolidating, often coinciding with strong support and resistance lines.

Ethereum has settled into a similar flat trading pattern, but with less momentum than Bitcoin. While Bitcoin price is above the support line, Ethereum appears to be held back by the resistance line near $1,900. The difference in performance points to an increase in capital inflows to Bitcoin compared to Ethereum, largely due to potential higher institutional investor involvement.

The post Bitcoin and Ethereum are strong even with strong economic indicators ──Risk market has already factored in rate hikes | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

94

2 years ago

94

English (US) ·

English (US) ·